Traders Load Up on Nine-Figure Bullish Bitcoin Bets, Raising Liquidation Risks

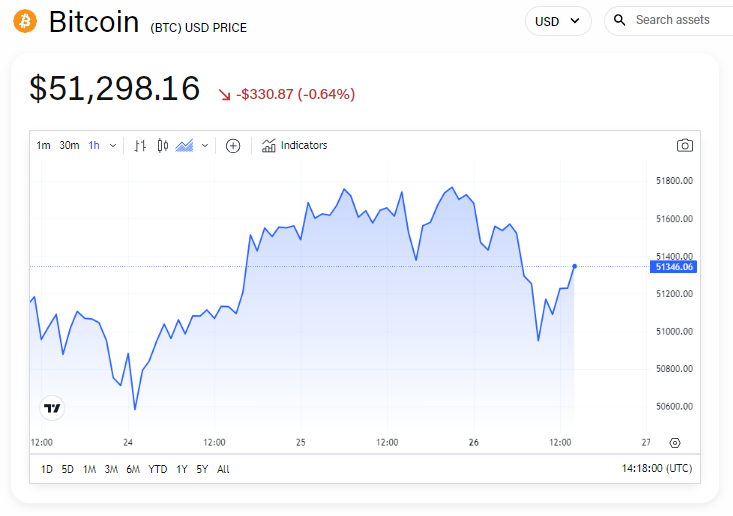

Traders are using leverage in an attempt to lift bitcoin BTC$115,283.91 back to record highs, creating a high-risk environment that could result in a derivatives unwind to the downside if price begins to shift the other way.

Market analyst Skew warned one trader intent on opening a nine-figure long position to "maybe wait for spot to carry the buying so it doesn't create toxic flows."

$BTC

— Skew Δ (@52kskew) September 12, 2025

To the random 9 figure whale apeing into longs

maybe wait for spot to carry the buying so it doesn't create toxic flows pic.twitter.com/GOi1GZazl0

Bears are also adding leverage, with a separate trader currently dealing with a $7.5 million unrealized loss after shorting BTC to the tune of $234 million with an entry at $111,386. That trader added $10 million worth of stablecoins to maintain their position, with the liquidation currently standing at $121,510.

But the major liquidation risk is present to the downside, with data from The Kingfisher showing a large pocket of derivatives will be liquidated between $113,300 and $114,500, which could potentially prompt a liquidation cascade back to the $110,000 level of support.

"This chart shows where traders are over-leveraged," wrote The Kingfisher. "It's a pain map. Price tends to get sucked into those zones to clear out positions. Use this data so you don't end up on the wrong side of a big move."

Bitcoin is currently trading quietly around $115,000 having entered a period of low volatility, failing to break out of its current range for more than two months.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Egrag Crypto: Selling XRP Now Makes No Sense. Here’s Why

What are Intent Based Architectures?

Bitcoin could face severe headwinds amid macroeconomic growth warnings, analyst says

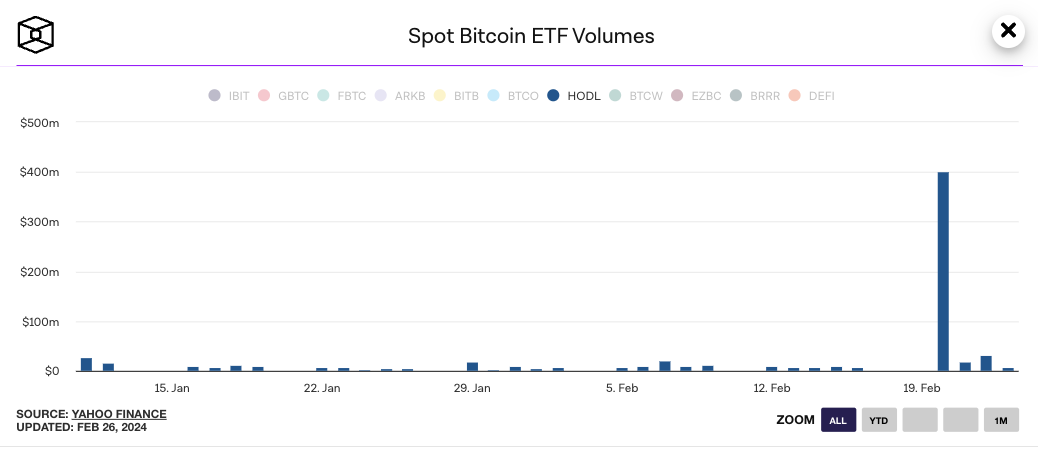

Spot bitcoin ETF volume spike may be due to high-frequency trading, CoinShares says