Ethereum price traded near $4,303 after a dormant whale moved 58,938 ETH, triggering mixed on-chain signals: selective long-term selling but stronger exchange outflows and momentum that favor buyers — ETH could retest $4,500 if accumulation continues.

-

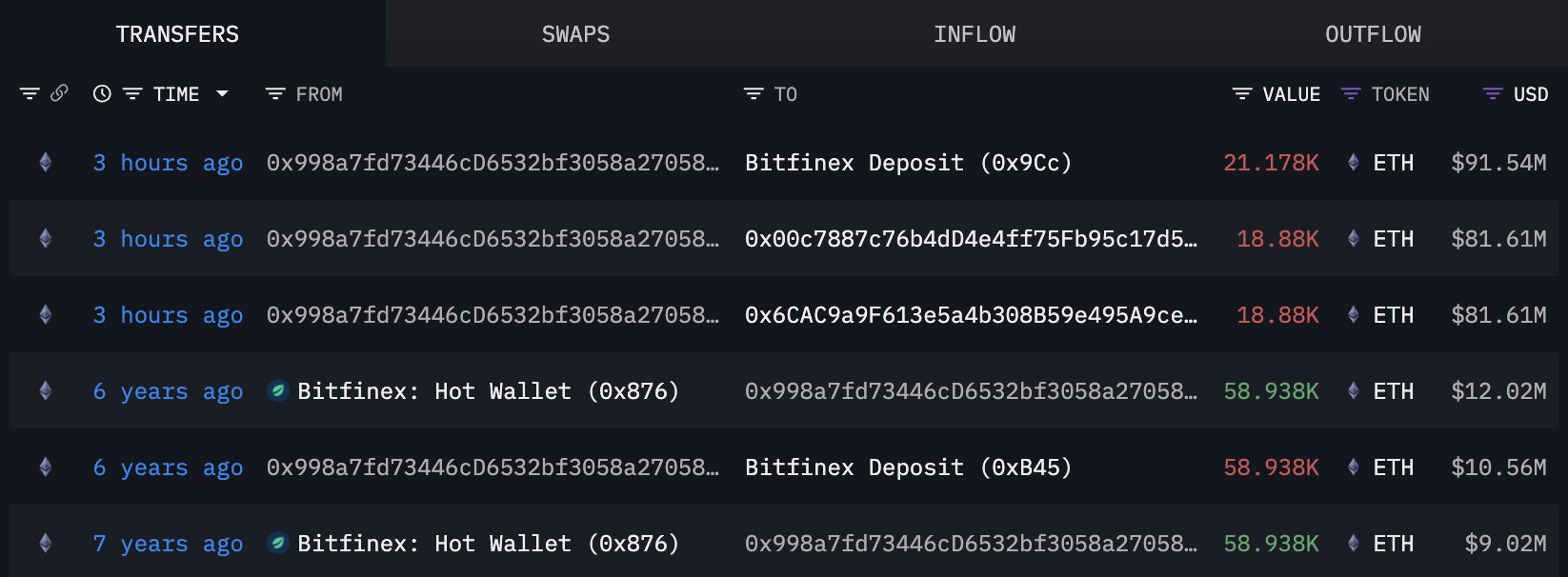

58,938 ETH moved by a dormant wallet — 21,178 ETH sent to Bitfinex.

-

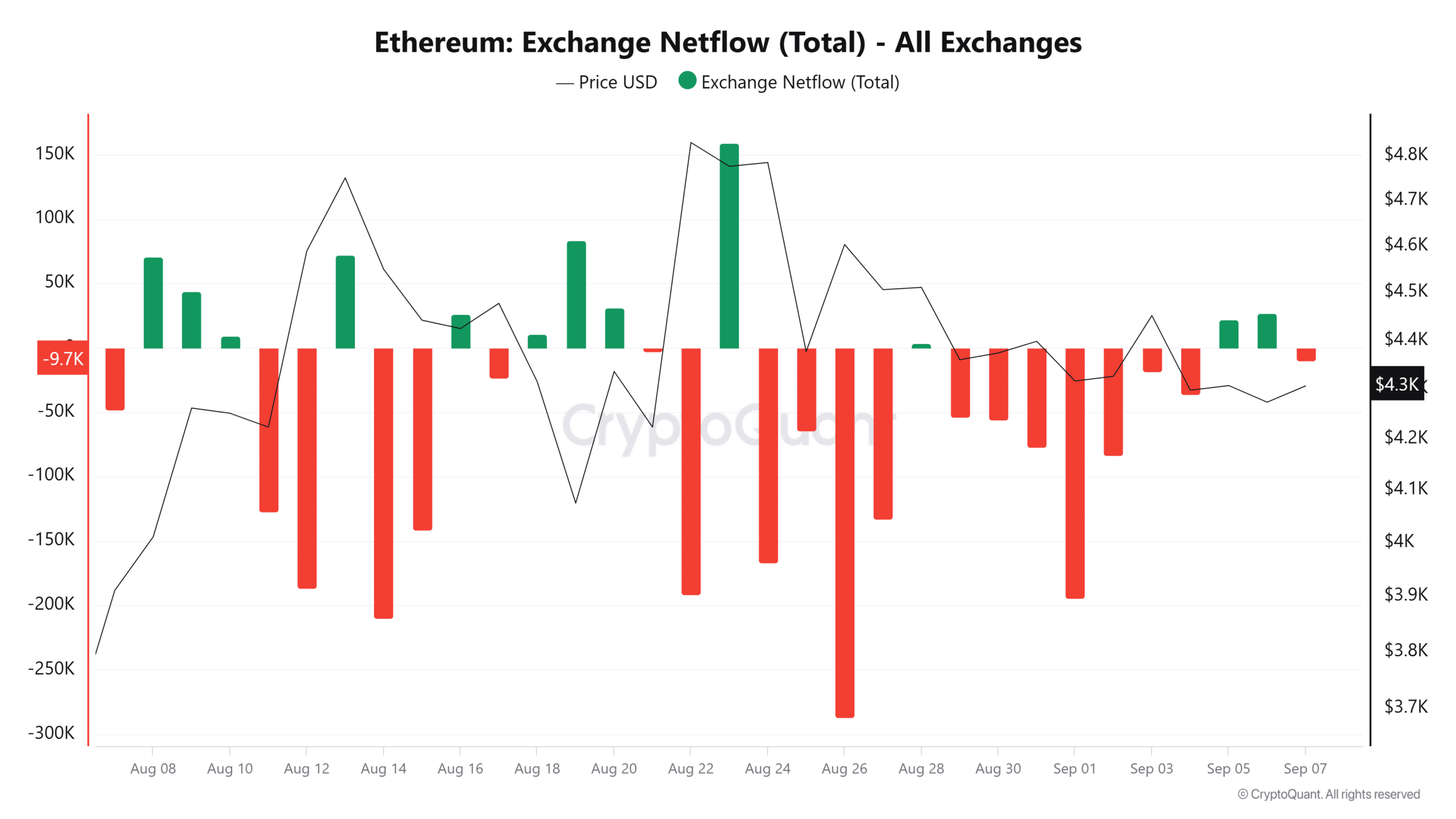

Exchange outflows totaled ~89,200 ETH versus inflows of 79,450 ETH, signaling spot accumulation.

-

Momentum metrics (DMI, RVGI) turned mildly supportive; key support sits at $4,078, resistance near $4,800.

Meta description: Ethereum price near $4,303 after a dormant whale moved 58,938 ETH; buyers accumulating. Read on for levels, on-chain signals, and outlook.

What is happening with Ethereum price and on-chain flows?

Ethereum price hovered around $4,303 after a long-dormant whale moved 58,938 ETH, creating short-term volatility. Exchange flows and cohort data show selective profit-taking by long-term holders while net exchange outflows and momentum indicators point to accumulating buyers pushing toward a retest of $4,500.

Why did a dormant Ethereum whale move 58,938 ETH?

A dormant wallet reactivated after roughly six years and transferred 58,938 ETH, according to on-chain tracking data from platforms cited in this report. Of that amount, 21,178 ETH landed on Bitfinex, indicating potential sell-side intent. This move represents concentrated profit-taking rather than mass liquidation.

On-chain cohort metrics suggest this was a targeted exit by a long-term holder instead of a broad capitulation across aging cohorts. That nuance matters for price interpretation: concentrated selling can be absorbed if market liquidity and buyers are present.

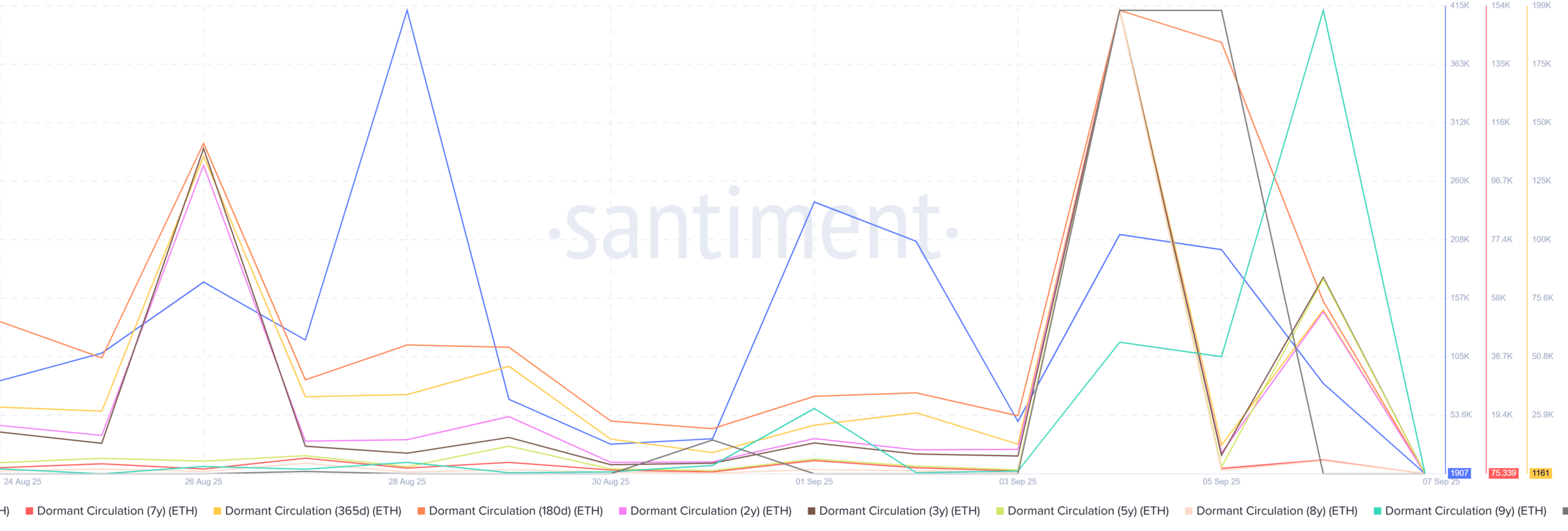

How did dormant circulation and cohort flows change?

Data from behavioral analytics providers show Dormant Circulation contracted sharply across several time cohorts. For example, the 180‑day cohort’s dormant circulation dropped from 189k ETH to about 1.5k ETH, and the 2–5 year cohort fell from 18.8k ETH to roughly 1.7k ETH.

This pattern points to selective profit-taking by older cohorts rather than wholesale exit behavior. In practice, that lowers the odds of a cascade sell-off if buyers continue to absorb supply.

Are buyers still dominating despite the whale move?

Yes. Exchange Netflow and exchange-level metrics indicate buyers are active. Aggregate outflows reached about 89,200 ETH versus inflows near 79,450 ETH, which pushed Netflow slightly negative and signals aggressive off-exchange accumulation by spot buyers.

Netflow turning negative in the short term is typically consistent with accumulation — funds leaving exchanges to cold wallets or DeFi. That behavior can support price even after large spot transfers to exchanges.

How are momentum indicators shaping near-term outlook?

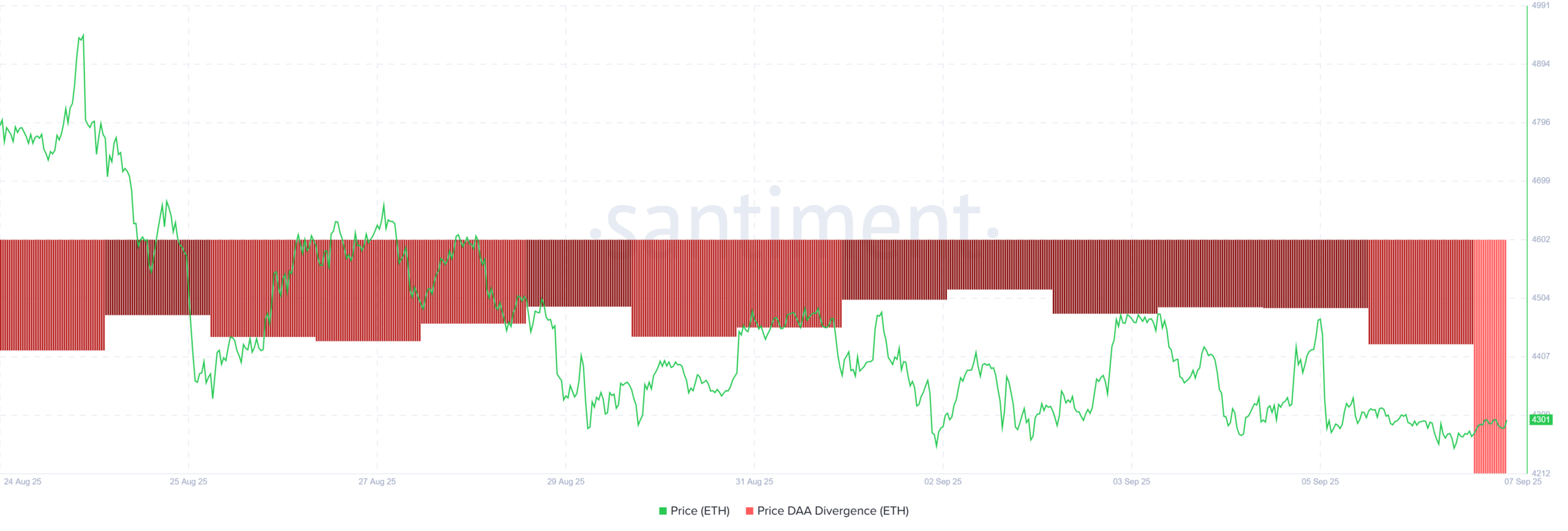

Technical momentum is mildly supportive. ADX sits near 18.3 with the DMI crossing bullishly (Positive Index ~18.48). The Relative Vigor Index (RVGI) remains above its signal line, indicating buyers have absorbed selling pressure but the trend is not yet strongly established.

Practical outlook: if on-chain demand and spot accumulation continue, ETH can challenge $4,500 and attempt $4,800 resistance. If demand wanes, downside risk targets $4,200 and then $4,078 as next support.

Frequently Asked Questions

Did a whale sell all 58,938 ETH?

No. The dormant wallet moved 58,938 ETH; 21,178 ETH was sent to an exchange (Bitfinex), suggesting partial sell intent rather than full liquidation. Other portions may be redistributed off-exchange or to cold storage.

What key levels should traders watch for Ethereum?

Watch resistance at roughly $4,500 and $4,800. On the downside, immediate support sits near $4,200, with $4,078 a deeper support if on-chain demand weakens.

Key Takeaways

- Whale activity: A dormant wallet moved 58,938 ETH; 21,178 ETH went to an exchange.

- Accumulation signal: Exchange outflows exceed inflows, indicating spot buyers absorbing supply.

- Momentum & levels: DMI and RVGI are supportive; key levels to monitor are $4,200 (support) and $4,500–$4,800 (resistance).

Conclusion

Ethereum price is rangebound near $4,303 after a notable dormant-whale transfer. On-chain cohort declines indicate selective profit-taking, while net exchange outflows and supportive momentum point to buyer-heavy conditions. Monitor on-chain flows and momentum; continued accumulation could set the stage for a move back toward $4,500.