Utila nearly triples valuation with $22 million Series A round

- Utila raises $22 million in extension round

- Institutional demand for stablecoin infrastructure grows

- Startup expands customers and focuses on global expansion

Utila, a stablecoin infrastructure company, announced it has raised $22 million in a Series A extension round led by Red Dot Capital Partners. The company noted that the operation "nearly tripled" its valuation in just six months after its initial $18 million round.

According to co-founder and CEO Bentzi Rabi, investor demand grew significantly following the IPO of Circle, the issuer of the USDC stablecoin, on the New York Stock Exchange in June.

“We saw more movement especially after Circle’s successful IPO”

Rabbi stated.

The extension included participation from Nyca, Wing VC, Digital Currency Group, Cerca Partners, Funfair Ventures, and SilverCircle, the latter being a new investor. Red Dot will also take a seat on the company's board. Despite the new funding, Utila emphasized that it has not yet used most of the funds raised in the previous Series A.

The funding will be used to expand the platform's infrastructure in response to the growing institutional demand for secure and scalable stablecoin solutions. Rabi described Utila as "the operating system for stablecoins," offering features such as custody, multi-signature wallets, transaction orchestration, regulatory compliance, banking integrations, and digital asset insurance.

According to the company, its customer base has more than doubled since March, surpassing 200 institutions. The platform now processes over $15 billion in monthly volume and has accumulated $90 billion in total transactions. Rabi highlighted that "several publicly traded companies" are among its clients, although he declined to reveal their names due to confidentiality agreements.

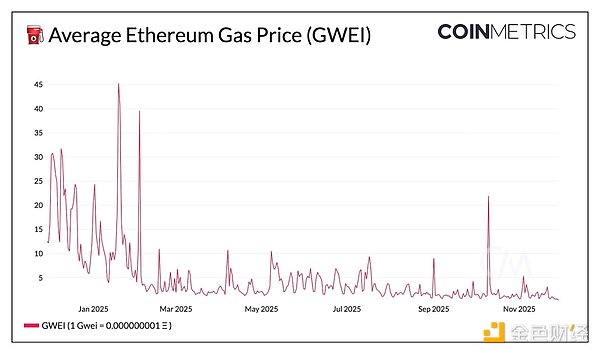

The current team of around 40 employees is expected to grow with the hiring of 15 to 20 professionals later this year, strengthening sales, support, and research. Utila's development plan includes simplifying gas operations on blockchains, expanding multichain support, and expanding liquidity on- and off-ramps.

Founded in 2022, the company has already raised over US$51 million in total and competes with players such as Fireblocks, Anchorage Digital, and Copper in the institutional infrastructure market for stablecoins.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Did top universities also get burned? Harvard invested $500 million heavily in bitcoin right before the major plunge

Harvard University's endowment fund significantly increased its holdings in bitcoin ETFs to nearly 500 million USD in the previous quarter. However, in the current quarter, the price of bitcoin subsequently dropped by more than 20%, exposing the fund to significant timing risk.

The Structural Impact of the Next Federal Reserve Chair on the Cryptocurrency Industry: Policy Shifts and Regulatory Reshaping

The change of the next Federal Reserve Chair is a decisive factor in reshaping the future macro environment of the cryptocurrency industry.

Tether: The Largest Yet Most Fragile Pillar in the Crypto World

In-depth Analysis of the Ethereum Fusaka Upgrade: Core Changes and Ecosystem Impact