Trump’s Fed Pick Revives “Third Mandate,” Sparking Dollar Concerns and Crypto Optimism

Contents

Toggle- Quick breakdown

- Forgotten clause re-emerges in US monetary policy debate

- Yield curve control back on the table

- Crypto voices see bullish outlook

Quick breakdown

- Trump’s Fed nominee Stephen Miran cited a “third mandate” requiring moderate long-term interest rates.

- The administration may use this clause to justify yield curve control and expanded money printing.

- Analysts say the move could weaken the dollar but fuel a major capital shift into Bitcoin.

Forgotten clause re-emerges in US monetary policy debate

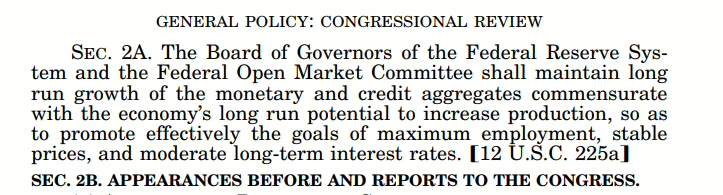

A rarely cited provision in the Federal Reserve’s founding documents is back in the spotlight, with the Trump administration looking to reshape long-term monetary policy. Stephen Miran, President Donald Trump’s nominee for Fed governor, recently referenced a “third mandate,” igniting speculation about more aggressive interventions in bond markets.

Source

:

US Government Publishing Office

Source

:

US Government Publishing Office

Traditionally, the Fed’s role has been defined by a dual mandate : ensuring price stability and supporting maximum employment. However, buried in its statutory framework is a third objective — maintaining moderate long-term interest rates. While long treated as a byproduct of the other two goals, Trump’s economic team appears ready to leverage it as legal cover for bolder monetary action.

Yield curve control back on the table

According to Bloomberg, the administration may pursue policies such as direct yield curve control, quantitative easing, or bond buybacks to actively suppress long-term interest rates. The move could reduce government borrowing costs as the national debt climbs past $37.5 trillion, while also easing mortgage rates to boost the housing market.

Trump has long criticized Fed Chair Jerome Powell for being “too slow” to cut rates, and the revived mandate could offer fresh grounds to push for lower borrowing costs. Despite expressing frustration over the Fed’s cautious approach to cutting interest rates, Trump firmly stated he has no plans to remove Powell from his position.

Crypto voices see bullish outlook

Market analysts suggest this shift could undermine the dollar while boosting demand for alternative assets. Christian Pusateri, founder of Mind Network, referred to the mandate as “financial repression by another name,” likening it to yield curve control.

Arthur Hayes, the outspoken BitMEX co-founder, went further, predicting that such policies could eventually drive Bitcoin’s price toward $1 million. In August, Hayes compared the U.S. Federal Reserve’s recent actions to a fleeting “sugar high” for the economy, suggesting that this could lead to a temporary boost with lasting impacts on the crypto market.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ETFs are being launched in clusters, but coin prices are falling. Can ETF approval still be considered good news?

On one hand, Vanguard Group has opened trading for Bitcoin ETFs, while on the other, CoinShares has withdrawn its applications for XRP, Solana Staking, and Litecoin ETFs, highlighting a significant divergence in institutional attitudes towards ETFs for different cryptocurrencies.

Crypto Market Thrives as Ethereum Gains and ARB Coin Potential Rise

In Brief The crypto market shows signs of activity ahead of the Fed meeting. Ethereum's strong performance is sparking widespread interest. ARB Coin shows potential with consistent TVL growth.

The Chainlink ETF Disappoints Despite $41 Million Inflows — Why?