Academic faction makes a comeback, small-town professor Waller becomes the hottest candidate for Federal Reserve Chair

Stablecoins, RWA, and on-chain payments are experiencing a rare period of policy alignment.

Author: Ethan, Odaily

In the early morning of September 12, East 8th District time, the US federal funds rate market sent a highly explicit signal: the probability that the Federal Reserve will cut interest rates by 25 basis points at this month's policy meeting has reached as high as 93.9%. After five consecutive “holds,” the market has finally welcomed a directional shift in monetary policy. Meanwhile, another bet concerning the direction of the Fed over the next two years is quietly advancing: Who will succeed Powell as the next Fed Chair?

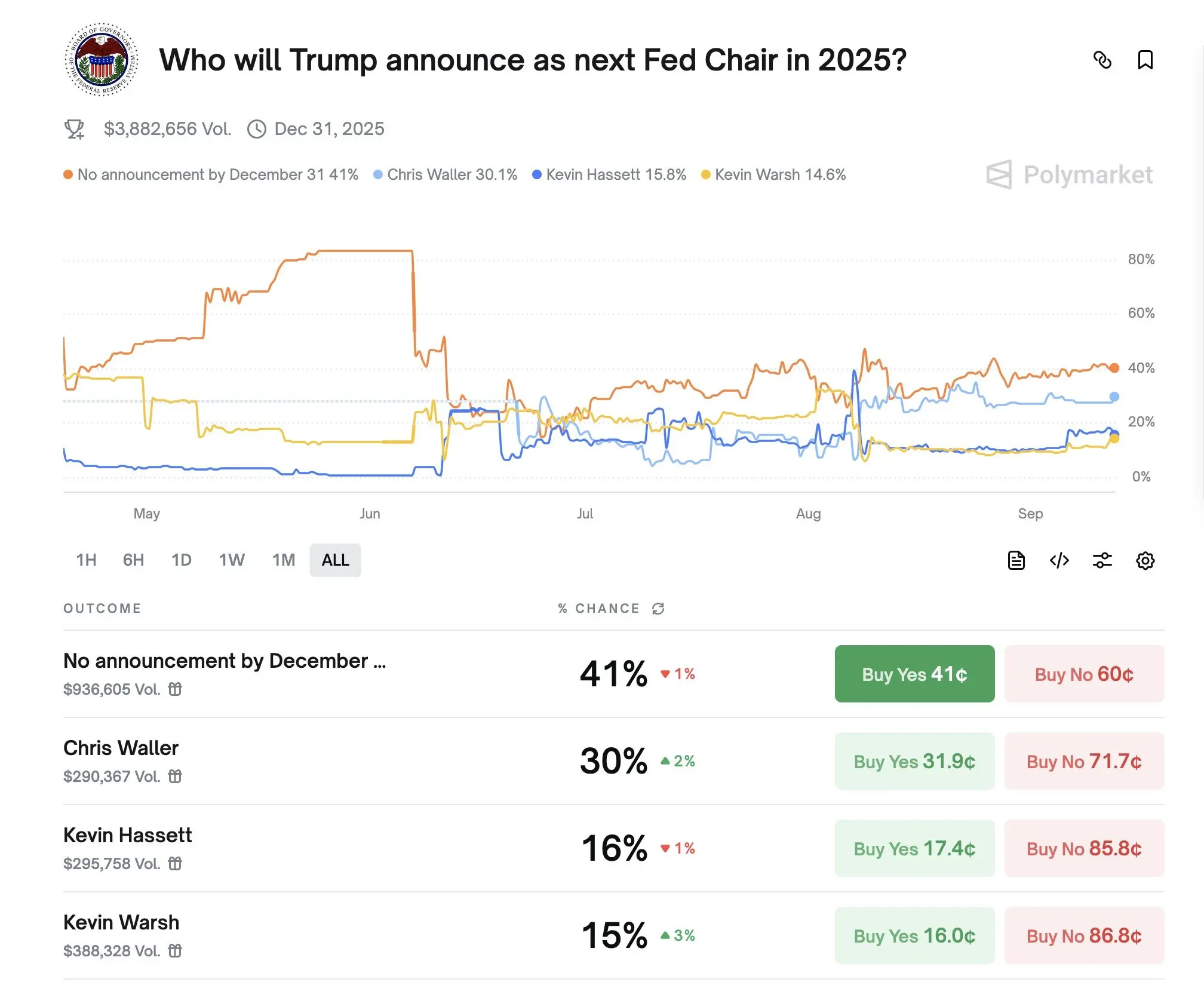

On the decentralized prediction platform Polymarket, as of the same day, current Fed Governor Christopher Waller leads with a 30% probability, ahead of the other two “Kevin faction” contenders—Hassett (16%) and Warsh (15%). However, the market also retains a more dramatic possibility: the probability that “Trump will not announce a successor before the end of the year” still ranks first, as high as 41%.

This series of data indicates that the market is betting in two directions simultaneously: one is the already consensus path of rate cuts, and the other is the still uncertain contest for the monetary helm. And between these two, Waller’s name repeatedly appears in various trading perspectives and policy games.

Why has the market started to “believe in Waller”?

The story of an “atypical Fed Governor”: How did a small-town professor come to the forefront?

Waller’s background and resume stand out in the Fed system. He did not come from the Ivy League, nor did he hold key positions at Goldman Sachs or Morgan Stanley; he was born in a small town in Nebraska with a population of less than 8,000. Starting from Bemidji State University, he earned a bachelor’s degree in economics. In 1985, he received his PhD in economics from Washington State University and began a long academic career, teaching and researching at Indiana University, the University of Kentucky, and the University of Notre Dame for a total of 24 years.

He then spent 24 years in academia researching monetary theory, focusing mainly on central bank independence, tenure systems, and market coordination mechanisms. In 2009, he left academia to join the St. Louis Fed as Director of Research. Until 2019, he was nominated by Trump to join the Federal Reserve Board of Governors—a nomination process full of controversy and a confirmation process that was not smooth. But finally, on December 3, 2020, the Senate confirmed his appointment by a narrow margin of 48:47. Entering the Fed’s highest decision-making body at the age of 61, Waller is older than most governors, but this has become an advantage: he has fewer burdens, owes no favors to Wall Street, and, having worked at the St. Louis Fed, knows that the Fed is not monolithic—different voices are not only tolerated but sometimes encouraged.

This path allows him to have professional judgment while retaining the freedom to express himself, without being categorized as a spokesperson for any faction. In Trump’s view, such a person may be easier to “put to use”; in the eyes of the market, such a candidate means “less uncertainty.”

But in a game of power transition intertwined with bureaucracy and political will, Waller is not the kind of candidate naturally favored by the market. His career trajectory is relatively academic and technical, not known for public rhetoric, nor does he frequently appear on financial television.

Yet it is precisely such a person who has gradually become the “consensus candidate” frequently mentioned in various market tools and political commentary. The reason lies in his triple compatibility:

First, his monetary policy style is flexible but not speculative.

Waller is neither a typical “inflation hawk” nor a proponent of monetary easing. He advocates that policy should move with economic conditions: in 2019, he supported preemptive rate cuts to stave off recession; in 2022, he favored rapid rate hikes to curb inflation; and in 2025, amid economic slowdown and falling inflation, he was among the first Fed governors to vote for rate cuts. This “non-ideological” policy style stands out as rare in today’s highly politicized Fed landscape.

Second, his political relationships are clear, and his technical image is extremely clean.

Waller was nominated by Trump in 2020 to be a Fed governor, making him one of the few monetary policy officials within the Republican system who can achieve “technical neutrality” and “political compatibility.” He is neither seen as “Trump’s confidant” nor rejected by the party establishment. This unique middle-ground positioning gives him broader political maneuvering space amid fierce partisan competition.

Unlike Hassett, who has a clear stance and strong factional color, or Warsh, who has close ties to Wall Street, Waller displays a purer technocratic quality. He is more easily seen as “a trustworthy professional,” and in the context of highly polarized American politics, this de-ideologized, competence-based image makes him a stable and broadly acceptable appointment.

Third, his attitude toward crypto technology is “tolerant” within the system.

Waller is not a so-called “crypto believer,” but he is one of the most vocal people in the Fed system on topics such as stablecoins, AI payments, and tokenization. He does not advocate government-led innovation and opposes CBDC, but supports private stablecoins as tools to improve payment efficiency, proposing that “the government should build the underlying infrastructure like highways, and leave the rest to the market.”

Between traditional finance and digital assets, compared to the other two candidates, he may be the only Fed official to clearly send a “public-private collaboration” signal.

Sensitivity and sense of timing: He knows when to speak and when to keep quiet

This July, the Fed held its summer FOMC meeting. Although the market generally expected to “keep rates unchanged,” the meeting saw a rare occurrence: Waller and Michelle Bowman cast dissenting votes, advocating for an immediate 25 basis point rate cut.

Such “minority dissent” is uncommon within the Fed. The last time a similar situation occurred was in 1993.

Two weeks before the vote, Waller had already expressed his position at a central bank seminar at New York University. His public speech clearly advocated that “current economic data supports a moderate rate cut.” On the surface, this was a technical “advance communication”; but in terms of timing, it was a release of a political signal. At the time, Trump had a love-hate relationship with Powell, repeatedly attacking him on Truth Social and demanding “immediate rate cuts.” Waller’s vote and speech neither fully aligned with the president nor provided cover for Powell. He stood precisely between “policy adjustment” and “technical independence.”

In a highly politicized Fed environment, a governor who can strike this balance and knows when to make a statement appears to have more leadership qualities.

Trump criticizes Powell for “poor and incompetent” management of the Fed building construction

If he takes office, how should the crypto market react?

For the crypto market, “who steers the Fed” has never been mere gossip, but a triple reflection of policy expectations, market sentiment, and regulatory pathways. If this time, Waller really becomes chair, we need to seriously consider how three types of players will reprice the future.

First, for stablecoin issuers and the compliance track, it is the large-scale opening of a “regulatory dialogue window”

Waller has repeatedly made it clear in speeches that he opposes central bank digital currencies (CBDC), saying they “cannot solve the market failures of the existing payment system,” and instead emphasizes the advantages of private stablecoins (such as USDC, DAI, PayPal USD, etc.) in improving payment efficiency and cross-border settlement. He stresses that regulation should come from “legislation by Congress, not agency expansion,” and calls for “these new technologies not to be stigmatized.”

This means that if he becomes chair, projects like Circle, MakerDAO, Ethena, etc., may usher in a “period of regulatory certainty,” no longer always stuck in the gray area between the SEC and CFTC. More importantly, Waller’s philosophy of “market-led, government paving the way” may prompt the Treasury, FDIC, and other supporting agencies to jointly develop a stablecoin regulatory framework, promoting the implementation of policies such as “licensing, reserve standardization, and information disclosure standardization.”

Second, for main chain assets like BTC and ETH, it is a “mid-term protection umbrella” of positive sentiment and regulatory easing

Although Waller has not publicly praised Bitcoin or Ethereum, he stated in 2024: “The Fed should not take sides in the market.” This brief statement means that the Fed will not actively “suppress non-dollar systems” as long as they do not touch the bottom lines of payment sovereignty and systemic risk.

This will provide BTC and ETH with a “relatively mild regulatory cycle” window. Even if the SEC may still question their securities attributes, if the Fed does not push CBDC, does not block crypto payments, and does not intervene in on-chain activities, then market speculation and risk appetite will naturally improve.

In short, in the “Waller era,” Bitcoin may not receive “official endorsement,” but will enjoy the natural benefit of “regulatory tailwinds loosening.”

Third, for developers and DeFi native innovators, it is a rare window of “central bank dialogue partner”

Waller has mentioned “AI payments,” “smart contracts,” and “distributed ledger technology” on multiple occasions this year, stating: “We may not necessarily adopt these technologies, but we must understand them.” This stance is in stark contrast to many regulators who avoid or denigrate crypto technology.

This opens up an extremely important space for developers: not necessarily to be accepted, but at least no longer to be excluded.

From Libra to USDC, from EigenLayer to Visa Crypto, generation after generation of developers and central bank regulators have been stuck in an “awkward parallel universe.” If Waller takes office, the Fed may become the first central bank leader “willing to talk to DeFi natives.”

In other words, crypto developers may usher in a starting moment for “policy negotiation rights” and “financial discourse power.”

Conclusion: Prediction markets price the future, the chair candidate prices the direction

Whether “Waller will be the new chair” is still undetermined. But the market has already started trading on “how he would price the future if he became chair.” And the prediction market’s 31% bet on him continues to climb, far surpassing his competitors.

At this juncture, it is certain that rate cut expectations are moving toward realization; the crypto industry is seeking a policy breakthrough; and US dollar assets are in a global “US Treasury issuance increase—high interest rates—risk appetite recovery” triangular game. As a politically acceptable, policy predictable, and market-imaginable “successor,” Waller has naturally become the focus of bets.

But perhaps there is another topic worth watching: If he ultimately does not become Fed Chair, how will the market readjust these expectations? And if he really takes office—perhaps the “next-generation US dollar system” race has only just begun.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why SEI must reclaim KEY support to avoid drop below $0.07

Ethereum Faces Uncertainty with Tight Trading Range

Fundstrat Internal Report Projects Crypto Drawdown Despite Tom Lee Bullish Stance