Curve Finance Pitches Yield Basis, a $60M Plan to Turn CRV Into an Income Asset

Curve Finance founder Michael Egorov unveiled a proposal on the Curve DAO governance forum that would give the decentralized exchange's token holders a more direct way to earn income.

The protocol, called Yield Basis, aims to distribute sustainable returns to CRV holders who stake tokens to participate in governance votes, receiving veCRV tokens in exchange. The plan moves beyond the occasional airdrops that have defined the platform's token economy to date.

Under the proposal, $60 million of Curve's crvUSD stablecoin will be minted before Yield Basis starts up. Funds from selling the tokens will support three bitcoin-focused pools; WBTC, cbBTC and tBTC, each capped at $10 million.

Yield Basis will return between 35% and 65% of its value to veCRV holders, while reserving 25% of Yield Basis tokens for the Curve ecosystem. Voting on the proposal runs from Sept. 17 to Sept. 24.

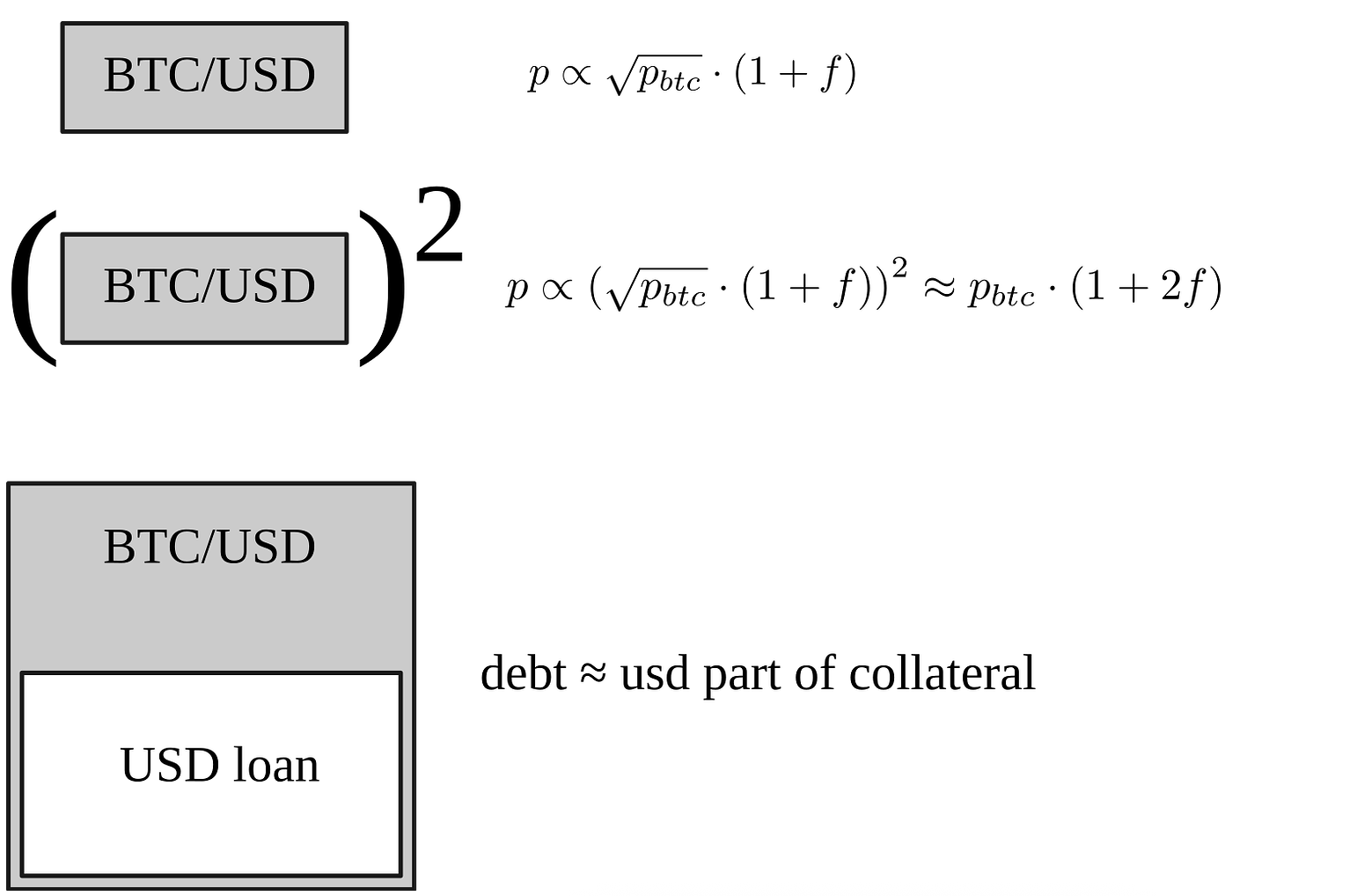

The protocol is designed to attract institutional and professional traders by offering transparent, sustainable bitcoin yields while avoiding the impermanent loss issues common in automated market makers.

Impermanent loss occurs when the value of assets locked in a liquidity pool changes compared with holding the assets directly, leaving liquidity providers with fewer gains (or greater losses) once they withdraw.

The new protocol comes against a backdrop of financial turbulence for Egorov himself. The Curve founder has suffered several high-profile liquidations in 2024 tied to leveraged CRV purchases.

In June, more than $140 million worth of CRV positions were liquidated after Egorov borrowed heavily against the token to support its price. That episode left Curve with $10 million in bad debt.

Most recently, in December, Egorov was liquidated for 918,830 CRV (about $882,000) after the token dropped 12% in a single day. He later said on X that the position was linked to funds from the uWu hack and represented repayment of a promise by uWu’s founder.

CRV rose around 1% in the past 24 hours.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

COC the Game Changer: When Everything in GameFi Becomes "Verifiable", the Era of P2E 3.0 Begins

The article analyzes the development of the GameFi sector from Axie Infinity to Telegram games, pointing out that Play to Earn 1.0 failed due to the collapse of its economic model and trust issues, while Play for Airdrop was short-lived because it could not retain users. COC Game has introduced the VWA mechanism, which verifies key data on-chain in an attempt to address trust issues and build a sustainable economic model. Summary generated by Mars AI. This summary was generated by the Mars AI model, and its accuracy and completeness are still being iteratively updated.

BTC Volatility Weekly Review (November 17 - December 1)

Key metrics (from 4:00 PM HKT on November 17 to 4:00 PM HKT on December 1): BTC/USD: -9.6% (...

When all GameFi tokens have dropped out of the TOP 100, can COC reignite the narrative with a Bitcoin economic model?

On November 27, $COC mining will be launched. The opportunity to mine the first block won't wait for anyone.

Ethereum's Next Decade: From "Verifiable Computer" to "Internet Property Rights"

Fede, the founder of LambdaClass, provides an in-depth explanation of anti-fragility, the 1 Gigagas scaling goal, and the vision for Lean Ethereum.