Polygon Labs and Cypher Capital Partner to Accelerate Institutional Adoption of POL in the Middle East

Contents

Toggle- Quick Breakdown:

- Driving institutional adoption of POL

- Strengthening DeFi nfrastructure on polygon

Quick Breakdown:

- Polygon Labs partners with Dubai-based Cypher Capital to expand institutional adoption of POL.

- Collaboration provides exposure, yield strategies, and improved liquidity for institutional investors.

- Initiative strengthens Polygon’s DeFi infrastructure, validator incentives, and dApp growth.

Polygon Labs has joined forces with Dubai-based Cypher Capital to drive institutional adoption of POL, the token powering the Polygon network. The partnership is designed to channel long-term capital into the blockchain ecosystem, while improving liquidity, unlocking yield opportunities, and strengthening network security.

🚨JUST IN: Polygon Labs is partnering with Cypher Capital to expand institutional access to $POL across the Middle East.

The collaboration will provide institutions exposure to $POL , enable yield generation strategies, boost liquidity, strengthen network growth and security, and… pic.twitter.com/5FBIkhyFP7

— DeFi Planet (@PlanetDefi) September 12, 2025

Driving institutional adoption of POL

Building on its recent acquisition of a significant allocation of POL, Cypher Capital will collaborate with Polygon Labs to provide institutions and family offices with direct exposure to the asset. Through structured pathways, investors will be able to integrate POL into portfolios and access yield-generation strategies that mirror decentralized finance (DeFi) mechanisms.

Moreover, the partnership aims to tackle liquidity fragmentation by enhancing trading conditions for POL across venues, thereby reinforcing the token’s role in DeFi markets. To advance adoption, Polygon Labs and Cypher Capital will also host roundtables across the Middle East, connecting financial institutions with blockchain opportunities and raising awareness about tokenized assets.

Strengthening DeFi nfrastructure on polygon

By embedding POL as a core institutional asset, the collaboration is expected to scale Polygon’s infrastructure while increasing resilience across its ecosystem. Inflows secured through this initiative will not only underpin validator incentives but also fund decentralized application (dApp) development, contributing to long-term growth and sustainability.

Polygon Labs emphasized that this step aligns with its broader strategy to create institutional-grade rails for blockchain finance. With Cypher Capital’s backing, POL is being positioned as both a yield-bearing token and a mechanism to reinforce network security, signaling a decisive shift toward internet-scale financial infrastructure on Polygon.

The initiative also underscores a growing global momentum behind institutional adoption of blockchain technology. It follows Polygon Labs’ earlier advocacy efforts in the United States, where the firm’s leadership highlighted the role of blockchain in driving financial innovation. Now, through partnerships like this, Polygon is extending that message globally embedding POL deeper into institutional finance and DeFi markets alike.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

‘It felt so wrong’: Colin Angle on iRobot, the FTC, and the Amazon deal that never was

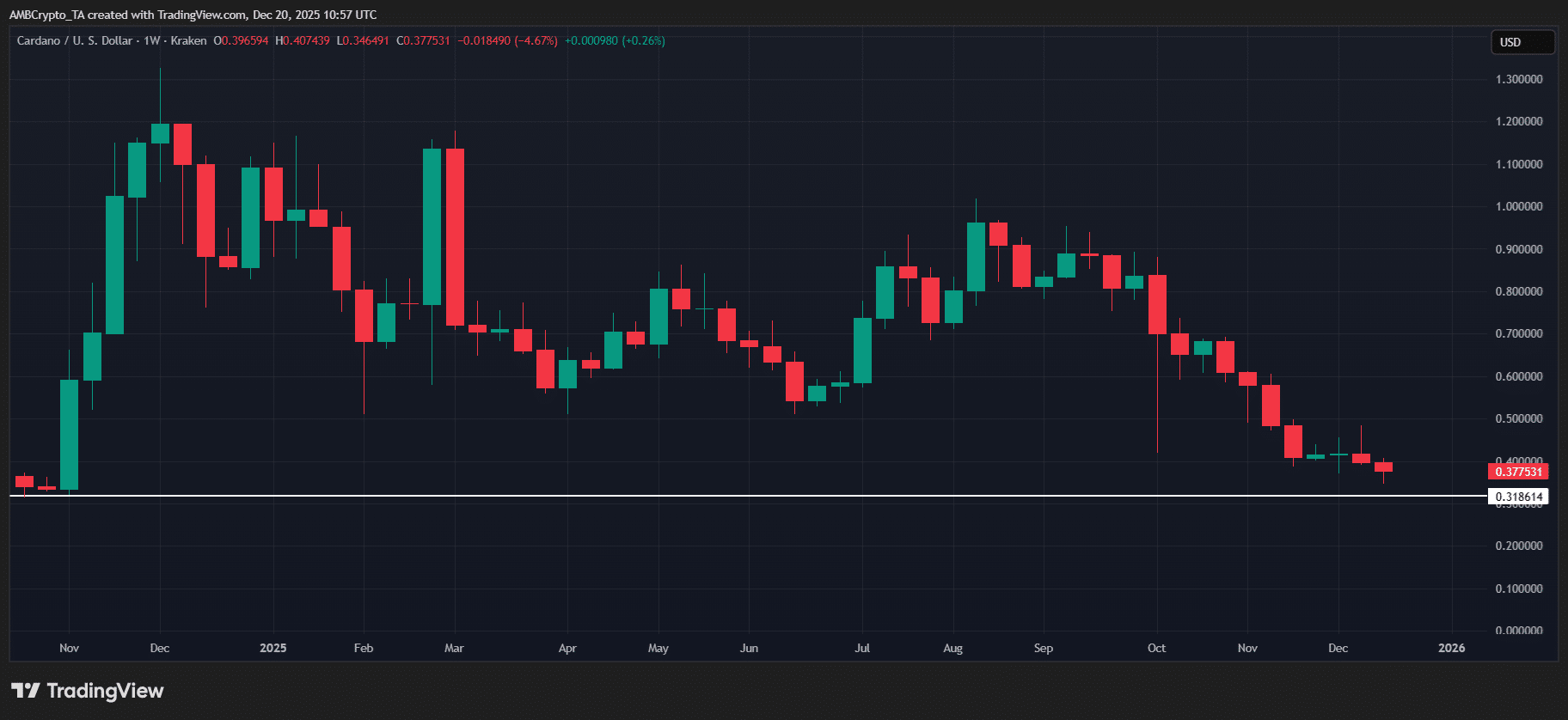

Cardano erases 100% of election rally gains – Can ADA hold top 10?

Why SEI must reclaim KEY support to avoid drop below $0.07