CARDS surged 9 times in a week: Unveiling the new "on-chain blind box" economy behind Pokémon cards

In just one week, a token called CARDS saw its market cap soar nearly ninefold. Behind this surge is not a new public chain or a complex financial derivative, but rather a group of Pokémon cards.

On August 29, Collector Crypt launched the CARDS token on the Solana chain, with an initial fully diluted valuation (FDV) of only about $67 million. According to CoinGecko data, since its launch, the CARDS token has surged from less than $0.02 to around $0.30 between September 3 and September 6, a cumulative increase of nearly 10 times. Although there was a subsequent pullback, the price has remained stable above $0.20, several times higher than its initial level.

Physical Cards On-chain: The Business Logic of Collector Crypt

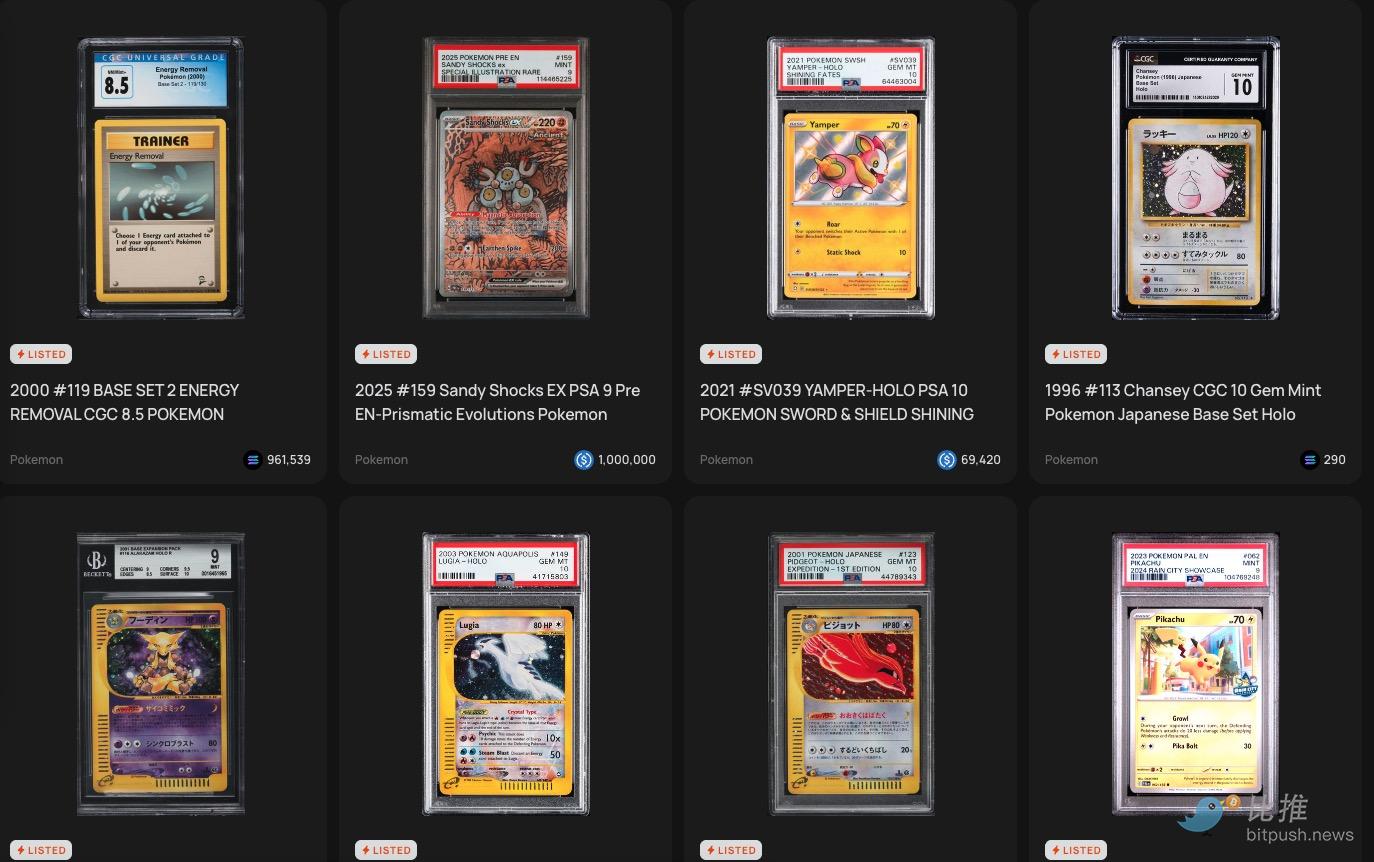

Collector Crypt is a collectibles trading platform built on the Solana public chain, featuring "physical card on-chain + random card draw mechanism." It tokenizes real, graded, and encapsulated Pokémon cards, storing them in secure physical vaults.

The core team of Collector Crypt:

-

CEO Tuom Holmberg: Holmberg is a serial entrepreneur with a background in applied physics and an MBA. He has over 25 years of Magic: The Gathering collecting experience and has been mining bitcoin since 2013.

-

CTO Dax Herrera: Herrera has a background in computer science and is a serial entrepreneur in the digital marketing field.

-

Sr. Software Engineer Richard Shafer: Shafer has 15 years of extensive experience in software and technology.

The project successfully completed its seed round financing in February 2023, with support from well-known investment institutions such as GSR, Big Brain Holdings, and Genesis Block Ventures.

According to the official introduction, users can randomly obtain digital certificates (NFTs) of these cards through the platform's "Gacha Machine" (capsule toy-style card draw mechanism), and can choose to use the buyback mechanism to exchange NFTs for fiat or crypto assets.

The platform's core token, CARDS, is used for payments, incentives, and governance within the platform.

The platform's core token, CARDS, is used for payments, incentives, and governance within the platform.

Collector Crypt attempts to solve three major pain points in traditional collectibles trading: insufficient liquidity, difficulty in distinguishing authenticity, and lengthy cash-out processes.

The platform stores graded Pokémon cards in partner vaults and maps them to redeemable NFTs. Users can choose to hold the NFT and redeem it for the physical card in the future, or purchase random packs through the platform's "Gacha" capsule mechanism. Similar to blind boxes in the real world, users do not know whether they will draw a regular card or a rare one.

However, unlike traditional methods, Collector Crypt provides an instant buyback quote on-chain, at about 85%–90% of the index price on external markets such as eBay and ALT. This means that even if players draw an undesirable card, they can quickly cash out the NFT, lowering the entry barrier and risk.

Trading Volume and Cash Flow

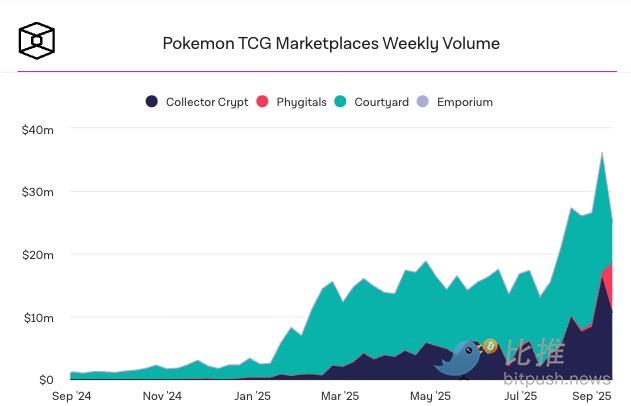

Data shows that this is not a "hot air game." Since the beginning of this year, the platform's Pokémon TCG trading volume has exceeded $150 million. In the past week alone, transaction volume surpassed $10 million, while the previous week reached $16 million. Since the start of the year, the average weekly trading volume growth rate has reached 27%.

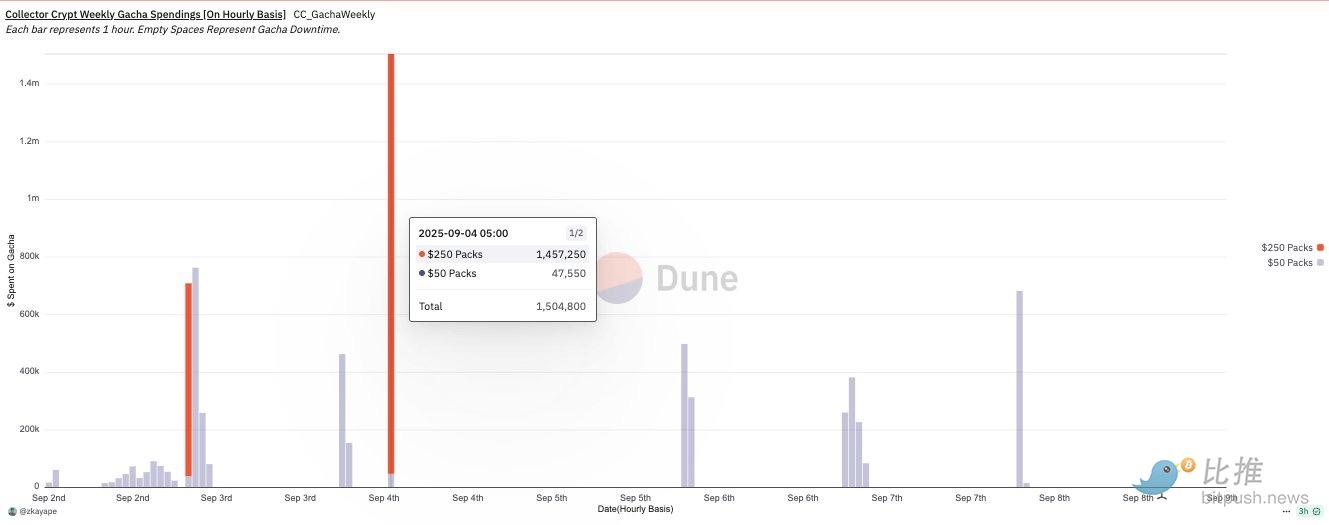

On the consumer side, data from The Block shows that over the past five weeks, user spending on Gacha has remained above $5.7 million per week. The platform's average weekly revenue is about $666,000, most of which is used to support buybacks.

Dune data shows that in the past week, even with only one day online, Collector Crypt still generated $7.9 million in card pack sales (the previous single-week record was $8.5 million).

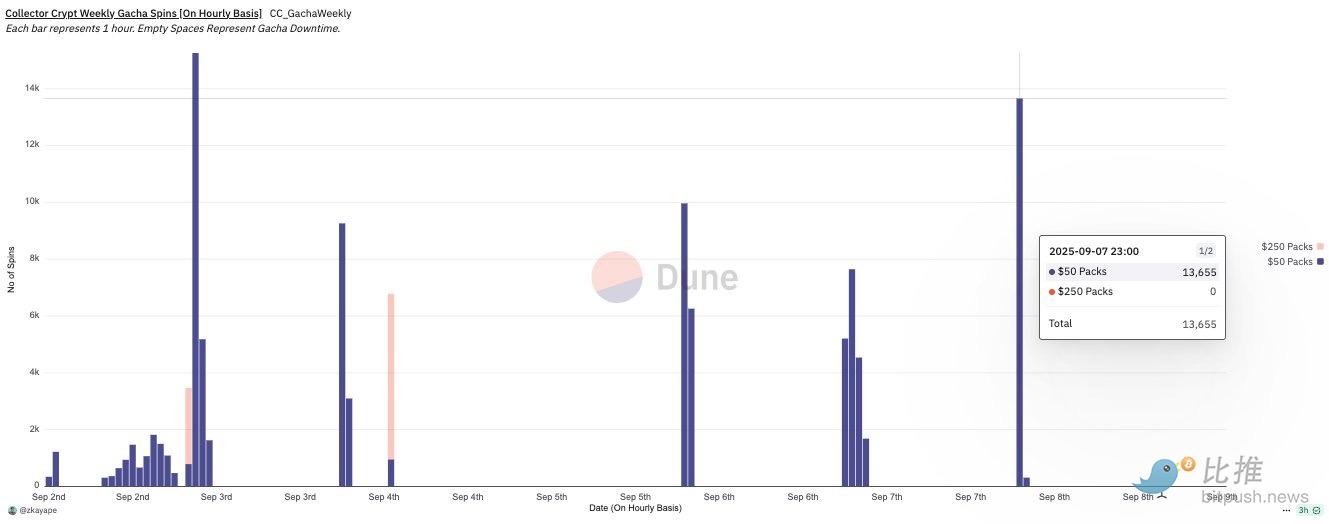

Market demand for Collector Crypt's card lottery machine is extremely strong. In the most recent platform opening, about 14,000 card packs priced at $50 each were sold within an hour, totaling $700,000 in spending, equivalent to:

-

233 card packs sold per minute;

-

an average of 4 transactions per second;

In several sales before the system was suspended, performance was equally impressive: typically about 15,000 to 17,000 $50 card packs were sold. On September 4, legendary card packs priced at $250 each sold out in less than an hour, totaling $1.5 million.

This "revenue—buyback—reinvestment" cycle forms a cash flow-driven endogenous growth logic. On one hand, sustained real trading volume provides a value anchor for the token; on the other, the buyback mechanism offers a liquidity exit for participants, further stimulating user engagement.

The Drivers Behind the Surge: Narrative, Mechanism, and Capital

The surge in CARDS is not driven by a single factor, but by the resonance of narrative, mechanism, and capital.

First, Pokémon itself is one of the most influential IPs globally. In 2023, the secondary market turnover for Pokémon cards reached several billions of dollars. The pain points of traditional collectibles are:

Poor trading liquidity: Collectibles are difficult to cash out quickly, especially high-value cards.

Difficulty in ensuring authenticity: Hard to distinguish real from fake, leading to high trust costs.

High entry barriers: Ordinary players find it hard to access rare cards.

Collector Crypt, through its "tokenization + randomization" model, lowers the participation threshold and transparently records transactions on the blockchain, attracting a user base that understands Web3 and is passionate about collecting.

More importantly, capital plays a key role.

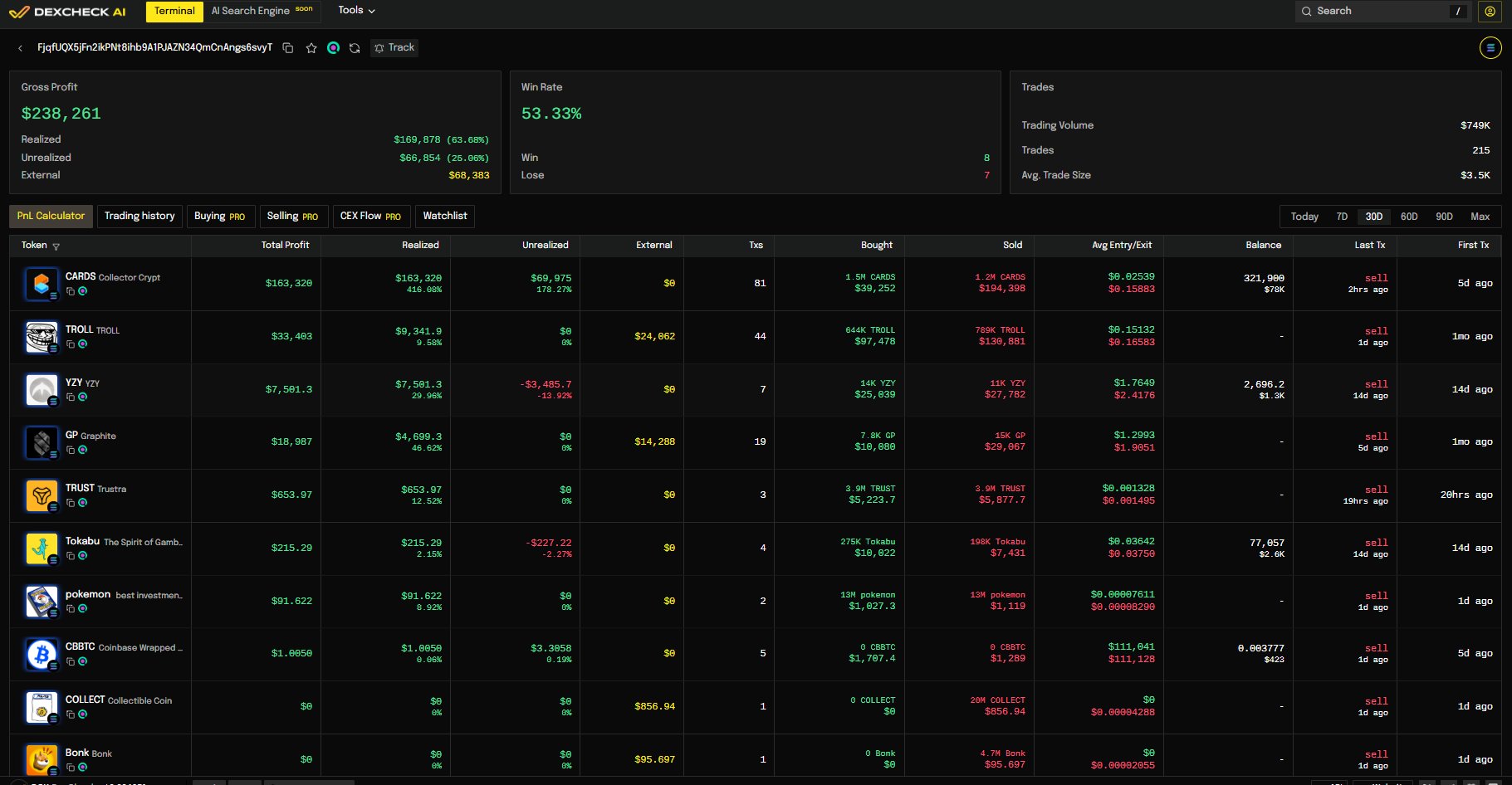

On-chain data shows that some whales concentrated their purchases in the days after the token launch, then sold in batches as the price rose, making hundreds of thousands of dollars in just one week.

For example, one trader invested a total of $39,000 to buy CARDS on August 30 and September 2, purchasing 1.5 million tokens at an average price of $0.025. When the token hit its all-time high, the total value of his holdings exceeded $360,000. He then chose to sell 80% of his position, netting a profit of $163,000. He still holds CARDS worth $275,000, meaning that, excluding other external sales, his total profit in the past 30 days has exceeded $180,000. Of his last 15 trades, 8 were profitable, with a win rate of 53%.

Such "whale" operations not only directly pushed up the price but also created a herd effect, attracting retail investors to flock in.

The Test of Sustainability

However, market frenzy cannot hide potential risks. Currently, only about 10% of CARDS tokens are in circulation, and future unlocking pressure is inevitable. The short-term arbitrage behavior of whales means that dramatic price fluctuations are likely to recur in a short period.

In addition, the random mechanism and cashback design of Gacha have strong "gambling-like" characteristics, which may face regulatory scrutiny in different jurisdictions in the future. Collector Crypt's heavy reliance on the single Pokémon IP is also a potential concern. If it cannot expand into other collectible fields, its growth story may encounter a bottleneck.

But as with all surges driven by capital and sentiment, the future challenge is: can Collector Crypt maintain growth in trading volume and revenue after the hype fades, and transform itself from an "on-chain blind box" into truly sustainable collectible financial infrastructure?

Author: Bootly.eth

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Legislation Booms Globally, Why Is China Taking the Opposite Approach? An Article to Understand the Real National Strategic Choices

Amid the global surge in stablecoin legislation, China has chosen to firmly curb stablecoins and other virtual currencies, while accelerating the development of the digital yuan to safeguard national security and monetary sovereignty. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Liquidity migration begins! Japan becomes the Fed's "reservoir," 120 billions in carry trade returns set to ignite the December crypto market

The Federal Reserve has stopped quantitative tightening and may cut interest rates, while the Bank of Japan plans to raise rates, changing the global liquidity landscape and impacting carry trades and asset pricing. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.

Weekly Hot Picks: Bank of Japan Sends Strongest Rate Hike Signal! Is the Copper Market Entering a Supercycle Rehearsal?

The leading candidate for Federal Reserve Chair is being questioned for potentially "accommodative rate cuts." Copper prices have reached a historic high, and a five-hour meeting between the United States and Russia ended without results. Expectations for a Japanese interest rate hike in December have surged, and Moore Threads' stock soared more than fivefold on its first day... What market moves did you miss this week?

Monad Practical Guide: Welcome to a New Architecture and High-Performance Development Ecosystem

This article will introduce some resources to help you better understand Monad and start developing.