Sonic upgrades tokenomics as part of U.S. expansion strategy

Sonic Labs is rolling out major tokenomics changes designed to support its U.S. expansion and institutional adoption plans.

- Sonic will issue 633.9M new S tokens (~$196.5M), with $150M earmarked for U.S. expansion through Sonic USA, ETF development, and a NASDAQ PIPE vehicle.

- New burn mechanics and fee redistribution aim to counter dilution, increasing deflationary pressure and long-term token value.

- The August governance vote saw 99.99% support, signaling strong community backing for Sonic’s TradFi push.

The details were outlined in a Sept. 7 post on X by Tokenomist, who broke down the new issuance and supply dynamics following the governance proposal that closed on Aug. 31 with near-unanimous approval.

Sonic’s tokenomics overhaul

According to Tokenomist, Sonic ( S ) will issue 633.9 million new S tokens, valued at about $196.5 million. The allocation is split across three categories: 150 million tokens for Sonic’s U.S. operations, 322.6 million reserved for a NASDAQ private investment vehicle locked for at least three years, and 161.3 million earmarked for a future ETF partnership with BitGo custody.

The changes increase Sonic’s total available supply from 4.12 billion to 4.75 billion, with circulating supply climbing 14% to 3.79 billion. Released supply rises 5.4% to 3.14 billion, while total supply expands by 14% to 3.89 billion.

Despite this inflationary effect, the project has introduced stronger burn mechanics. 90% of fees from builder-focused transactions will go back to builders, 5% to validators, and 5% will be burned. For non-builder transactions, half of all fees will be permanently removed from circulation.

Supporting U.S. expansion

In addition to giving Sonic Labs the capital flexibility it lacked under Fantom’s original token model, these changes are designed to offset dilution from new issuance and establish long-term scarcity in the S token.

The tokenomics shift is closely tied to Sonic’s U.S. institutional expansion plan . To engage with regulators and capital market players, the project is establishing Sonic USA, a Delaware-based company with a presence in New York. Funding from the new issuance will also seed a U.S.-listed exchange-traded fund tracking the S token and support the NASDAQ PIPE, which locks tokens to align with institutional partners.

Sonic Labs hopes to improve its competitiveness against projects with larger treasuries and create opportunities for regulated investment products by merging modern tokenomics with institutionally friendly structures.

Passed with nearly 860 million votes and 99.98% in favor, the latest governance proposal demonstrates the community’s strong support for the project.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ECB Says Digital Euro Is Ready as Decision Shifts to EU Lawmakers

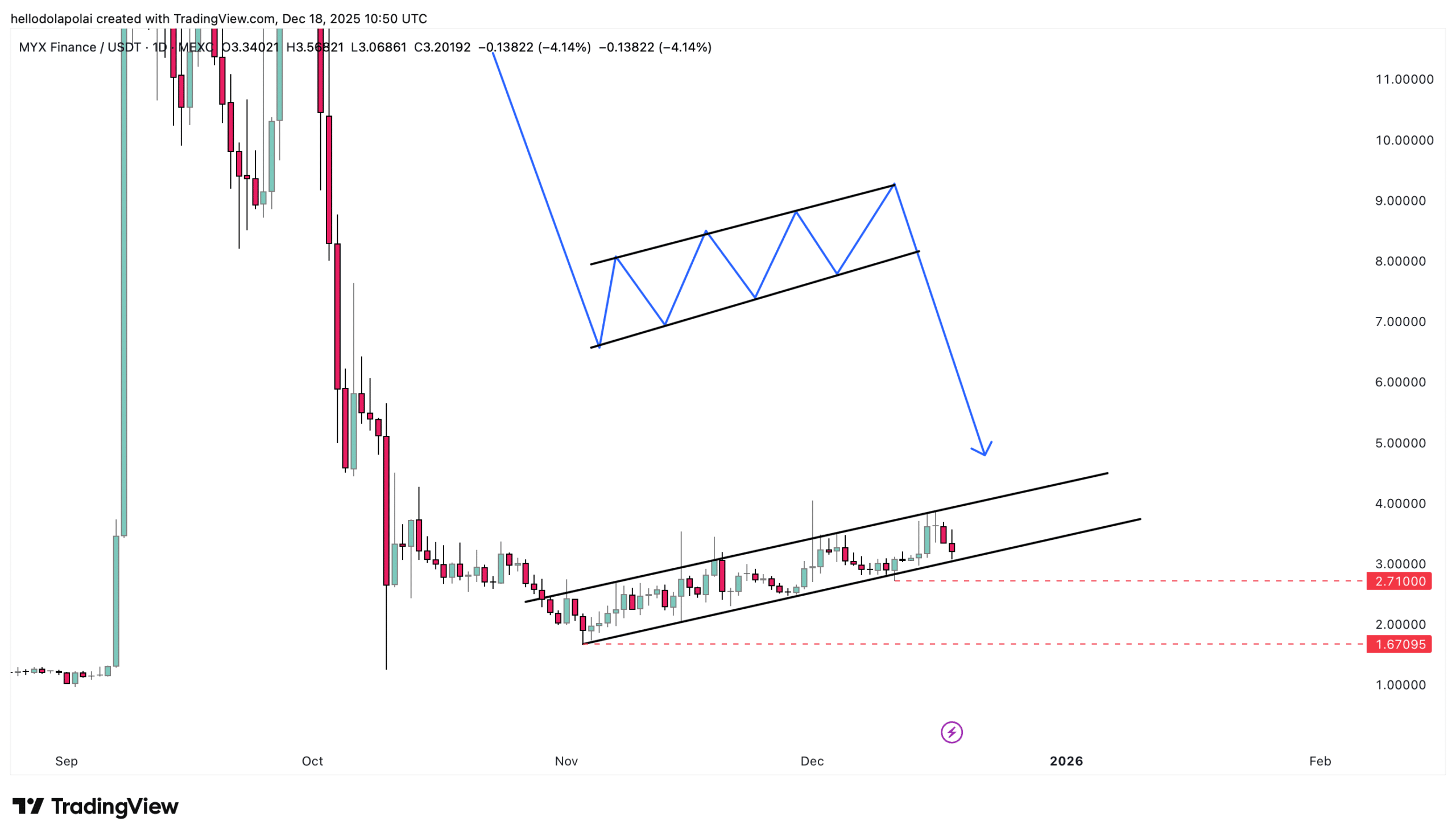

MYX drops 11% as liquidity dries up – Can bulls defend THIS support?

Take Down OpenAI? The Ambition of the Open-Source AI Platform Sentient Goes Beyond That