Pre-market | AI software applications extend losses, Figma drops over 15% after earnings, C3.ai falls over 13% after earnings

On Thursday, September 4, the three major U.S. stock index futures continued to fluctuate during pre-market trading. Nasdaq 100 index futures rose 0.19% to 23,492 points, S&P 500 index futures rose 0.12% to 6,465 points, and Dow Jones index futures fell 0.07% to 45,276 points.

In terms of news:

U.S. August ADP employment increased by 54,000, expected 65,000, lower than expected.

In terms of individual stocks

Investment company T. Rowe Price Group rose more than 8%. According to Bloomberg, Goldman Sachs will purchase $1 billion worth of the company's stock and will cooperate with the company to sell private market products;

Telecom operator Lumen Technologies rose 0.85%, once up more than 8%. Palantir and Lumen Technologies have reached a cooperation to introduce Foundry and AI platforms into Lumen;

Meta rose more than 1%. Market sources said that Meta Platforms will update its full-year performance guidance to reflect the impact of transactions;

Honeywell fell 0.9%, once up more than 1%. Market sources said that Nvidia's venture capital arm will invest in Honeywell's Quantinuum;

American Bitcoin, a bitcoin miner under the Trump family, fell 2%. The stock closed up more than 16% on its debut yesterday and once doubled during trading;

Pharmaceutical giant Sanofi Aventis plunged more than 8% as the company's new eczema drug trial results were disappointing;

AI software application stocks saw expanded declines. Figma fell more than 15%. Q2 revenue increased by 41% but missed expectations, and adjusted net profit was slightly below expectations;

C3.ai fell more than 13%. Q1 revenue missed expectations and the company withdrew its full-year guidance;

GitLab fell more than 6%. Q2 revenue grew by 29% but net loss widened, and the CFO's departure raised concerns;

Duolingo fell more than 2%. D.A. Davidson downgraded Duolingo's rating from "Buy" to "Neutral".

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

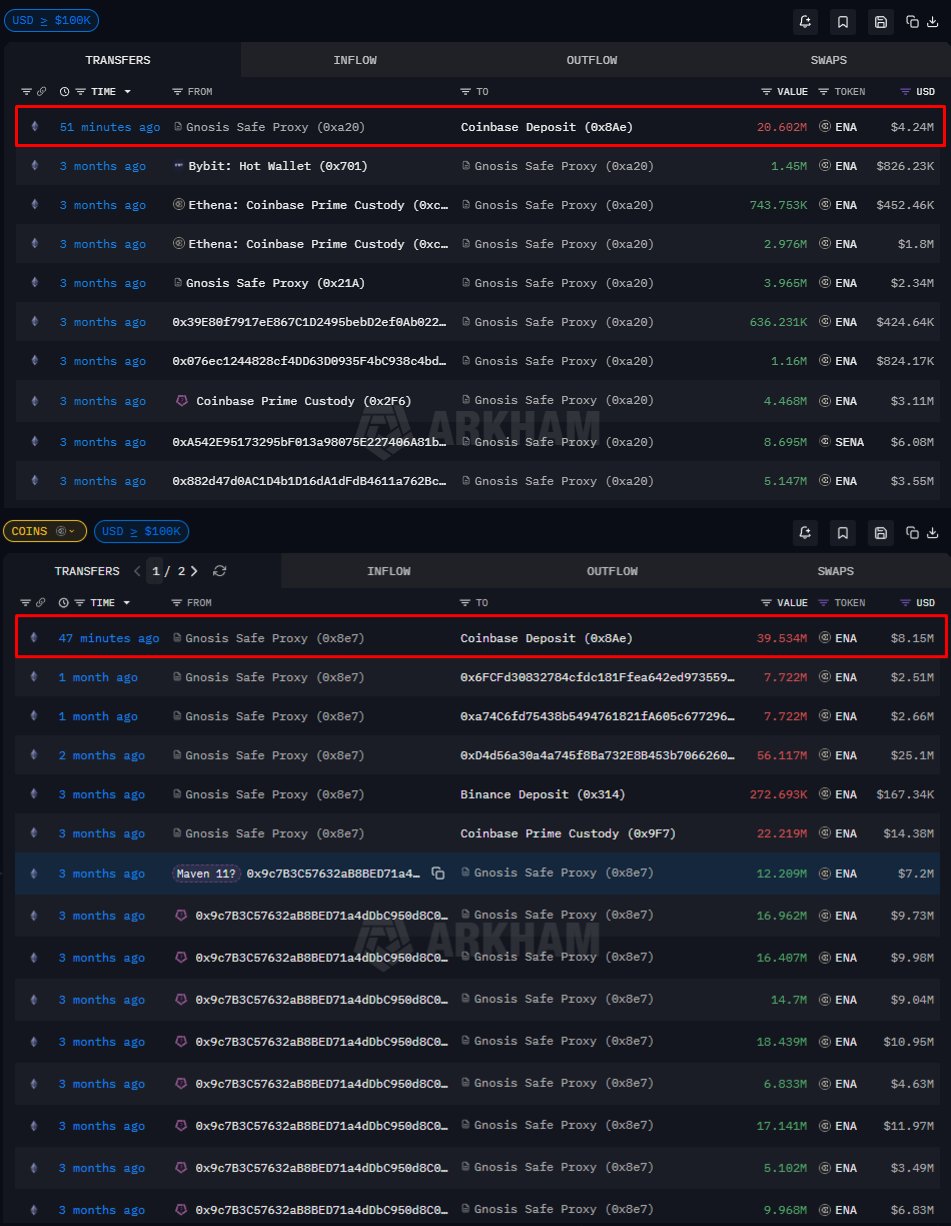

Can Ethena hold $0.20 after 101M ENA flood exchanges?

Galaxy Digital, Which Manages Billions of Dollars, Reveals Its Bitcoin, Ethereum, and Solana Predictions for 2026

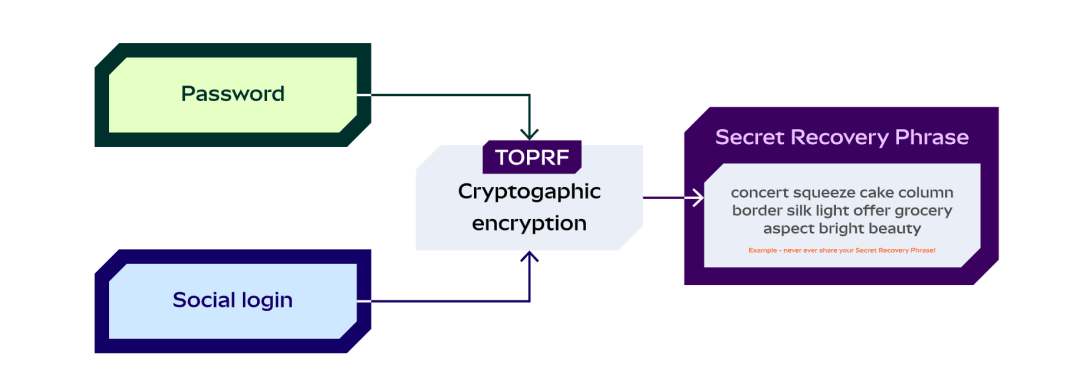

A Brief History of Blockchain Wallets and the 2025 Market Landscape

Tom Lee responds to X's debate with Fundstrat over differing bitcoin outlooks