Somnia’s Bullish Momentum Builds: Is a 40% Rise Towards All-Time High on the Horizon?

Somnia (SOMI) is gaining bullish traction, supported by capital inflows and stronger Bitcoin alignment. With resistance at $1.44, a breakout could set the stage for a retest of its $1.90 all-time high.

Somnia has drawn strong bullish attention in recent days, with the altcoin maintaining upward momentum.

Investors are showing confidence as SOMI steadily consolidates gains. With sentiment strengthening, the token is now on track to challenge its all-time high (ATH).

Somnia Investors Are Bullish

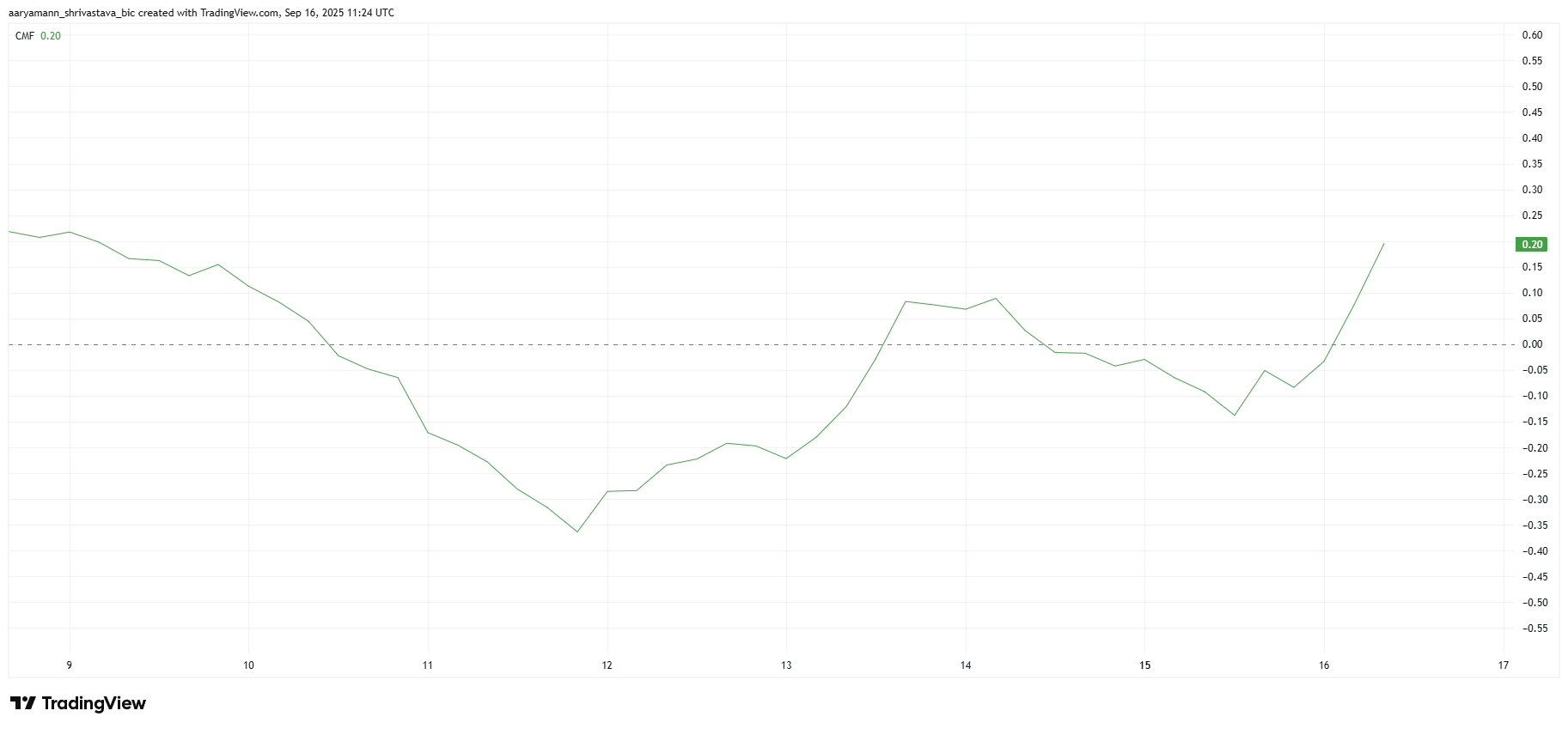

The Chaikin Money Flow (CMF) indicator reflects growing investor optimism toward Somnia. The metric, which measures capital inflows and outflows, has been climbing steadily, highlighting that more funds are entering the asset than leaving it.

Such an uptick is generally viewed as a positive signal for price action. Increasing inflows suggest that traders expect SOMI to continue rallying. This would provide a strong base for the altcoin to attempt to push toward its ATH in the near term.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

SOMI CMF. Source:

SOMI CMF. Source:

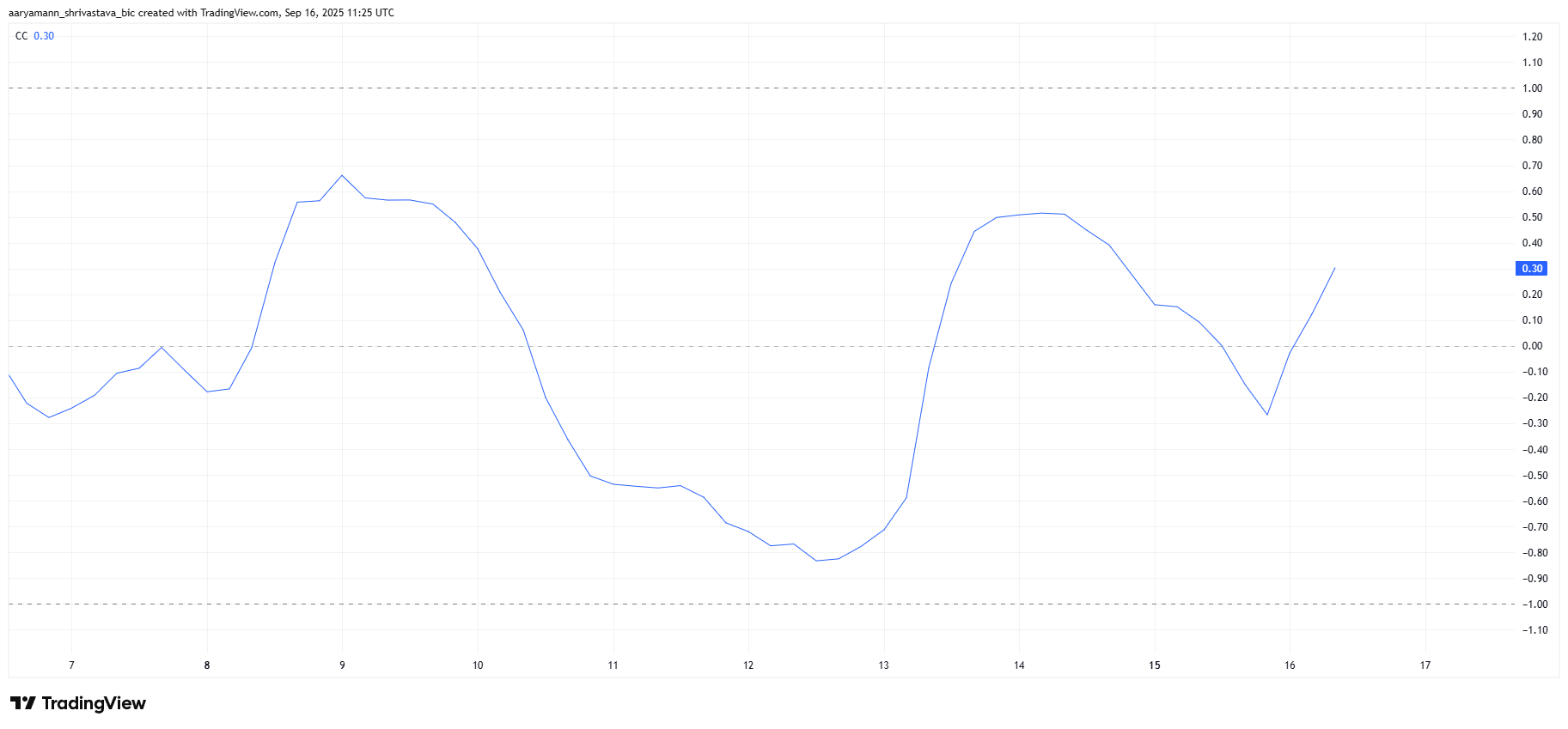

Somnia’s correlation with Bitcoin has improved, standing at 0.30 compared to -0.35 noted earlier. While not yet a strong correlation, this shift points to SOMI aligning more closely with broader market trends.

If Bitcoin maintains its bullish momentum, Somnia could benefit from the spillover effect. A rising correlation often allows smaller tokens to follow BTC’s trajectory. This would improve their odds of sustaining growth and attracting more investor capital.

SOMI Correlation To Bitcoin. Source:

SOMI Correlation To Bitcoin. Source:

SOMI Price Faces Resistance

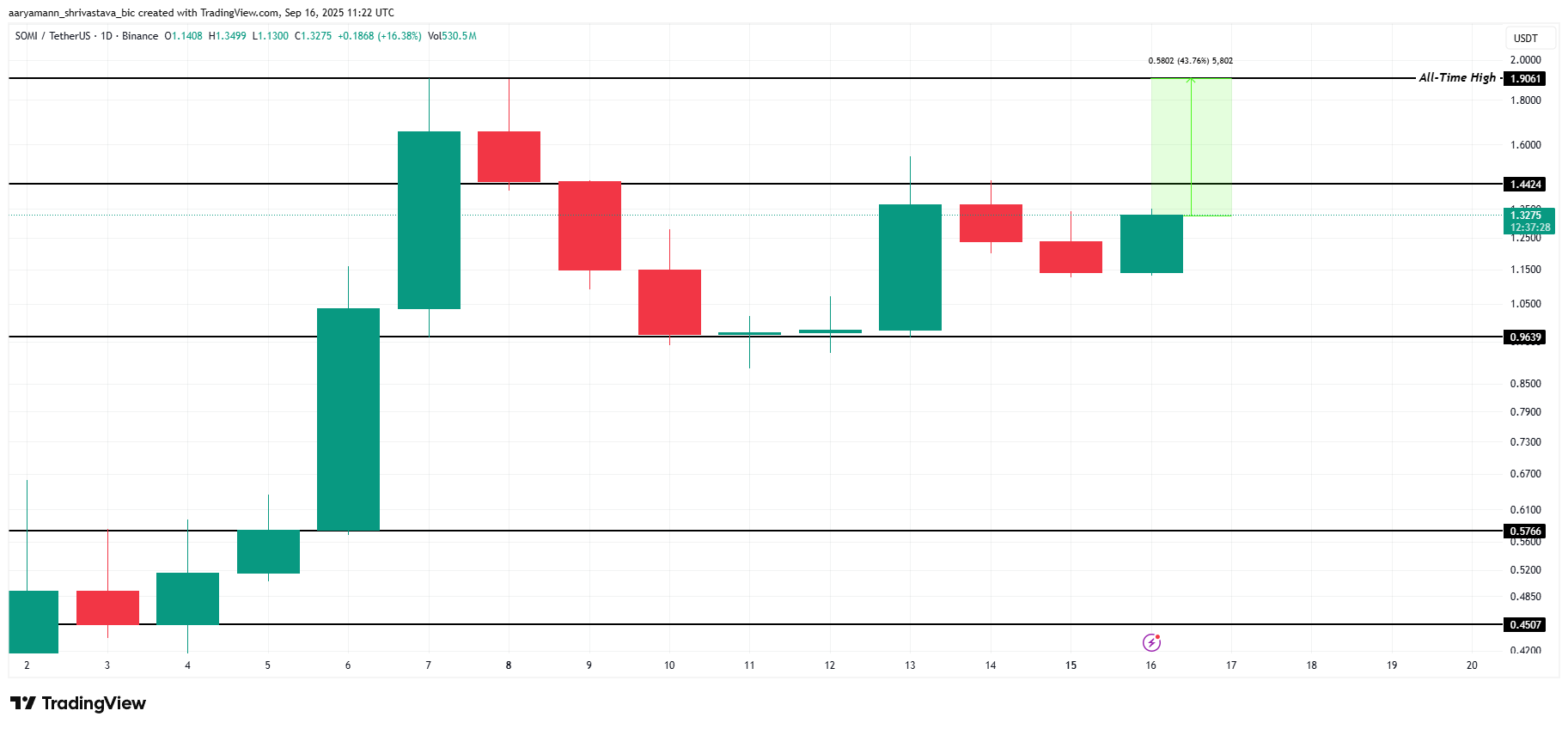

At press time, Somnia is trading at $1.32, holding firm above its $0.96 support. The token has struggled to breach the $1.44 resistance level in recent sessions. However, the support floor suggests resilience against downside pressure.

Based on market sentiment and capital inflows, SOMI could flip $1.44 into support. Doing so would open the path toward retesting the $1.90 ATH. A breakout beyond this level could see the altcoin form a new all-time high in the coming weeks.

SOMI Price Analysis. Source:

SOMI Price Analysis. Source:

However, risks remain if investor sentiment shifts. Should selling pressure increase, Somnia could fall through the $0.96 support level. This would expose the token to a deeper correction, potentially dragging it down to $0.57 and invalidating the current bullish outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Decoding VitaDAO: A Paradigm Revolution in Decentralized Science

Mars Morning News | ETH returns to $3,000, extreme fear sentiment has passed

The Federal Reserve's Beige Book shows little change in U.S. economic activity, with increasing divergence in the consumer market. JPMorgan predicts a Fed rate cut in December. Nasdaq has applied to increase the position limit for BlackRock's Bitcoin ETF options. ETH has returned to $3,000, signaling a recovery in market sentiment. Hyperliquid has sparked controversy due to a token symbol change. Binance faces a $1 billion terrorism-related lawsuit. Securitize has received EU approval to operate a tokenization trading system. The Tether CEO responded to S&P's credit rating downgrade. Large Bitcoin holders are increasing deposits to exchanges. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

The central bank sets a major tone on stablecoins for the first time—where will the market go next?

The People's Bank of China held a meeting to crack down on virtual currency trading and speculation, clearly defining stablecoins as a form of virtual currency with risks of illegal financial activities, and emphasized the continued prohibition of all virtual currency-related businesses.