Long-Term Shiba Inu Holders Sell Heavily As Price Hits 3-Week High

Shiba Inu rallied to a 3-week peak, yet heavy selling by long-term holders and rising exchange inflows put pressure on SHIB’s short-term outlook.

Shiba Inu’s price has climbed over the past week, sparking short-term optimism among investors.

The meme coin is trading near a three-week high, but the surge also highlighted vulnerability among holders. Many long-term investors (LTHs) have started selling, putting downward pressure on SHIB.

Shiba Inu Investors Are Losing Confidence

On-chain data shows a sharp spike in the age consumed metric, which tracks when long-held tokens are spent. The indicator reached a three-month high, reflecting heavy selling by LTHs. Such activity typically signals profit-taking after rallies.

Because LTHs hold significant supply, their actions often shape price direction. Large sell-offs tend to weaken investor confidence and drag the market lower. With SHIB facing this pressure, the risk of retracement has increased despite the recent upward move.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Shiba Inu Age Consumed. Source:

Santiment

Shiba Inu Age Consumed. Source:

Santiment

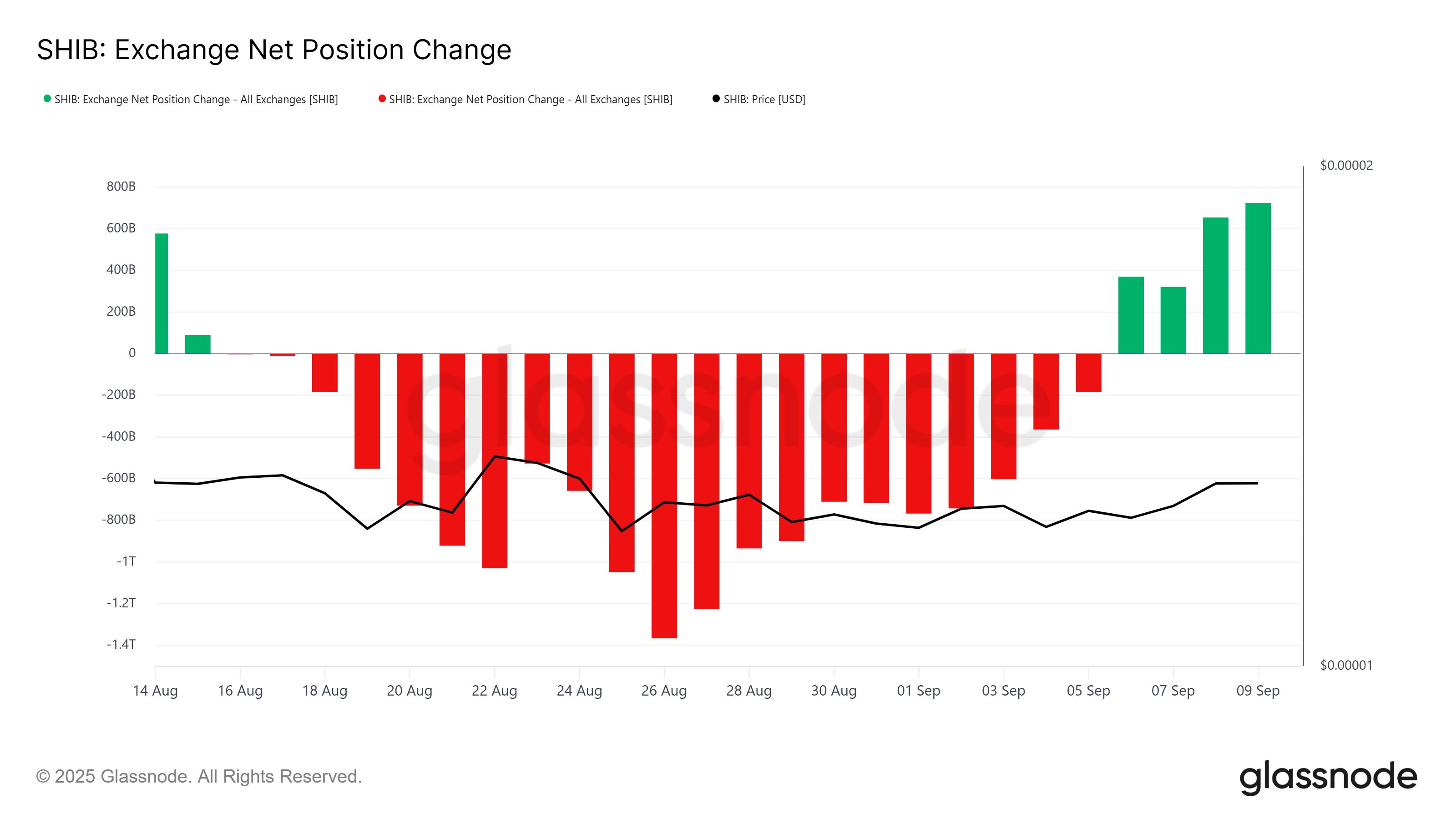

The exchange net position change metric further supports the bearish outlook. Green bars on the indicator highlight rising inflows, suggesting investors are transferring tokens to exchanges to sell. This trend reflects a decline in optimism among Shiba Inu holders.

In just five days, over 906 billion SHIB, worth $11.6 million, have been sold into exchanges. This sustained selling pressure reveals growing caution in the market. While Shiba Inu achieved a short-term rally, investor sentiment does not currently back a prolonged recovery.

Shiba Inu Exchange Net Position Change. Source:

Glassnode

Shiba Inu Exchange Net Position Change. Source:

Glassnode

SHIB Price To Bounce Back

Shiba Inu has been up 6.69% in the past week, with token trading at $0.00001291. The meme coin is attempting to establish $0.00001285 as a support level, holding near its recent peak.

However, maintaining this momentum appears difficult without strong investor conviction. If selling continues, SHIB could drop toward $0.00001252 or even lower to $0.00001182, erasing recent gains.

Shiba Inu Price Analysis. Source:

TradingView

Shiba Inu Price Analysis. Source:

TradingView

On the flip side, if the Shiba Inu price successfully defends the $0.00001285 support, a rebound may follow. In that case, SHIB could push toward $0.00001391, which would invalidate the bearish outlook and signal renewed strength.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

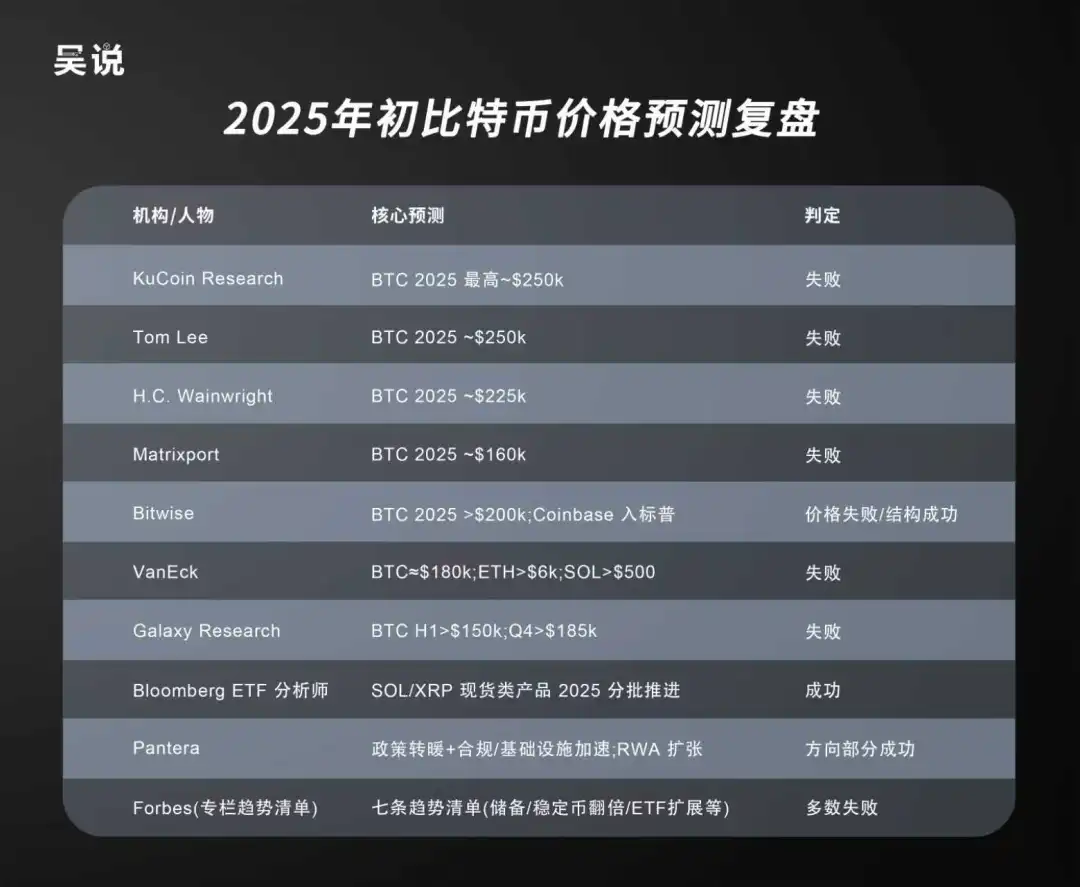

Galaxy Digital’s Head of Research Explains Why Bitcoin’s Outlook in 2026 Is So Uncertain

Crypto Coins Surge: Major Unlocks Impact Short-Term Market Dynamics

Revealing Insight: How Differing Views Shape Bitcoin Price Predictions at Fundstrat