The Internet is building a native financial system, and the key to success or failure still lies in user experience.

We now have a new monetary operating system, known as the Internet-native financial cloud service, but most people still cannot access it.

We have a new monetary operating system, called the Internet-native financial cloud service, but most people still cannot access it.

Written by: Ignas Survila

Translated by: AididiaoJP, Foresight News

Money is experiencing its own "Internet moment."

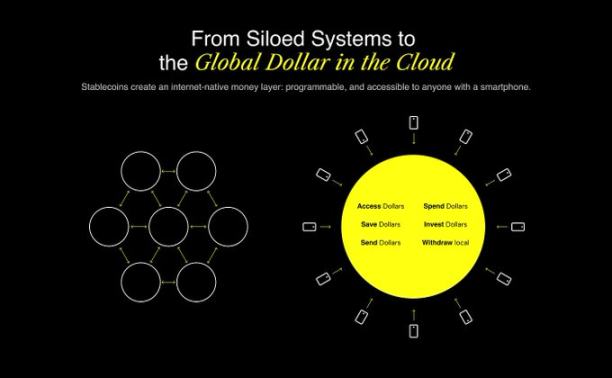

The Internet has long had its communication systems (email), publishing platforms (blogs, social media), and commercial systems (Stripe, Shopify). Now, it is building its own financial system. This system is inherently programmable, open by default, and borderless from day one. It is being built on the underlying protocol of stablecoins.

But the key is: although the infrastructure is emerging, we still lack the crucial user experience. And history tells us that it is here that the biggest winners are crowned.

Infrastructure Enables Possibility, User Experience Wins Everything

Every cool technological revolution starts with infrastructure, but no one remembers the protocols—everyone remembers the products that made them usable.

In 1982, the Simple Mail Transfer Protocol (SMTP) made email possible. However, it wasn't until 2004, when Gmail launched with its clean product, massive storage, and effective spam filters, that email truly became widespread.

Search engines existed long before Google. AltaVista, Archie, Lycos. But Google simplified everything—it was faster, cleaner, and smarter.

Skype did not invent the Internet Voice Protocol (VoIP), and WhatsApp did not invent instant messaging, but they made these technologies accessible to ordinary people.

We Are at the Same Inflection Point in the Evolution of Money

Stablecoins are helping to create an Internet-native financial system.

And this is not theoretical—it is already running.

- In 2024, stablecoins settled over $15.6 trillions on-chain.

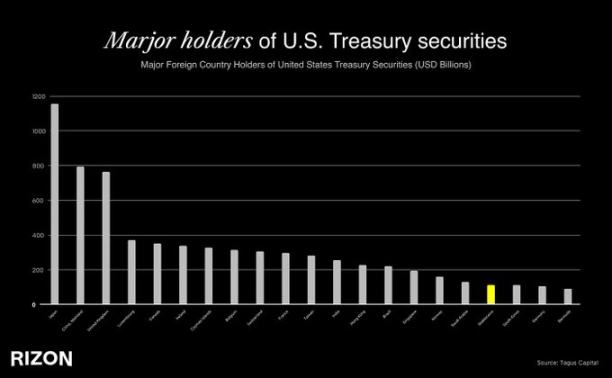

- Tether is now the 18th largest holder of U.S. Treasury bonds in the world, surpassing countries like South Korea, the UAE, and even Germany. In other words, the world's fourth-largest economy now holds less U.S. debt than a single stablecoin issuer.

- Yet despite this scale, the stablecoins in circulation amount to only $263 billions, while the U.S. M2 money supply is $22 trillions, giving a penetration rate barely reaching 1%.

- Today, less than 5% of the global population uses stablecoins, but it is expected that adoption will reach 7-10% in the next five years, unleashing a new wave of massive financial inclusion.

- In regions such as Latin America, the Middle East and North Africa, and Southeast Asia, stablecoins are already operating as parallel dollar economies, relied upon daily to escape inflation, capital controls, or failures of local banking systems.

We have never seen financial infrastructure scale so rapidly, especially across borders. Stablecoins have already reached millions of users worldwide. There are good reasons for this: they are fast, borderless, denominated in U.S. dollars, and run on open protocols. In a world where 1.4 billion people lack adequate financial services and even more are subject to capital controls or volatile local currencies, stablecoins offer something revolutionary: an interface to the global dollar network, accessible from anywhere with just a smartphone.

But the problem is: if you try to use stablecoins today, you quickly hit a wall. The payment experience is clunky, onboarding is confusing, and everything is wrapped in jargon, wallets, gas fees, networks, and cross-chain bridges.

This is where the gap lies. We have a new monetary operating system, called the Internet-native financial cloud, but most people still cannot access it.

It's like getting a PS2 steering wheel for Christmas but not having a PlayStation to plug it into. A huge opportunity is right in front of us: to make all of this feel normal, invisible, and seamless.

Why User Experience Is a Moat

In fintech, having users means having user relationships. Trust is built here, user behavior is shaped here, and long-term value is created here.

Although user experience is rarely the strongest argument in strategic meetings, in fintech, it is everything. Because this is not just software—this is money. And money requires trust.

Just look at the most successful cases in neobanking: Revolut, Cash App, Nubank. These companies operate in different markets, but they all follow the same strategy: providing a world-class user experience.

As stablecoins enter their next stage of adoption, the real winners will be the brands people trust when sending money to family, the cards they instinctively use to pay for lunch, and the apps that quietly replace their local banks. It will be the experience that makes stablecoins invisible, making them feel like ordinary money. Ordinary, but globally accepted.

Why Now?

What makes this moment so urgent and exciting is the convergence of three forces:

Infrastructure Is Ready

- Stablecoins are liquid and being deeply integrated.

- Wallet-as-a-service platforms (such as Privy) and embedded onramps (such as Bridge) are solving the technical user experience challenges.

- Credit card issuance, compliance-as-a-service, and KYC providers—all of these have been battle-tested.

Regulation Is Catching Up

- Hong Kong introduced stablecoin legislation in 2024.

- The U.S. Treasury's GENIUS Act outlines a future path for regulated, scalable stablecoin usage.

The User Base Is Growing Rapidly

- In Latin America and sub-Saharan Africa, stablecoins are leapfrogging banks.

- There are still 1.4 billion people worldwide without adequate financial services. But they have smartphones.

- Gen Z are digital natives of Internet finance.

This is not a speculative hype cycle. This is the maturity of infrastructure, regulation paving the way, and a huge consumer market waiting to be served. Billions of people still lack access to modern financial tools and services, but they have smartphones, Internet access, and are becoming increasingly familiar with stablecoins. The underlying protocols are finally in place. Now it's a race to build the experience layer that brings everything to life.

The Stablecoin Standard Is Being Written

We believe that the most underestimated move in fintech today is building a stablecoin experience that feels like Apple Pay—an experience that blends into the background, just works, and wins by being obvious, trustworthy, and globally accepted.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

COC the Game Changer: When Everything in GameFi Becomes "Verifiable", the Era of P2E 3.0 Begins

The article analyzes the development of the GameFi sector from Axie Infinity to Telegram games, pointing out that Play to Earn 1.0 failed due to the collapse of its economic model and trust issues, while Play for Airdrop was short-lived because it could not retain users. COC Game has introduced the VWA mechanism, which verifies key data on-chain in an attempt to address trust issues and build a sustainable economic model. Summary generated by Mars AI. This summary was generated by the Mars AI model, and its accuracy and completeness are still being iteratively updated.

BTC Volatility Weekly Review (November 17 - December 1)

Key metrics (from 4:00 PM HKT on November 17 to 4:00 PM HKT on December 1): BTC/USD: -9.6% (...

When all GameFi tokens have dropped out of the TOP 100, can COC reignite the narrative with a Bitcoin economic model?

On November 27, $COC mining will be launched. The opportunity to mine the first block won't wait for anyone.

Ethereum's Next Decade: From "Verifiable Computer" to "Internet Property Rights"

Fede, the founder of LambdaClass, provides an in-depth explanation of anti-fragility, the 1 Gigagas scaling goal, and the vision for Lean Ethereum.