Dogecoin price trades at $0.246 after reclaiming $0.240 support, forming higher lows and testing $0.250 resistance; momentum and institutional accumulation suggest a short-term bullish continuation if $0.240 holds and volume increases over the coming sessions.

-

Dogecoin reclaims $0.240; testing $0.250 resistance with higher lows supporting bullish momentum.

-

CleanCore Solutions bought $130M in DOGE, raising holdings to 500M tokens and expanding treasury accumulation.

-

DOGE ETF approval and DeFi TVL at $24.07M increase institutional awareness and on-chain participation.

Dogecoin price update: DOGE trading at $0.246 after reclaiming $0.240 support — track momentum, accumulation, and key resistance near $0.250. Read the market brief now.

What is the Dogecoin price outlook after reclaiming $0.240?

Dogecoin price is trading at $0.246 after reclaiming the $0.240 support level, forming higher lows and approaching $0.250 resistance. The short-term outlook is bullish if $0.240 holds and buying volume increases; a break below $0.240 would raise the risk of deeper consolidation.

How did DOGE establish its current technical structure?

On the four-hour chart, DOGE formed a sequence of higher lows after reclaiming $0.240, creating a clean breakout setup. Price consolidated between $0.210–$0.230 earlier, then advanced above $0.230 and is now testing $0.250 resistance.

Analyst observations note a rising weekly trendline established in 2024, which supports a multi-timeframe bullish bias. Technical targets referenced by market commentators extend toward $0.35 and further into 2026 under bullish continuation scenarios.

$DOGE is trading at $0.246, showing strong momentum after reclaiming the $0.240 support zone. $DOGE highlights a clean breakout setup, with price forming higher lows and now aiming toward the $0.250 resistance, signaling bullish continuation if momentum holds. pic.twitter.com/v4n1WhX6W6

— BitGuru 🔶 (@bitgu_ru) September 11, 2025

In mid-August DOGE faced rejection near $0.250 and pulled back toward $0.220. The subsequent base between $0.210 and $0.230 enabled the current rally once buyers stepped in above $0.230.

Source: AlexClay (X)

Source: AlexClay (X)

Alex Clay reported, “Massive accumulation cylinder holding strong. Higher lows consistently build. The next step is clear, a higher high.” This commentary aligns with technical projections that place intermediate targets above $0.35 under sustained accumulation.

How are institutional developments affecting DOGE?

Institutional activity has accelerated, with CleanCore Solutions buying $130 million in DOGE during September and increasing holdings to 500 million tokens. The company has stated an ambition to reach one billion DOGE for its treasury reserve.

Custody arrangements are being managed through established custodians including Bitstamp and Robinhood, indicating conventional custody flows for large holders. This infrastructure reduces custody risk and supports institutional accumulation narratives.

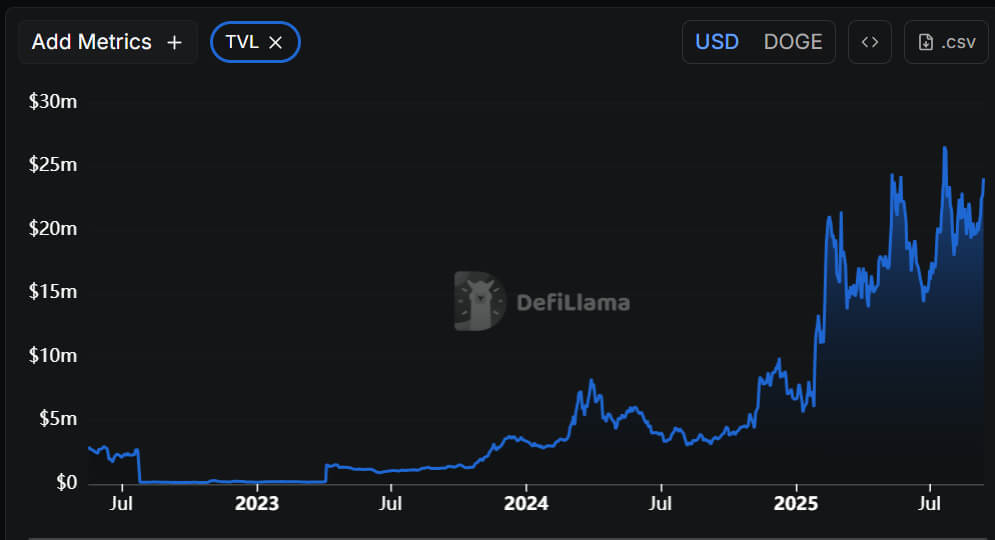

Source: DeFiLlama

Source: DeFiLlama

DeFiLlama reports total value locked for Dogecoin at $24.07 million, while daily chain fees are approximately $3,859—metrics that reflect steady network activity and growing DeFi engagement.

Frequently Asked Questions

What key levels should traders watch for DOGE?

Watch $0.240 as primary support and $0.250 as near-term resistance. A sustained break above $0.250 with volume confirmation targets higher areas; a drop below $0.240 could signal extended consolidation toward $0.210–$0.220.

Is the recent ETF approval relevant for Dogecoin?

Yes. The Rex-Osprey DOGE ETF (DOJE) received approval under the Investment Company Act of 1940, raising institutional awareness and providing an additional regulated on-ramp for funds and large-scale investors.

Key Takeaways

- Support and momentum: DOGE reclaimed $0.240 and formed higher lows, supporting a short-term bullish outlook.

- Institutional accumulation: CleanCore’s $130M buy increases treasury demand and institutional interest.

- On-chain confirmation: DeFi TVL of $24.07M and daily fees near $3.9K show steady network participation—monitor volume for confirmation.

Conclusion

Dogecoin price is exhibiting a bullish technical structure after reclaiming $0.240, trading at $0.246 and testing $0.250 resistance. Institutional accumulation, ETF approval, and improving on-chain metrics add support to the outlook. Monitor key levels and volume for confirmation — COINOTAG will continue to track developments and provide timely updates.