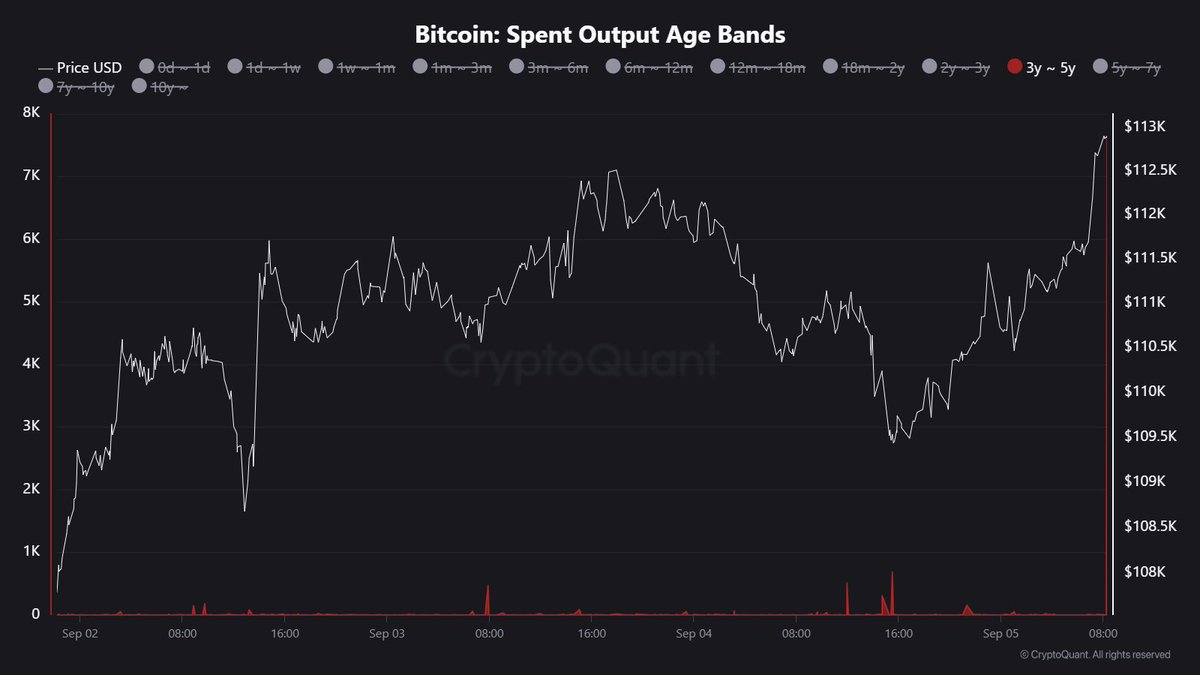

Old Bitcoin Supply Unlocks: 7,626 BTC Aged 3–5 Years Moves Onchain

Bitcoin is now trading more than 9% below its $124,500 all-time high, reflecting the weight of recent selling pressure. Despite the pullback, bears have struggled to push the price below the $105,000 support zone, a level that has so far acted as a firm floor for the market. The debate among analysts is intensifying—some are calling for a deeper correction that could reset overheated sentiment, while others see current price action as a prelude to another test of all-time highs.

Top analyst Maartunn shared fresh insights, describing the current environment as a “major Bitcoin reshuffle.” According to him, old coins are increasingly flowing into ETF wallets, a phenomenon marked by three significant waves: summer 2024, fall 2024, and summer 2025. Unlike past cycles, where such redistribution events typically occurred once before fading, this cycle has shown a repeated pattern of supply rotation.

This unusual trend highlights a structural shift in Bitcoin’s market dynamics. Long-term holders appear to be reducing exposure, while ETFs and institutional vehicles continue to absorb supply. Whether this redistribution stabilizes the market or fuels further volatility will be a defining factor for Bitcoin’s trajectory in the coming months.

Old Bitcoin Supply Unlocks: Market Dynamics In Focus

According to Maartunn, a significant movement of 7,626 BTC aged between three to five years has recently taken place. This type of activity is notable because it signals long-term holders deciding to release dormant coins back into circulation. Historically, such events often coincide with heightened market uncertainty and shifts in investor behavior, reinforcing the narrative that old supply continues to play a decisive role in shaping Bitcoin’s trajectory.

Despite this selling pressure, Bitcoin has managed to hold above the $110,000 level, showing resilience in the face of profit-taking from long-term holders. This stability is encouraging, as it demonstrates that buyers are stepping in to absorb supply, though the strength of that demand remains in question. Some market participants are pointing to ETF inflows as the primary reason Bitcoin has avoided a sharper correction. ETFs, by nature, act as a consistent demand sink, channeling institutional capital into Bitcoin through regulated frameworks.

However, the risk remains that without robust new demand, the selling pressure from newly unlocked coins could begin to outweigh buying interest. If this happens, recent holders may face the brunt of volatility. For now, the market appears to be balancing between long-term holders’ profit-taking and institutional accumulation.

This emerging dynamic highlights how Bitcoin’s current cycle differs from previous ones—ETF participation and repeated redistribution of old coins are reshaping the market structure. The coming weeks will be critical in determining whether ETF inflows are strong enough to offset the increased activity of older supply and keep Bitcoin on a bullish path.

Testing Mid-Range Resistance Levels

Bitcoin is currently trading at $112,409, showing a modest recovery after recent volatility. The chart highlights a rebound from the $109K–$110K demand zone, which has acted as short-term support during the past week. However, BTC now faces resistance as it tests the 50-day moving average (blue line at $111,661) and the 100-day moving average (green line at $114,382). These levels represent key barriers for bulls attempting to reclaim higher ground.

The broader picture shows BTC still lagging behind its all-time high near $124,500, marked by the yellow resistance line. Despite multiple attempts, Bitcoin has struggled to generate enough momentum to retest this level, largely due to persistent selling pressure and cautious sentiment among traders. The red 200-day moving average at $114,746 sits just above current price action, creating a cluster of resistance levels that could limit upside in the near term.

If Bitcoin manages to close above $114K, it would confirm bullish continuation and potentially set the stage for a retest of the $120K–$124K zone. Conversely, failure to sustain above $110K could see BTC revisiting lower supports around $106K–$108K. For now, consolidation dominates, with bulls needing fresh demand to push beyond resistance.

Featured image from Dall-E, chart from TradingView

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Staking Weekly Report December 1, 2025

🌟🌟Core Data on ETH Staking🌟🌟 1️⃣ Ebunker ETH staking yield: 3.27% 2️⃣ stETH...

The Blood and Tears Files of Crypto Veterans: Collapses, Hacks, and Insider Schemes—No One Can Escape

The article describes the loss experiences of several cryptocurrency investors, including exchange exits, failed insider information, hacker attacks, contract liquidations, and scams by acquaintances. It shares their lessons learned and investment strategies. Summary generated by Mars AI This summary was produced by the Mars AI model, and the accuracy and completeness of its generated content are still in the process of iterative improvement.

Mars Morning News | Federal Reserve officials to advance stablecoin regulatory framework; US SEC Chairman to deliver a speech at the New York Stock Exchange tonight

Federal Reserve officials plan to advance the formulation of stablecoin regulatory rules. The SEC Chair will deliver a speech on the future vision of capital markets. Grayscale will launch the first Chainlink spot ETF. A Coinbase executive has been sued by shareholders for alleged insider trading. The cryptocurrency market fear index has dropped to 23. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative updates.

OECD's latest forecast: The global interest rate cut cycle will end in 2026!

According to the latest forecast from the OECD, major central banks such as the Federal Reserve and the European Central Bank may have few "bullets" left under the dual pressures of high debt and inflation.