Polymarket Secures CFTC No-Action Relief, Expands Event Contracts in U.S.

American crypto-focused prediction platform Polymarket has been granted operational greenlight after the U.S. Commodity Futures Trading Commission (CFTC) issued a no-action notice to two entities linked to the company. This action follows the application for regulatory relief in July.

In brief

- CFTC grants no-action relief to QCX and QC Clearing, enabling Polymarket’s U.S. expansion.

- The relief applies to swap data reporting and recordkeeping rules for event contracts.

- Polymarket acquired QCEX for $112M, securing a licensed exchange and clearinghouse.

- Activity surged with 11,500+ new markets in July, as Trump Jr. joined its advisory board.

No-Action Relief Clears Path for Event Contracts in U.S. Markets

In the Wednesday statement, the CFTC announced it will not follow through with enforcement action against QCX LLC and QC Clearing LLC. As per the notice, this no-action letter pertains to “swap data reporting and recordkeeping regulations for event contracts.”

Essentially, this means that Polymarket can provide event contracts within the U.S. borders without facing enforcement for not reporting the data. However, while this waiver offers temporary relief, it does not exempt the firms from regulatory compliance.

The divisions will not recommend the CFTC initiate an enforcement action against either entity or their participants for failure to comply with certain swap-related recordkeeping requirements and for failure to report to swap data repositories data associated with binary option transactions and variable payout contract transactions.

The Commodity Futures Trading Commission statement

Commenting on the recent development, Polymarket CEO Shayne Coplan told his over 98,000 X followers that the CFTC’s action has granted the company an operational nudge to “go live in the USA.” He also expressed delight over the speed at which the process was accomplished.

Polymarket expanded its reach in the U.S. markets after purchasing QCEX in July —an investment that cost the company about $112 million. The acquisition also included a CFTC-licensed derivatives exchange and clearinghouse.

CFTC Eases Stance as Polymarket Expands Amid Pro-Crypto Regulatory Shift

In the July no-action filing, QCX explained that the contracts will remain fully collateralized, meaning participants must post the entire required margin upfront, and that no transactions will be cleared through an external clearing member.

The CFTC’s no-action notice reinforces the softer regulatory stance adopted by U.S. financial regulatory bodies following the changeover to a pro-crypto administration. Under President Donald Trump’s administration, the Securities and Exchange Commission (SEC) has dropped legal proceedings against several crypto-focused companies, many of which were initiated during the previous administration.

Polymarket was a target of this series of regulatory clampdowns under the previous government. The company was fined $1.4 million for running an “illegal, unregistered or non-designated facility.”

Reports also revealed that regulatory bodies had investigated the firm over trades involving US-based users following the 2024 US elections. However, these cases were closed in July.

Polymarket has been riding a favorable wave, posting a remarkable uptick in activity over the past months. The firm added over 11,500 new markets in July—44% more than the previous month. Meanwhile, the company recently appointed the U.S. president’s son, Donald Trump Jr., to its advisory board .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

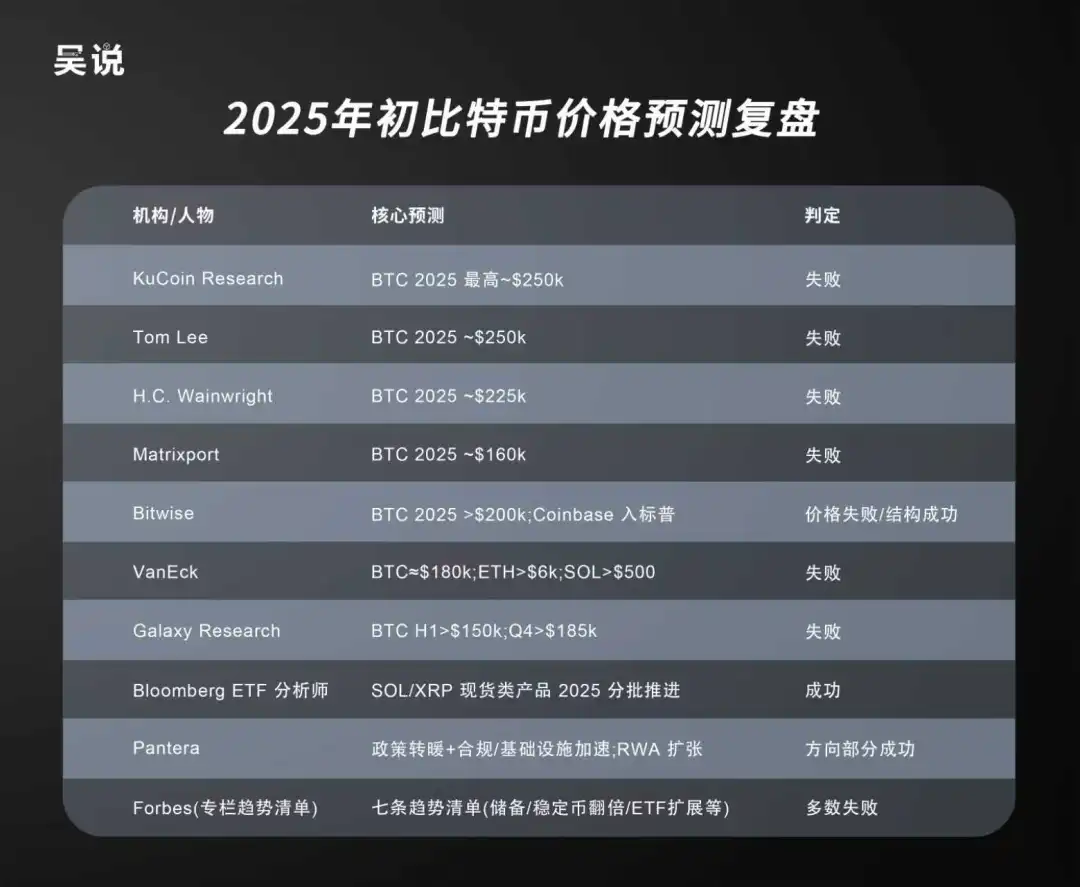

Galaxy Digital’s Head of Research Explains Why Bitcoin’s Outlook in 2026 Is So Uncertain

Crypto Coins Surge: Major Unlocks Impact Short-Term Market Dynamics

Revealing Insight: How Differing Views Shape Bitcoin Price Predictions at Fundstrat