Bloomberg Strategist Mike McGlone Says Bitcoin Now Prone to Sharp Pullbacks After Massive Rallies – Here’s Why

Senior Bloomberg strategist Mike McGlone says that Bitcoin ( BTC ) is now susceptible to deep corrections after the huge rallies it has experienced during its lifetime.

In a new thread, McGlone tells his 70,500 followers on X that the top crypto asset by market cap’s role is shifting into that of a speculative, hype-driven commodity, making it prone to sharp pullbacks.

Furthermore, McGlone says that the sheer number of digital assets listed on the market is diminishing the crypto king’s value by undermining its perception of having a capped maximum supply.

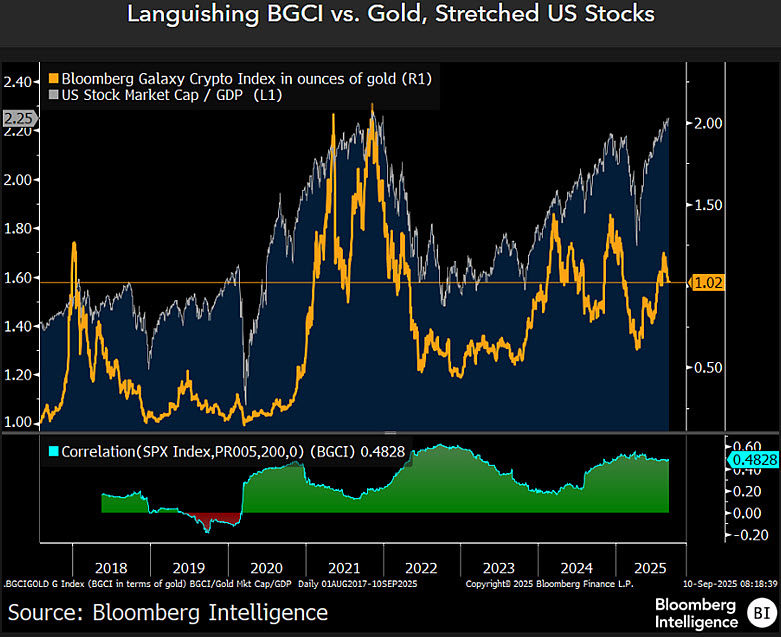

“Digital gold or commodity? Bitcoin vs. 21 million offshoots – Bitcoin’s role may be shifting toward that of a speculative, hype-driven commodity, leaving it prone to sharp pullbacks after outsized rallies and potentially boosting the appeal of gold as a haven.

CoinMarketCap’s listing of 21 million cryptos highlights the unchecked proliferation of numbers on a screen mostly tracking holdings with no underlying assets, undermining Bitcoin’s perception of limited supply.”

Source: Mike McGlone /X

Source: Mike McGlone /X

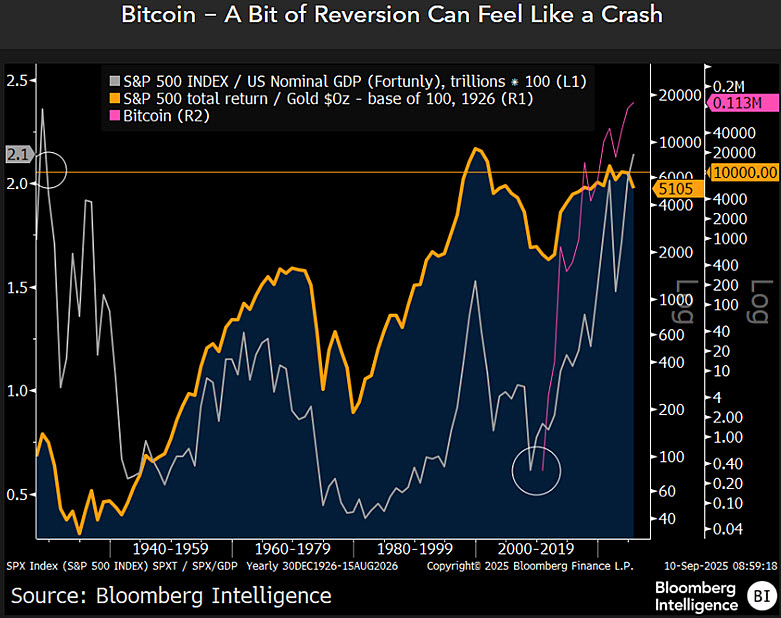

McGlone goes on to note that commodities tend to see massive corrections after periods of large growth, a phenomenon that could apply to BTC.

“Bitcoin at $10,000? Commodity-like autocorrelation – commodities often retreat after outsized gains, a pattern that may apply to Bitcoin.

Initially hyped as digital gold with supply capped at 21 million vs. increasing demand and adoption, the price of the first-born cryptocurrency seemed destined to rise, and it did. But what was one digital asset in 2009 is now about 21 million listings on CoinMarketCap.”

Source: Mike McGlone /X

Source: Mike McGlone /X

Bitcoin is trading for $114,497 at time of writing, a fractional increase during the last 24 hours.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stock Futures Rush: Trade popular stock futures and share $250,000 in equivalent TSLA tokenized shares. Each user can get up to $8,000 TSLA.

Bitget margin trading to support BGB cross margin trading and loans

Bitget margin trading to support BGB cross margin trading and loans

Bitget has decoupled loan interest rates from futures funding rates for all coins in spot margin trading