XRP Price Reaches $3 But May Not Sustain As Market Top Signal Strengthens

XRP surged past $3, reigniting bullish hopes—but signs of a market top and weakening network growth suggest a possible reversal. With resistance levels tightening, XRP may struggle to maintain upward momentum.

XRP price has climbed back to $3.05 after weeks of volatile trading, sparking renewed optimism among investors. The altcoin attempted a recovery, briefly reclaiming key levels.

However, analysts caution that the rally may be short-lived as indicators show profit saturation, a signal that often precedes downside corrections.

XRP Investors Are Pulling Back

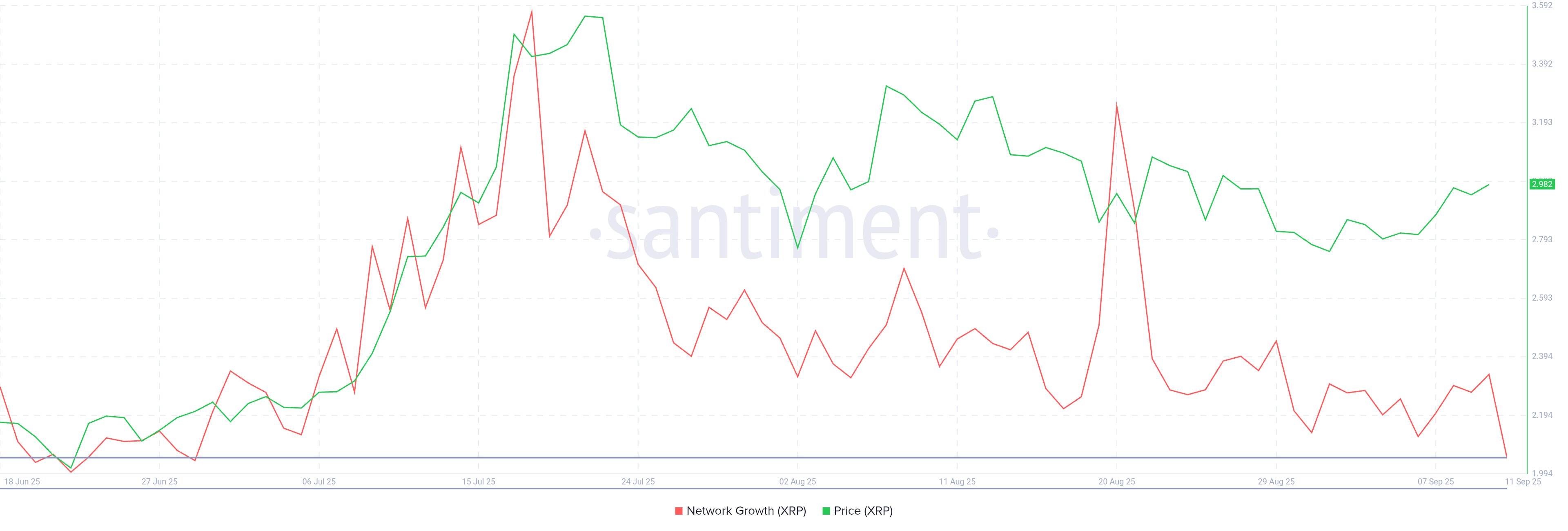

XRP’s network growth has fallen to its lowest point in six weeks, highlighting a slowdown in new investor participation. This metric reflects the number of fresh addresses joining the network, a vital indicator for gauging long-term adoption and capital inflows. The decline suggests weakening momentum despite the recent price surge.

Lower participation by new entrants reduces buying pressure, limiting XRP’s ability to sustain gains. For cryptocurrencies, expanding network activity often supports higher valuations. With XRP losing traction in this area, the chances of securing consistent upward momentum become smaller, raising concerns about its resilience against future selling activity.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

XRP Network Growth. Source:

Santiment

XRP Network Growth. Source:

Santiment

The supply in profit for XRP has surged to 95%, nearing the historically recognized threshold for market tops. When such a high percentage of tokens are in profit, investors often take advantage of favorable conditions to secure gains, creating strong selling pressure across exchanges.

This saturation of profit could weigh heavily on XRP’s price action. Traders who bought earlier may now exit positions, increasing volatility and dampening bullish momentum. Unless fresh capital enters the market, the current setup leaves XRP vulnerable to a pullback, particularly as macro conditions favor cautious strategies.

XRP Supply In Profit. Source:

Glassnode

XRP Supply In Profit. Source:

Glassnode

XRP Price Is In Danger

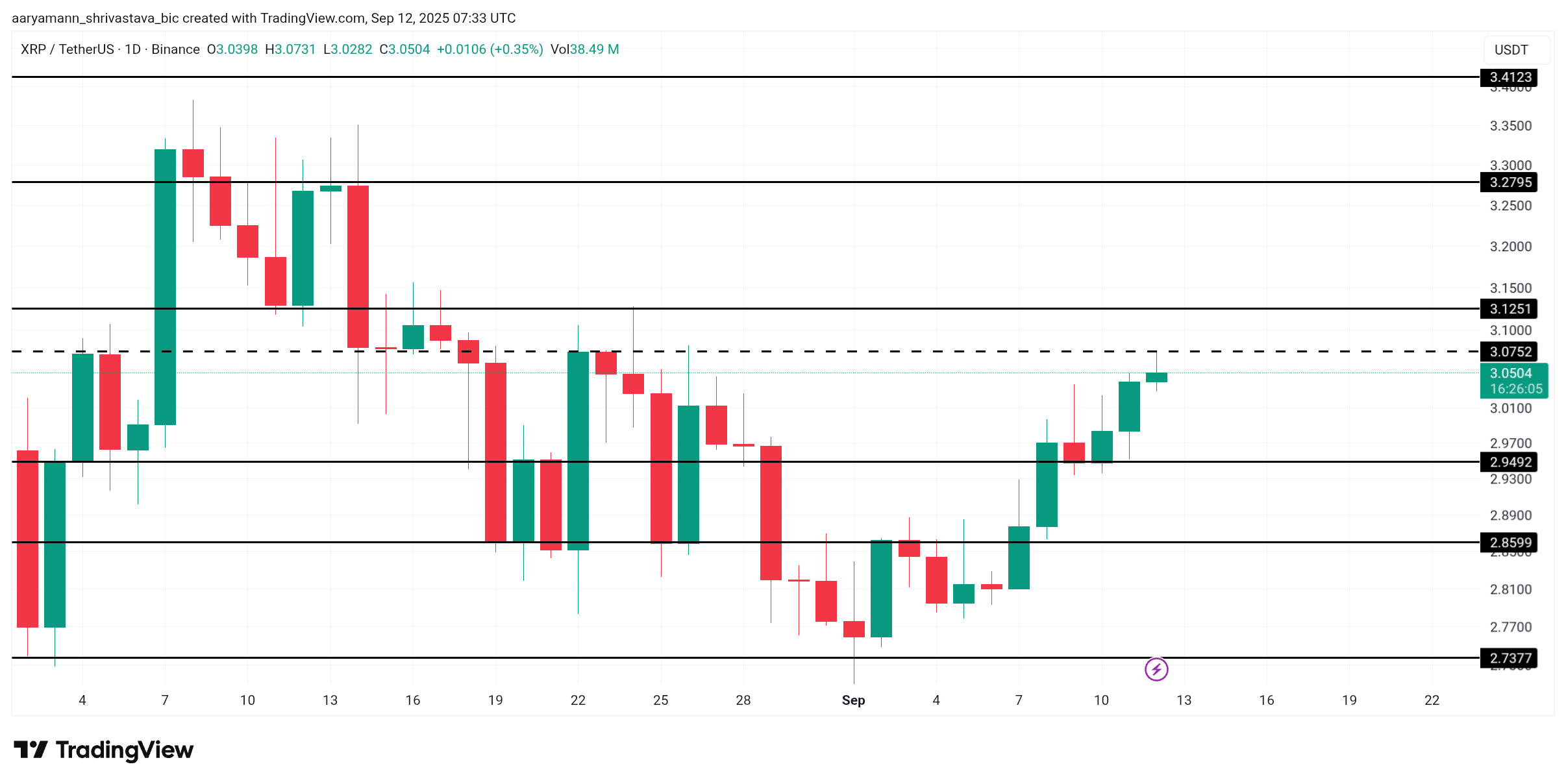

XRP is trading at $3.05, positioned above the $2.94 support and facing resistance at $3.07 and $3.12. Breaking through these levels will be a significant challenge as bears attempt to defend overhead barriers, while bulls aim to keep prices above critical support lines.

Given the declining network activity and elevated supply in profit, XRP may struggle to extend its rally. If selling accelerates, the token could fall back to $2.94, testing investor confidence and leaving little room for upward growth in the near term.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

Still, bullish traders have not entirely retreated. Should optimism prevail and HODL behavior dominate, XRP could breach $3.12 and establish new support. This move may drive the price toward $3.27, marking a monthly high and restoring faith in the asset’s recovery potential.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Federal Reserve officials to advance stablecoin regulatory framework; US SEC Chairman to deliver a speech at the New York Stock Exchange tonight

Federal Reserve officials plan to advance the formulation of stablecoin regulatory rules. The SEC Chair will deliver a speech on the future vision of capital markets. Grayscale will launch the first Chainlink spot ETF. A Coinbase executive has been sued by shareholders for alleged insider trading. The cryptocurrency market fear index has dropped to 23. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative updates.

OECD's latest forecast: The global interest rate cut cycle will end in 2026!

According to the latest forecast from the OECD, major central banks such as the Federal Reserve and the European Central Bank may have few "bullets" left under the dual pressures of high debt and inflation.

MSTR, the leading Bitcoin concept stock, plunges up to 12% intraday after first signaling possible "coin selling"

MicroStrategy has announced the establishment of a $1.44 billion cash reserve to "weather the winter," and for the first time has acknowledged the possibility of selling bitcoin under certain conditions.

A respite for global markets? Bitcoin halts its decline as Japanese bond auction eases liquidity concerns

Bitcoin also stabilized and rebounded, rising by as much as 0.7% to surpass the $87,000 mark. Strong demand in the Japanese government bond auction and the recovery of the crypto market have jointly eased investors' concerns about liquidity tightening.