Vitalik’s Delusion: Why Ethereum Can’t Become the Next Google

Can low-risk DeFi like Aave or MakerDAO drive Ethereum’s growth? Explore Vitalik’s vision and challenges with stablecoins and RWAs.

Low-risk DeFi has become the focal point of debate within the Ethereum community. Many argue it could serve as the network’s core driver, much like Google Search drives Google.

However, a number of experts caution that this view may be overly optimistic given Ethereum’s fierce competition with stablecoins and RWAs.

Low-risk DeFi – A New Growth Engine for Ethereum?

As BeInCrypto reported, Vitalik Buterin suggested that low-risk DeFi protocols like Aave or MakerDAO could become a primary revenue source for Ethereum (ETH). He likened this model to how Google derives much of its revenue from Google Search.

“Importantly, low-risk defi is often very synergistic with a lot of the more experimental applications that we in ethereum are excited about.” Vitalik observed.

Applied to Ethereum’s case, Vitalik emphasizes that the network needs safe financial activities that support savings and payments—especially for underserved communities—to preserve the ecosystem’s cultural identity.

This view from Vitalik has sparked lively debate. David Hoffman states that low-risk DeFi does not generate much blockspace demand for Ethereum. Nevertheless, locking large amounts of ETH in lending protocols like MakerDAO, Aave, or Uniswap elevates ETH into a form of “commodity money” within the Ethereum ecosystem.

Some developers argue that low-risk DeFi is universal, simple, and scalable to billions of users. Stani Kulechov has envisioned a day when Aave could distribute yield to billions globally, turning DeFi into a foundational financial tool for humanity.

“Low-risk DeFi is Ethereum’s workhorse: simple, powerful, and universally useful. One day, Aave could be distributing yield to billions across the globe.” Stani commented.

Low Revenue, Hard to Justify the Valuation

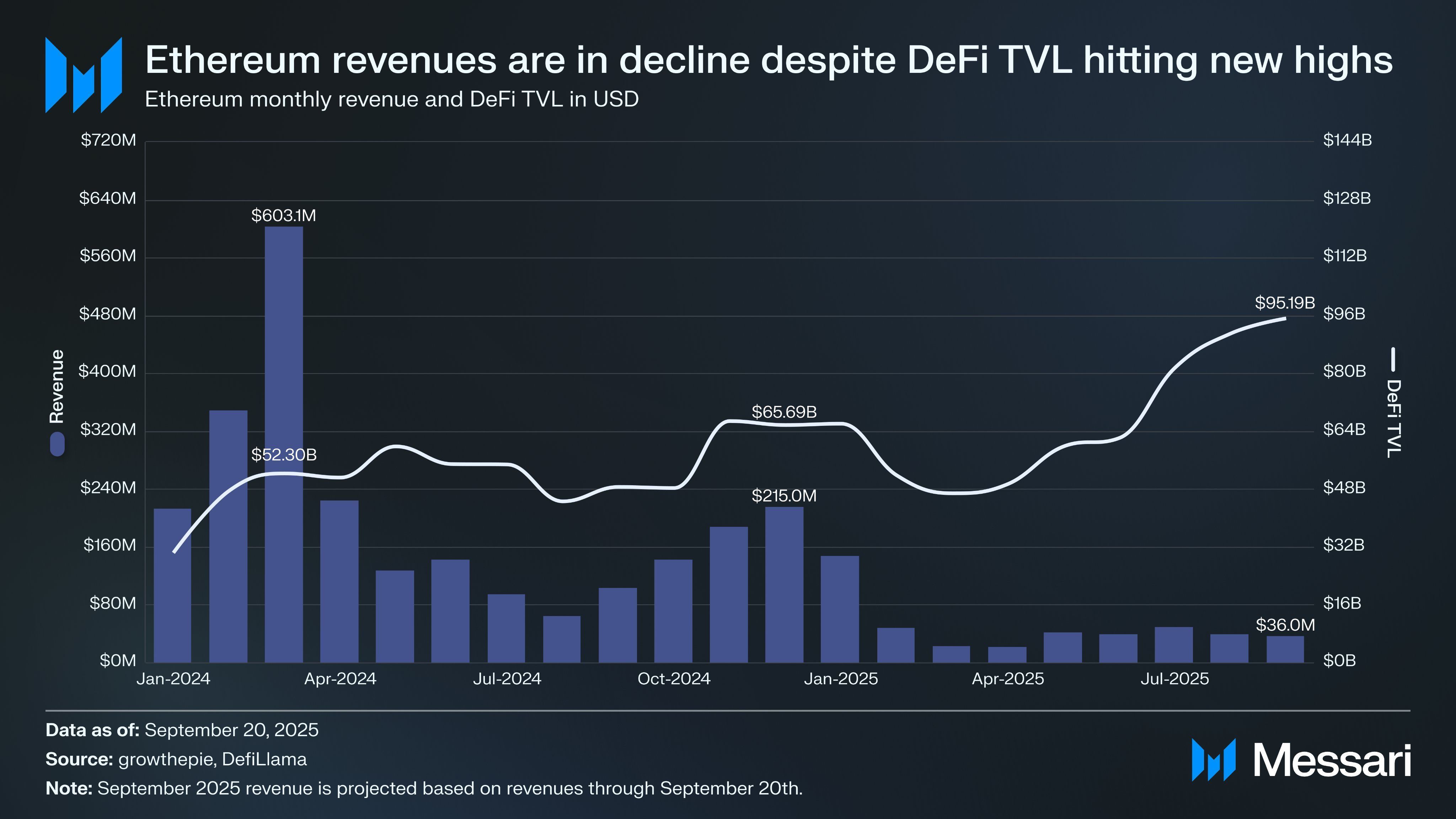

Not everyone agrees with Vitalik. Another X user argues that low-risk DeFi alone cannot justify Ethereum’s enormous market cap, currently about $0.5 trillion. Trading volume from these protocols reached only around $36 million in September—a figure far too small to create sustained cash flow for the network. Moreover, despite DeFi’s TVL of roughly $95.2 billion and a stablecoin supply of $161.3 billion, these metrics still do not generate enough blockspace demand to keep network fees attractive for validators.

“Low-risk DeFi as Ethereum’s ‘Google Search’ can only work if it prioritizes ETH as the primary monetary asset. However, with stablecoins dominant and many pushing Ethereum as the ‘RWA chain,’ ETH must compete with an ever-increasing field of monetary assets for this position,” a user on X shared.

Ethereum revenue and DeFi TVL. Source:

Ethereum revenue and DeFi TVL. Source:

Another commentator warns that Vitalik’s framing of serving the unbanked via low-risk DeFi misstates the practical objective. They caution that moving lending/borrowing markets entirely on-chain at Layer-1 degrades user experience and reduces composability. Ethereum also struggles to compete with dedicated payment systems like Stripe or Circle, or fee-optimized chains like Solana, where high MEV subsidizes low costs.

Competition with Stablecoins and RWAs

Another strand of thought holds that Ethereum is in fierce competition with stablecoins and RWAs to retain the role of the ecosystem’s native monetary asset. While RWAs may attract users with yield, they are unlikely to match ETH’s reliability and liquidity; thus, ETH retains an edge as an unmatched monetary asset.

Notably, some analysts stress the appeal of neutral chains like Ethereum as a custody layer for centralized assets such as USDC or RWAs. Holding USDC on Aave via Ethereum may be less susceptible to intervention by Circle than storing it on centralized enterprise chains, increasing Ethereum’s attractiveness as a censorship-resistant infrastructure.

Although some see the idea of “nationalizing” core DeFi protocols on Ethereum as the right direction, many experts believe Ethereum is not yet ready to provide low-risk, low-cost, highly scalable DeFi services. This remains an endgame target that goes beyond merely on-chain lending/borrowing.

“Enshrined services is the real endgame (one step beyond what Vitalik is saying here), but it should not be limited to lending.” an expert shared on X.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BGB holders' Christmas and New Year carnival: Buy 1 BGB and win up to 2026 BGB!

Bitget Trading Club Championship (Phase 20)—Up to 2400 BGB per user, plus a RHEA pool and Mystery Boxes

Subscribe to ETH Earn products for dual rewards exclusive for VIPs— enjoy up to 8% APR and share 30,000 USDT!

Bitget Spot Margin Announcement on Suspension of ICNT/USDT, PROMPT/USDT, CAMP/USDT, FARTCOIN/USDT, PEAQ/USDT Margin Trading Services