Stablecoin L1 becomes the new arena, with Circle, Tether, and Stripe competing for dominance

Author: Terry Lee

Translation: TechFlow

Introduction

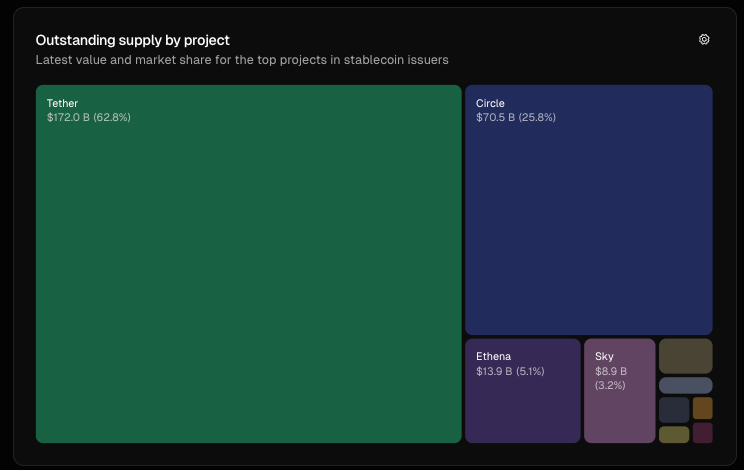

In less than 12 years, stablecoins have evolved from a niche crypto experiment and, as of September 2025, are still accelerating in growth. Notably, this growth is driven not only by market demand but also by regulatory clarity—the recently passed GENIUS Act in the US and the EU’s MiCA have provided legitimacy for stablecoins. Today, stablecoins are recognized by major Western governments as a key pillar of future finance. Even more interestingly, stablecoin issuers are not only “stable” but also highly profitable. Driven by the high interest rate environment in the US, Circle, the issuer of USDC, reported revenue of $658 million in Q2 2025, with most coming from reserve interest. Circle has been profitable since 2023, with net income reaching $271 million.

This profitability has naturally sparked competition. From Ethena’s algorithmic stablecoin USDe to Sky’s USDS, challengers are constantly emerging, attempting to break Circle and Tether’s market dominance. As competition intensifies, leading issuers like Circle and Tether are turning to developing their own Layer 1 blockchains, aiming to control the future of financial infrastructure. These financial infrastructures are designed to deepen their moats, capture more fees, and potentially reshape how programmable money flows across the internet.

The trillion-dollar question is: can giants like Circle and Tether withstand the impact of non-stablecoin-native players like Tempo?

Why Choose Layer 1? Background and Differentiation Analysis

Layer 1 blockchains are the foundational protocols of an ecosystem, responsible for processing transactions, settlement, consensus, and security. For technologists, they can be likened to operating systems in the crypto space (such as Ethereum or Solana), upon which all other functionalities are built.

For stablecoin issuers, entering Layer 1 is a vertical integration strategy. Rather than relying on third-party chains (like Ethereum, Solana, Tron) or Layer 2s, they are actively building their own infrastructure to capture more value, strengthen control, and comply with regulations.

To understand this battle for control, let’s look at the common features and unique distinctions of the Layer 1 blockchains from Circle, Tether, and Stripe:

Common Features:

-

Use their own stablecoins as native currency, eliminating the need to hold ETH or SOL to pay gas fees. For example, fees on Circle’s Arc will be paid in USDC, while in cases like Plasma, gas fees are completely waived.

-

High throughput and fast settlement: Each Layer 1 promises sub-second finality and thousands of TPS (e.g., Plasma’s 1000+ TPS, Stripe’s Tempo reaching 100,000+ TPS).

-

Optional privacy and regulatory environment: These are crypto ecosystems with stronger privacy and compliance, but at the cost of centralization.

-

EVM compatibility, ensuring developers are familiar with development standards.

Unique Differences:

-

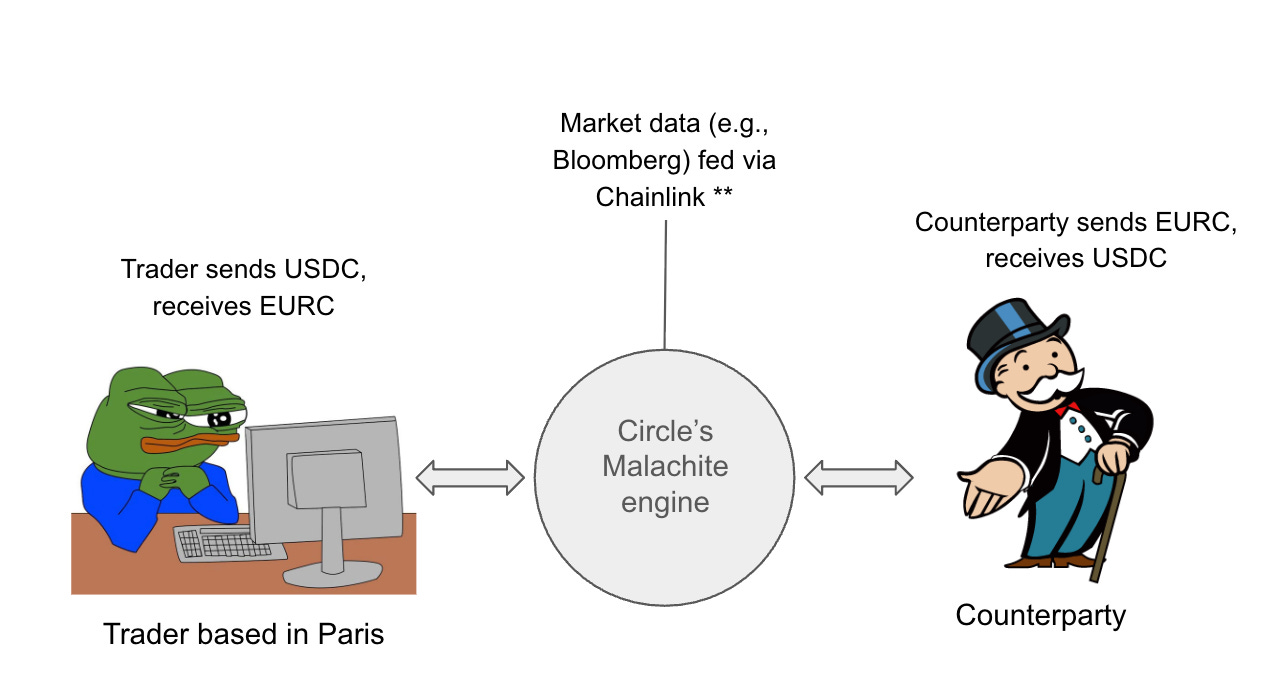

Circle’s Arc is designed for both retail and institutional users. Its internal forex engine (Malachite) makes it highly attractive in capital markets trading and payments, potentially positioning Arc as the “Wall Street” preferred crypto infrastructure.

-

Tether’s Stable and Plasma focus on accessibility, offering zero transaction fees for frictionless transactions by retail and P2P users.

-

Stripe’s Tempo takes a different approach, adhering to stablecoin neutrality. Since Tempo relies on its internal AMM mechanism to support various USD tokens, it may be highly attractive to developers seeking flexibility and users who don’t care which USD token they use.

Layer 1 Adoption Trends

From my perspective, there are three main trends:

Trend 1: Traditional Finance Access—Trust and Regulation

For stablecoin issuers, building their own Layer 1 is key to winning trust. By controlling the infrastructure or ecosystem, rather than simply relying on Ethereum, Solana, or Tron, Circle and Tether can easily provide compliant infrastructure that meets frameworks like the GENIUS Act (US) and MiCA (EU).

Circle has positioned USDC as a regulated product, requiring entities redeeming USDC for USD to comply with KYC and AML frameworks. Its newly launched Layer 1 protocol, Arc, goes a step further by combining auditable transparency with privacy features, making it a reliable candidate for institutional adoption. Tether has taken a similar approach with its Stable and Plasma chains. Their goal is to become the infrastructure backbone for banks, brokers, and asset management companies.

The potential “ideal” application scenario here is forex trading. Circle’s Arc offers sub-second finality, over 1000 TPS, and forex functionality. Arc can enable market makers and banks to settle forex trades instantly, creating opportunities for them to enter the $7 trillion+ daily forex market and forming strong network effects. Stablecoins like USDC and EURC can become the native settlement assets, locking developers into their ecosystems. This could also open the door for DeFi applications supporting institutional-grade RFQ systems, leveraging smart contracts to reduce counterparty risk and ensure rapid settlement.

Imagine a scenario where a forex trader based in Paris can directly use the USDC/EURC pair on Arc with Malachite to complete a $10 million USD-to-EUR trade. I assume they can use Chainlink’s oracle to get real-time exchange rates (e.g., $1 = €0.85), and execute a $10 million USDC to EURC conversion in less than 1 second, reducing traditional forex settlement delays from T+2 to T+0. Done!

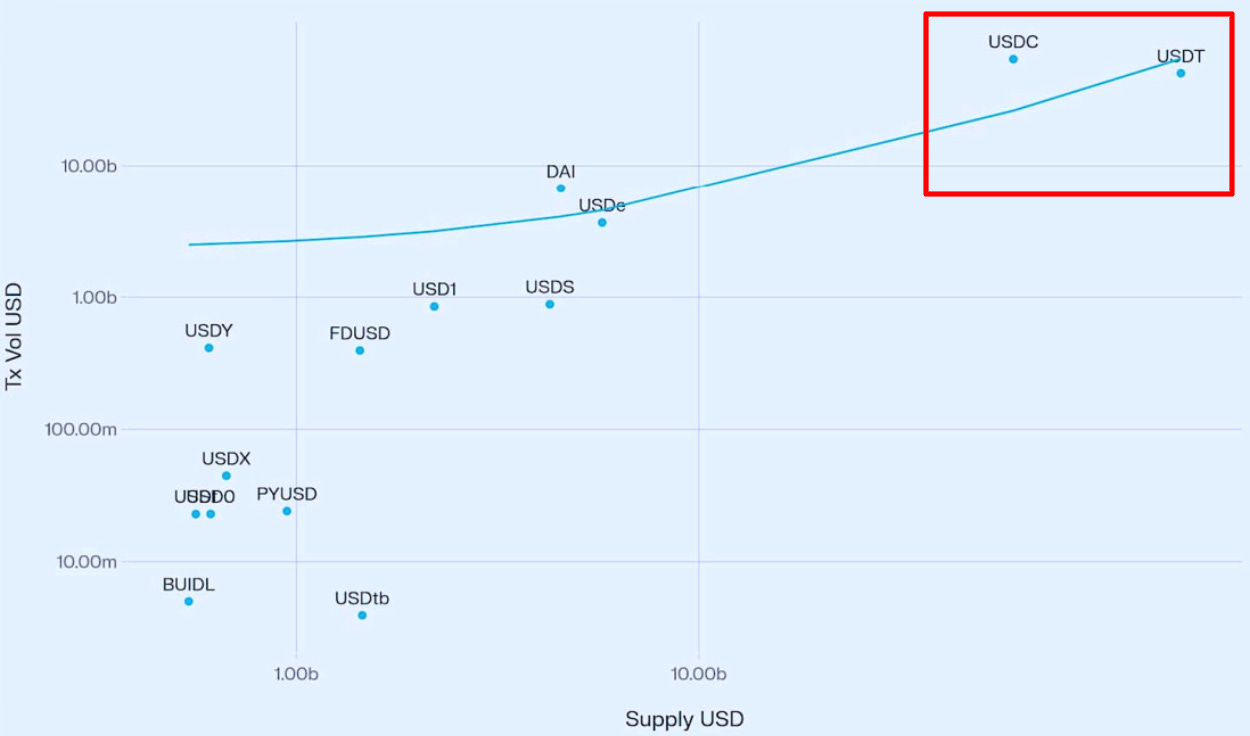

Research supports this direction. According to Vedang Ratan Vatsa’s research, there is a strong positive correlation between stablecoin supply and transaction volume, meaning greater supply leads to deeper liquidity and higher adoption. As the two largest issuers, Tether and Circle are thus well positioned to capture this institutional liquidity.

However, integrating traditional finance with blockchain infrastructure still faces significant challenges. Coordinating regulators, central banks, and regional laws requires navigating a complex environment (for example, interfacing with national central banks could take years). Issuing stablecoins for different currencies (e.g., XYZ tokens for emerging market currencies) adds further complexity, and adoption in developing economies may be extremely slow or even zero due to limited product-market fit. Even if these hurdles are overcome, banks and market makers may still be reluctant to migrate critical infrastructure to new chains. This shift could add extra costs, as not all currencies can be on-chain, forcing institutions to maintain both crypto and traditional systems. Additionally, as multiple issuers (such as Circle, Tether, Stripe, and potentially banks) launch their own blockchains, the risk of liquidity silos is increasing. Fragmentation may prevent any single chain from achieving the scale or liquidity needed to dominate the $7 trillion daily forex market.

Trend 2: Do Stablecoin Chains Threaten Traditional Payment Infrastructure?

As Layer 1s attract traditional finance with their programmability, their rise could also disrupt payment giants like Mastercard, Visa, and PayPal by providing instant, low-cost settlement services across a wide range of decentralized applications. Unlike closed, single-platform systems, these platforms are open and programmable, offering developers and fintechs a flexible foundation—akin to renting AWS cloud infrastructure rather than hosting payment infrastructure. This shift allows developers to deploy products for cross-border remittances, proxy (AI-driven) payments, and tokenized assets, all while enjoying near-zero fees and sub-second finality.

For example, developers can build a payment dApp on a stablecoin chain for instant settlement. Merchants and consumers can enjoy fast, low-cost transactions, while Layer 1s like Circle, Tether, and Tempo capture value as indispensable infrastructure. The biggest difference from traditional systems is that these systems eliminate intermediaries like Visa and Mastercard, directly creating more value for developers and users.

However, risks abound. As more issuers and payment companies launch their own Layer 1s, the ecosystem faces the risk of fragmentation. Merchants may encounter confusion with “USD”s from different chains that are not easily interchangeable. Circle’s Cross-Chain Transfer Protocol (CCTP) attempts to solve this by creating a single liquid version of USDC across multiple chains, but its coverage is limited to Circle’s tokens. In an oligopolistic market, interoperability may become a key bottleneck.

With Stripe’s recent announcement of Tempo, the landscape has shifted further. Tempo is a stablecoin-neutral Layer 1 platform co-incubated with Paradigm. Unlike Circle and Tether, Stripe has not launched its own token, but instead supports multiple stablecoins for gas and payments via a built-in AMM. This neutrality may attract developers and merchants seeking flexibility and not wanting to be locked in, potentially allowing Stripe to carve out a place in a field long dominated by crypto-native companies.

Trend 3: Duopoly Dynamics—Circle vs. Tether

As these Layer 1s challenge traditional players, they are also reshaping market structure. Currently, Circle and Tether dominate the stablecoin space with nearly 89% of issuance; as of September 2025, Tether holds 62.8% and Circle 25.8%. By launching their own Layer 1s (Arc and Stable/Plasma), they are consolidating their dominance by setting high entry barriers. For example, Plasma raised $1 billion in gold reserves for its token sale cap, constituting a high threshold for entry.

However, a subtle threat is emerging: stablecoin-neutral Layer 1s. Stripe’s Tempo reduces merchant onboarding friction and the concentration risk for regulators. If neutrality becomes the standard, the closed moats of Circle and Tether may turn into weaknesses. If neutrality becomes the norm, Circle and Tether could lose network effects and market share. The current duopoly may shift to an oligopoly, with multiple chains vying for the market.

Conclusion

In summary, as stablecoins have now become a powerful asset class exceeding $280 billion in scale, with issuers reaping huge profits, the rise of stablecoin-backed Layer 1s reveals three important trends:

(1) Integrating traditional finance into crypto-native infrastructure, entering the growing forex market;

(2) Transforming payments by eliminating intermediaries like Mastercard and Visa;

(3) Redefining the market landscape from a duopoly to an oligopoly.

Together, these shifts point to a grander vision: stablecoin issuers like Circle and Tether, as well as new entrants like Stripe’s Tempo, are no longer just bridges between crypto and fiat, but are positioning themselves as the cornerstones of future financial infrastructure.

Ultimately, this poses a question to my readers: how will these chains achieve product-market fit? Will Circle’s Arc, Tether’s Stable/Plasma, or stablecoin-neutral challengers like Tempo lead in transaction volume or institutional adoption? Despite opportunities and liquidity fragmentation, obstacles remain. Readers are welcome to share your thoughts!

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin surges to $93K after Sunday flush, as analysts eye $100K

BTC returns to $93,000 after a brief dip to $83,000—what exactly happened?

Economic Truth: AI Drives Growth Alone, Cryptocurrency Becomes a Political Asset

The article analyzes the current economic situation, pointing out that AI is the main driver of GDP growth, while other sectors such as the labor market and household finances are in decline. Market dynamics have become detached from fundamentals, with AI capital expenditure being key to avoiding a recession. The widening wealth gap and energy supply are becoming bottlenecks for AI development. In the future, AI and cryptocurrencies may become the focus of policy adjustments. Summary generated by Mars AI This summary was generated by the Mars AI model, and its accuracy and completeness are still in the process of iterative improvement.

AI unicorn Anthropic accelerates IPO push, taking on OpenAI head-to-head?

Anthropic is accelerating its expansion into the capital markets, initiating collaboration with top law firms, which is seen as an important signal toward going public. The company's valuation is approaching 300 billions USD, and investors are betting it could go public before OpenAI.