HBAR Price’s Breakout From Downtrend is Dependent on How Bitcoin Performs

HBAR’s recovery depends on Bitcoin’s strength, with a 0.95 correlation driving its direction. A breakout above $0.248 could end the downtrend, but failure risks deeper losses.

Hedera (HBAR) is showing signs of attempted recovery after weeks of subdued movement. The recent uptick comes amid a bullish wave across the broader crypto market and renewed investor support.

However, whether HBAR can sustain this rebound largely depends on Bitcoin’s trajectory.

Hedera Investors Are Bullish

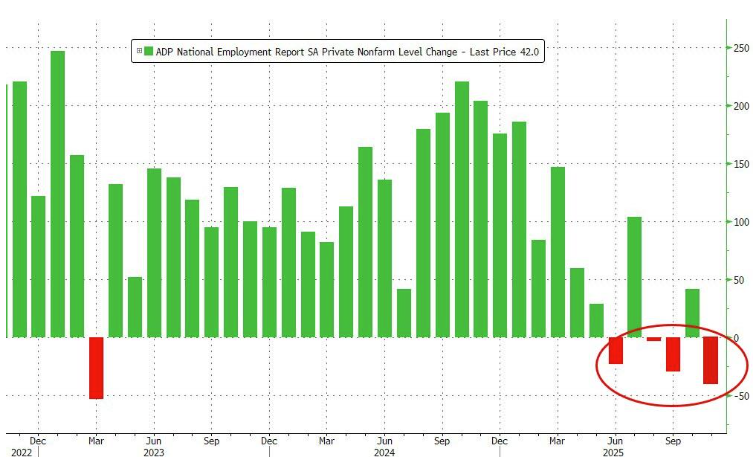

HBAR currently shares a strong correlation of 0.95 with Bitcoin, signaling that its movements are closely tied to the market leader. A high correlation often means HBAR will mimic BTC’s direction, which could be favorable if Bitcoin sustains its current momentum.

With Bitcoin trading above $117,000 and maintaining an upward push, HBAR could benefit directly from this rally. Investors are likely to view the altcoin’s performance through Bitcoin’s lens, meaning any bullish extension from BTC could serve as a catalyst for HBAR’s price growth.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

HBAR Correlation To Bitcoin. Source:

HBAR Correlation To Bitcoin. Source:

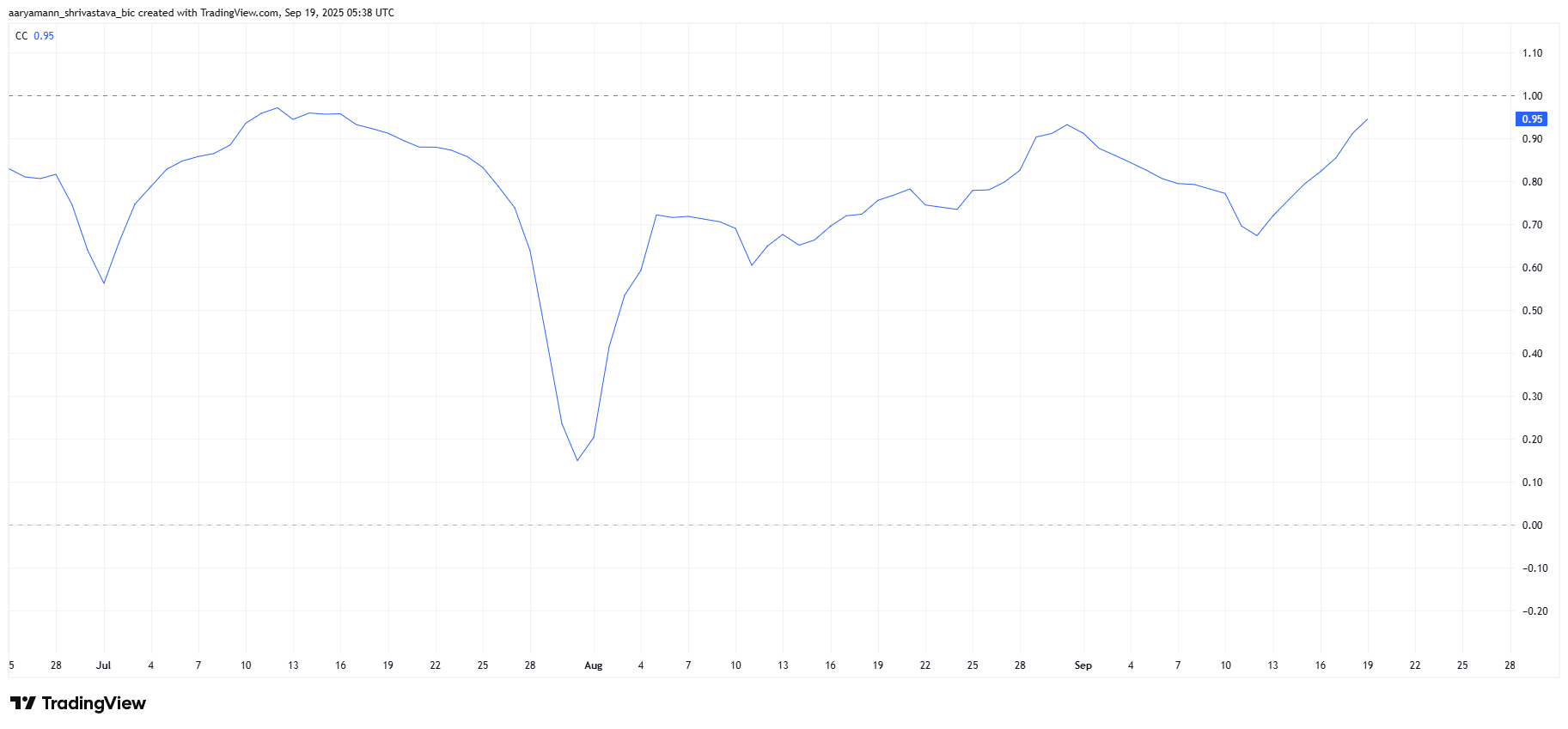

Beyond correlation, the Chaikin Money Flow (CMF) for HBAR is showing a sharp uptick, moving firmly into positive territory. This reflects growing investor inflows and suggests rising confidence in the asset’s short-term trajectory. Sustained capital movement is a key driver for bullish price action.

Strong inflows also indicate that HBAR is attracting attention despite broader market uncertainty. If investor participation continues at this pace, HBAR could secure a foundation for further gains, particularly as it attempts to break free from its ongoing downtrend.

HBAR CMF. Source:

HBAR CMF. Source:

HBAR Price Can End The Downtrend

At the time of writing, HBAR is priced at $0.244, just under the resistance of $0.248. The altcoin remains trapped in a downtrend that began in late July, making this resistance level crucial for recovery.

If bullish momentum persists, HBAR could breach $0.248 and target $0.266. Successfully flipping these levels into support would end the ongoing decline and establish the groundwork for extended growth in the coming weeks.

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

However, if HBAR fails to mirror Bitcoin’s strength or loses investor backing, it risks slipping through the $0.241 support. Such a breakdown could send the price toward $0.230 or even $0.219, effectively invalidating the current bullish outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin price fills CME gap, but '$240M market dump' stops a $104K rebound

$RAVE unveils tokenomics, igniting the decentralized cultural engine of global entertainment

$RAVE is not just a token; it represents a sense of belonging and the power of collective building. It provides the community with tools to create together, share value, and give back influence to society.

Interpretation of the ERC-8021 Proposal: Can Ethereum Replicate Hyperliquid's Developer Wealth Creation Myth?

The ERC-8021 proposal suggests embedding builder code directly into transactions. Along with a registry, developers can provide wallet addresses through the registry to receive revenue.

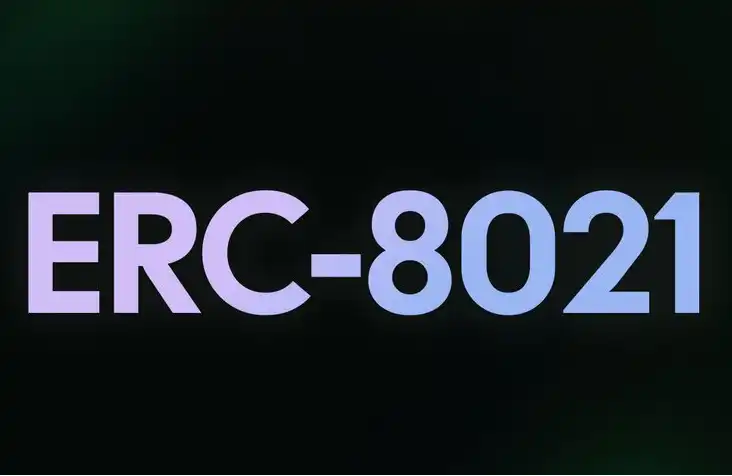

ADP data sounds the alarm again: US companies cut 11,000 jobs per week

The government shutdown has delayed official employment data, so ADP data has stepped in to reveal the truth: in the second half of October, the labor market slowed down, and the private sector lost a total of 45,000 jobs for the entire month, marking the largest decline in two and a half years.