Bitget Daily Digest(September 16)|Fed rate cut probability reaches 95.9%;Spot Gold Price Surpasses $3,680/oz;South Korea lifts restrictions on virtual asset trading and brokerage services

Today's Preview

1. The French financial regulator has warned of loopholes in the EU MiCA crypto regulations, which may hinder cross-border licensing and raise concerns over regulatory arbitrage.

2. Starting today, Pakistan’s crypto regulator will invite international virtual asset service providers to apply for local licenses, with the requirement to comply with Islamic law standards.

Macro & Hot Topics

1. Expectations for a Fed rate cut are heating up. The CME “FedWatch” tool shows a 95.9% probability of a 25 basis point cut this week, which could be positive for the markets.

2. The US is pushing for legislation to establish a strategic Bitcoin reserve, aiming to acquire 1 million BTC as a national strategic asset within five years.

3. The spot price of gold has surpassed $3,680/oz for the first time, intensifying the growing correlation between Bitcoin and gold.

4. South Korea has announced the lifting of restrictions on virtual asset trading and brokerage businesses starting today, allowing crypto companies to apply for high-risk enterprise certifications to promote compliant market development.

Market Updates

1. BTC and ETH market sentiment remains neutral in the short term. The total amount liquidated in the past 24 hours is about $125 million, mainly from long positions.

2. All three major US stock indexes closed higher, with the Nasdaq and S&P 500 both hitting all-time highs. The tech sector performed strongly, reflecting a positive market sentiment.

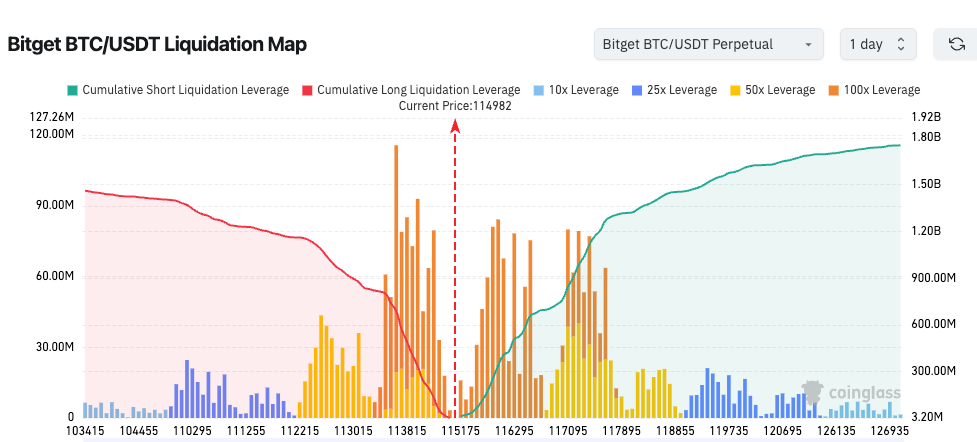

3. Bitget BTC/USDT liquidation map: BTC is currently trading at 114,982 USDT. There is dense high-leverage liquidation activity between 113,815 and 117,095. A price breakout could trigger extreme volatility, so caution is advised.

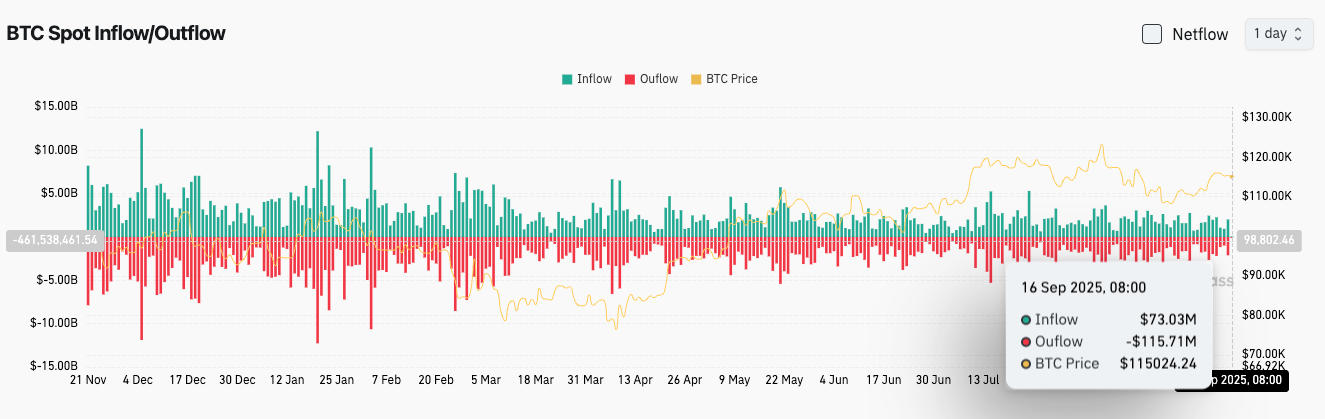

4. In the past 24 hours, BTC spot inflows totaled $73 million, outflows $116 million, resulting in a net outflow of $87 million.

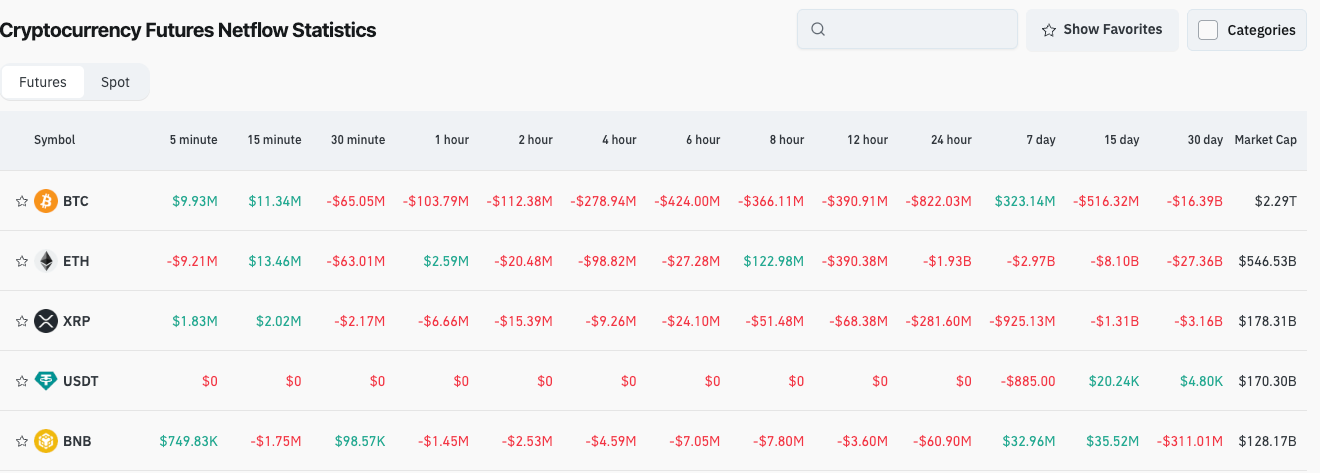

5. Over the past 24 hours, BTC, ETH, XRP, USDT, BNB, and other token contract trades have seen leading net outflows, possibly presenting trading opportunities.

News Updates

1. The Fellowship PAC has been officially established, pledging over $100 million to support pro-crypto candidates and advance regulatory clarity in the US.

2. The REX-Osprey™ XRP ETF will go live this week, while the Dogecoin ETF (DOJE) is planned for launch on Thursday.

3. Helius Medical Technologies has launched a $500 million corporate treasury centered around Solana.

Project Developments

1. MetaMask has officially launched the native stablecoin mUSD, supporting both Ethereum and Linea.

2. Neo X mainnet has upgraded to v0.4.2, enabling MEV-resistance features.

3. Starknet has suspended staking to integrate Bitcoin staking functions.

4. Ronin Network has approved migration to Ethereum’s L2 Optimism solution.

5. Digital Gold’s native token $GOLD has officially launched on Solana.

6. RuneSoul has completed a $4 million funding round, led by Bitgo Capital.

7. Wall Street Pepe has burned 3.6 billion WEPE tokens.

8. The Base and Solana open bridge is now live on the testnet.

9. BitMine Immersion Technologies (BMNR) announced that their crypto and cash holdings have reached $10.8 billion, with over 2.15 million ETH held, making them the largest ETH treasury globally.

Disclaimer: This report was generated by AI and human-verified for accuracy. It is not intended as investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Economic Truth: AI Drives Growth Alone, Cryptocurrency Becomes a Political Asset

The article analyzes the current economic situation, pointing out that AI is the main driver of GDP growth, while other sectors such as the labor market and household finances are in decline. Market dynamics have become detached from fundamentals, with AI capital expenditure being key to avoiding a recession. The widening wealth gap and energy supply are becoming bottlenecks for AI development. In the future, AI and cryptocurrencies may become the focus of policy adjustments. Summary generated by Mars AI This summary was generated by the Mars AI model, and its accuracy and completeness are still in the process of iterative improvement.

AI unicorn Anthropic accelerates IPO push, taking on OpenAI head-to-head?

Anthropic is accelerating its expansion into the capital markets, initiating collaboration with top law firms, which is seen as an important signal toward going public. The company's valuation is approaching 300 billions USD, and investors are betting it could go public before OpenAI.

Did top universities also get burned? Harvard invested $500 million heavily in bitcoin right before the major plunge

Harvard University's endowment fund significantly increased its holdings in bitcoin ETFs to nearly 500 million USD in the previous quarter. However, in the current quarter, the price of bitcoin subsequently dropped by more than 20%, exposing the fund to significant timing risk.

The Structural Impact of the Next Federal Reserve Chair on the Cryptocurrency Industry: Policy Shifts and Regulatory Reshaping

The change of the next Federal Reserve Chair is a decisive factor in reshaping the future macro environment of the cryptocurrency industry.