Falcon Finance unveils USDf expansion and RWA redemption plans

Falcon Finance is expanding its USDf stablecoin reach, launching fiat on- and off-ramps across LATAM, Turkey, MENA, Europe, and the U.S., while adding real-world asset redemption options.

- In 2025, Falcon Finance will add fiat on- and off-ramps in LATAM, Turkey, MENA, Europe, and the U.S., introduce physical gold redemption in the UAE, and support tokenized assets such as T-bills and stablecoins.

- In 2026, the protocol will launch a RWA engine for corporate bonds and private credit, expand gold redemption to MENA and Hong Kong, and roll out institutional-grade USDf products and investment funds.

Falcon Finance, the next-generation dual-token synthetic dollar protocol, has released an updated whitepaper, outlining its ongoing yield strategies and an expanded roadmap for global adoption and institutional integration.

The main update centers on expanding how USDf, Falcon Finance’s stable, overcollateralized synthetic dollar , can be used and redeemed across both digital and real-world assets. In 2025, the protocol will extend its fiat rails in LATAM, Turkey, MENA, Europe, and the U.S., enabling users to deposit and withdraw USDf in their local currencies.

This year, the protocol will also introduce physical gold redemption in the UAE, giving users the option to convert their USDf into gold. Alongside this, USDf will support tokenized assets such as T-bills, stablecoins, and select cryptocurrencies.

In 2026, Falcon Finance plans to launch a modular Real-World Asset engine, enabling the tokenization of corporate bonds, private credit, and other financial instruments into USDf-backed onchain liquidity. The protocol will also expand physical gold redemption services to additional financial hubs in the MENA region and Hong Kong, while rolling out institutional-grade USDf products and investment funds.

These updates come on the heels of several key milestones for the project. Most notably, USDf has recently surpassed 1 billion in circulation, ranking it among the top ten Ethereum-based stablecoins by market cap. The protocol also completed its first “live mint” of USDf against a tokenized U.S. Treasury fund, achieving an overcollateralization ratio of 116%, independently verified by ht.digital.

How Falcon Finance’s USDf earns yield

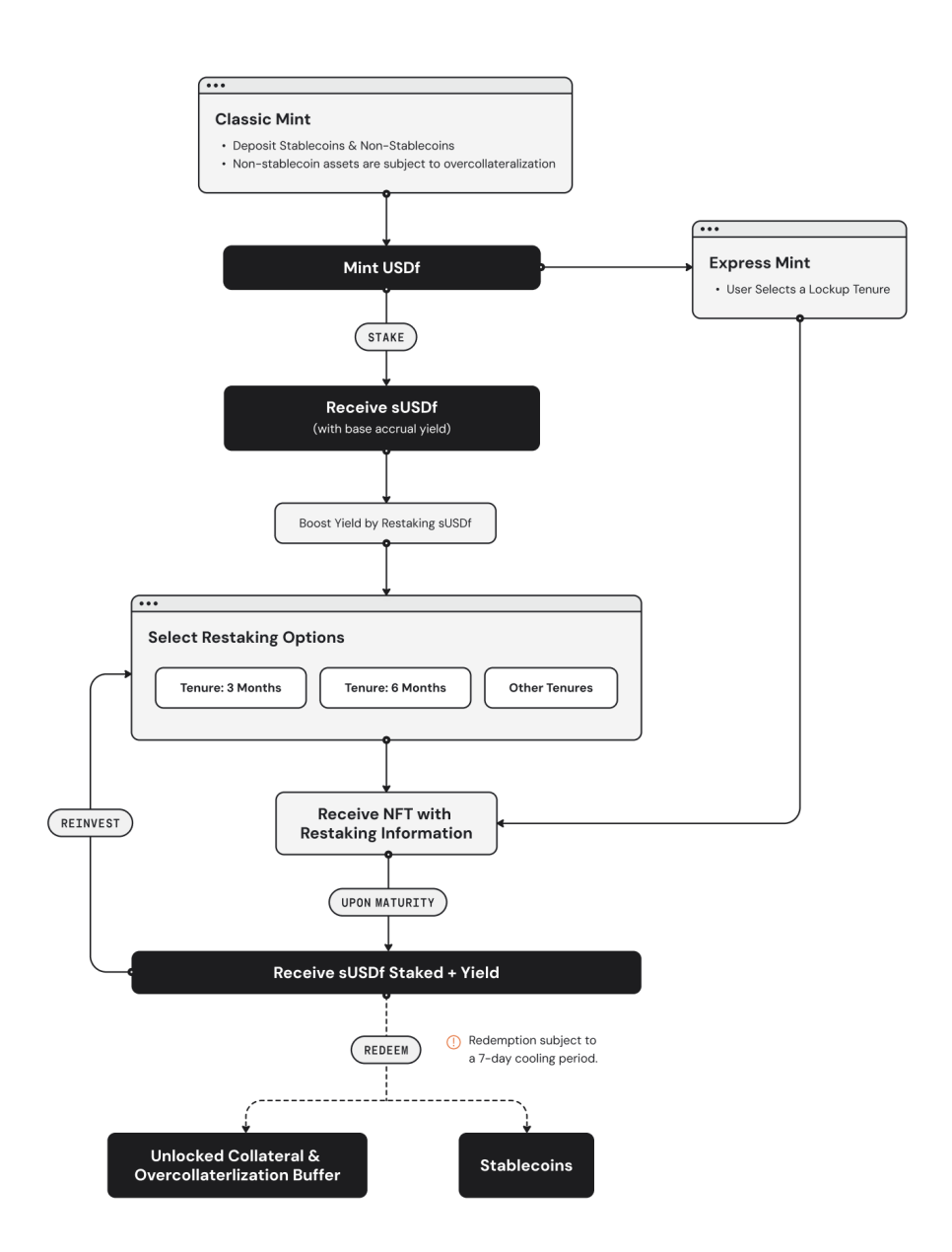

USDf is created when users deposit eligible collateral into the Falcon Finance protocol. This collateral can include stablecoins, major cryptocurrencies, or tokenized RWAs . For non-stablecoin assets like BTC or ETH, an overcollateralization ratio ensures that each USDf is fully backed, protecting both users and the protocol from market volatility.

Once minted, USDf can be staked to generate sUSDf, a yield-bearing token that accrues income through Falcon Finance’s diversified institutional-grade strategies, such as funding rate and price arbitrage. Users can redeem sUSDf for USDf, or, for non-stablecoin deposits, they can reclaim their original collateral along with any accrued overcollateralization buffer.

Source: Falcon Finance USDf Mint and Redemption Flowchart | Falcon Finance Whitepaper V2

Source: Falcon Finance USDf Mint and Redemption Flowchart | Falcon Finance Whitepaper V2

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Economic Truth: AI Drives Growth Alone, Cryptocurrency Becomes a Political Asset

The article analyzes the current economic situation, pointing out that AI is the main driver of GDP growth, while other sectors such as the labor market and household finances are in decline. Market dynamics have become detached from fundamentals, with AI capital expenditure being key to avoiding a recession. The widening wealth gap and energy supply are becoming bottlenecks for AI development. In the future, AI and cryptocurrencies may become the focus of policy adjustments. Summary generated by Mars AI This summary was generated by the Mars AI model, and its accuracy and completeness are still in the process of iterative improvement.

AI unicorn Anthropic accelerates IPO push, taking on OpenAI head-to-head?

Anthropic is accelerating its expansion into the capital markets, initiating collaboration with top law firms, which is seen as an important signal toward going public. The company's valuation is approaching 300 billions USD, and investors are betting it could go public before OpenAI.

Did top universities also get burned? Harvard invested $500 million heavily in bitcoin right before the major plunge

Harvard University's endowment fund significantly increased its holdings in bitcoin ETFs to nearly 500 million USD in the previous quarter. However, in the current quarter, the price of bitcoin subsequently dropped by more than 20%, exposing the fund to significant timing risk.

The Structural Impact of the Next Federal Reserve Chair on the Cryptocurrency Industry: Policy Shifts and Regulatory Reshaping

The change of the next Federal Reserve Chair is a decisive factor in reshaping the future macro environment of the cryptocurrency industry.