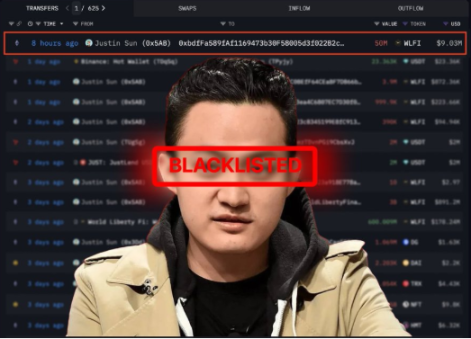

Trump-affiliated DeFi project WLFI bans Justin Sun's wallet: $90 million transfer sparks centralization concerns

Recently, the decentralized finance project World Liberty Financial (WLFI), supported by the Trump camp, has sparked major controversy:

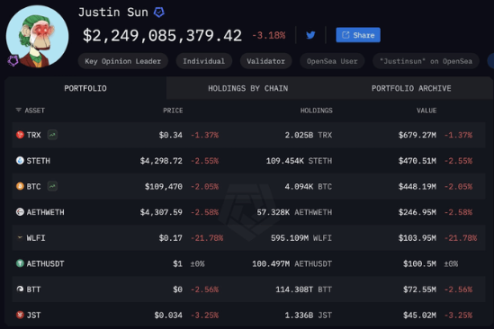

After a WLFI transfer worth $9 million, Justin Sun's wallet was directly blacklisted by the project team, and all his 595 million WLFI tokens (about $75 million investment) were frozen.

Event Review

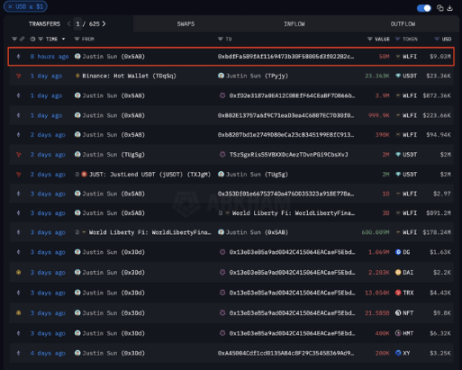

As one of WLFI's largest investors, Justin Sun was originally seen as a representative of the project's long-term strategic capital;

However, on-chain data shows that he once transferred 50 million WLFI tokens into an exchange wallet;

Soon after, the WLFI smart contract activated the blacklist function, completely freezing all of Sun's tokens.

The project team explained that this move was to prevent "suspicious dumping behavior" and emphasized that 272 wallets had already been frozen for similar reasons. However, the freezing of the largest investor has led the community to question the real motives behind the action.

Justin Sun's Response

Justin Sun strongly opposed this freezing decision, stating:

He had no intention of cashing out, and the related transfer was merely an internal test;

He had previously promised not to sell WLFI early, and even planned to invest an additional $10 million;

In his public statement, he wrote: "Tokens are sacred and inviolable; this should be the fundamental value of blockchain."

Market and Community Reaction

The market immediately fell into turmoil: WLFI's price dropped from above $0.30 to $0.18, with daily trading volume surging;

In the short term, due to the freezing of Sun's 595 million tokens, the market's circulating supply decreased, and the price once rebounded by about 8%;

However, the question "If Sun's wallet can be frozen, then anyone's can" quickly spread, severely undermining investor confidence.

Deeper Issues

WLFI was originally designed to be a symbol of "free finance," serving as a decentralized alternative to traditional Wall Street. However, this incident exposed that:

The smart contract is still controlled by a centralized team, and key permissions can arbitrarily freeze funds;

The so-called "DeFi decentralization" may, in reality, have the same control issues as traditional financial institutions;

The handling of Justin Sun instead reveals the fragility of DeFi project governance and trust mechanisms.

Conclusion

The conflict between Justin Sun and WLFI is not just a dispute between an individual and a project team, but a clash between DeFi ideals and centralized power.

In the short term, WLFI has gained huge trading volume due to the high-profile incident, but price volatility and a crisis of trust are inevitable;

In the medium term, Justin Sun's reputation is once again under pressure. Although the TRON ecosystem was not directly affected, the concern that "if even Sun can be frozen, small investors have even less protection" will continue to ferment;

In the long term, WLFI's survival depends on whether it can prove itself to be a true free finance experiment, rather than just another "DeFi project with a centralized key."

This incident serves as a wake-up call for the entire industry: if decentralized protocols still retain back-end permissions to arbitrarily freeze assets, then so-called "free finance" may just be an illusion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How do 8 top investment banks view 2026? Gemini has summarized the key points for you

2026 will not be a year suitable for passive investing; instead, it will belong to investors who are skilled at interpreting market signals.

Valuation Soars to 11 Billions: How Is Kalshi Defying Regulatory Pressure to Surge Ahead?

While Kalshi faces lawsuits and regulatory classification as gambling in multiple states, its trading volume is surging and its valuation has soared to 11 billion dollars, revealing the structural contradictions of prediction markets rapidly growing in the legal gray areas of the United States.

How will the Federal Reserve in 2026 impact the crypto industry?

Shifting from the technocratic caution of the Powell era, the policy framework is moving towards a more explicit goal of reducing borrowing costs and serving the president's economic agenda.

Babylon partners with Aave Labs to launch native Bitcoin-backed lending services on Aave V4

Babylon Labs, the team behind the leading Bitcoin infrastructure protocol Babylon, today announced the establishment of a strategic partnership with Aave Labs. Both parties will collaborate to build a native Bitcoin-backed Spoke on Aave V4 (the next-generation lending architecture developed by Aave Labs). This architecture adopts a Hub and Spoke model, aiming to support markets built for specific scenarios.