Bitcoin price briefly hit a local low of $107,000 before recovering to roughly $110,900, pressured by shrinking Bitcoin ETF inflows and rotation into altcoins. Rising Bitcoin open interest near $40 billion suggests heightened derivatives activity and potential increased volatility into Q4.

-

BTC touched $107,000 then rebounded to ~$110,900

-

Spot Bitcoin ETF inflows have fallen for two months, reducing institutional tailwinds.

-

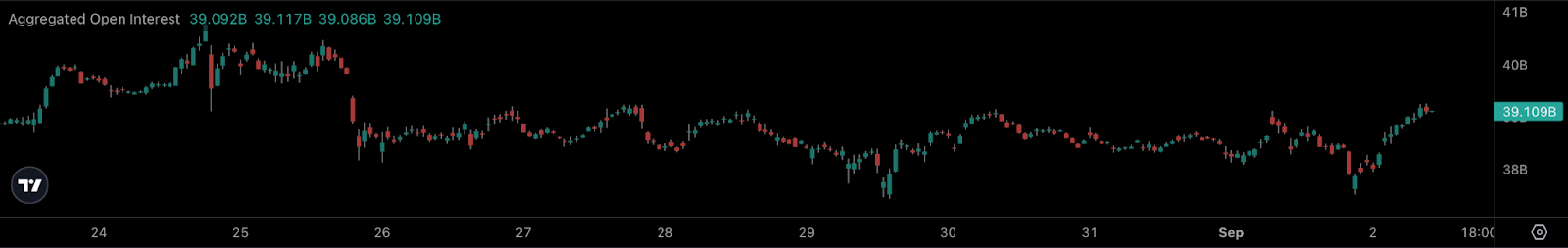

Bitcoin open interest approached $40 billion, up from $15–16 billion a year ago — a bullish volatility signal.

Bitcoin price falls to $107,000; ETFs see shrinking inflows and OI nears $40B — read expert analysis and WLFI update on Coinotag. Stay informed now.

What is the current Bitcoin price trend?

Bitcoin price hit a local low of $107,000 on some exchanges and has since recovered to about $110,900, reflecting short-term selling pressure from reduced ETF inflows and liquidity rotating into altcoins. The near-term trend shows elevated volatility but technical support near $107k held intraday.

How have Bitcoin ETFs affected market sentiment?

Spot Bitcoin ETFs in the U.S. have seen inflows shrink for two months, signaling lower incremental demand from long-term institutional buyers. On Sept. 1, 2025, combined ETF inflows totaled roughly $192 million, and aggregate AUM for the segment retraced from a mid-August peak of $155 billion to about $142 billion.

Funds such as IBIT and FBTC remain among the most active, while Ethereum ETF market cap rose from $22 billion to $24 billion in the same period, indicating partial rotation into altcoin exposure.

Image by CoinGecko

Why does Bitcoin open interest near $40 billion matter?

Bitcoin open interest (OI) — the total value of outstanding futures contracts — climbed toward $40 billion in equivalent, approaching weekly highs. Higher OI typically accompanies stronger liquidity and increased volatility, as more traders hold directional derivatives positions.

To put this in perspective, OI was around $15–16 billion a year ago, so the current level reflects substantial growth in institutional derivatives participation, which can amplify both rallies and corrections.

Image by CoinAlyze

What happened with WLFI’s exchange debut?

WLFI, the token issued by World Liberty Financial, listed on multiple centralized exchanges on Sept. 1, 2025. The token spiked above $0.30 at launch, implying a market capitalization reported at roughly $8.26 billion at peak pricing, then settled near $0.22.

Market participants raised concerns about extreme supply concentration: approximately 80% of WLFI’s supply remains locked without a clear vesting schedule, creating manipulation risk. Early distribution events reportedly allowed insiders and beneficiaries to realize multi-billion dollar gains on initial listings.

Was Venus Protocol hacked for $30 million?

No — the $30 million hack rumor was debunked by blockchain security researchers. Instead, an individual Venus Protocol user lost about $27 million to a phishing scam after authorizing a malicious transaction that granted token approvals to an attacker address.

Security firm PeckShield (mentioned as plain text) and on-chain forensic signals confirmed the incident was a user-targeted scam, not a protocol-level exploit. As always, users should verify approvals and use hardware wallets or trusted wallet interfaces for large positions.

What other security incidents were reported today?

Separately, Bunni DeFi reported a $2.4 million drain (reported previously by COINOTAG as plain text) and paused protocol activity while investigations continue. The exchange built on Uniswap v4 code froze operations to isolate the issue and protect remaining funds.

Frequently Asked Questions

How low did Bitcoin fall and is the sell-off over?

Bitcoin fell to a local low of $107,000 on some venues but recovered to roughly $110,900. The sell-off appears limited for now as support held, though continued ETF outflows and altcoin rotation could extend short-term pressure.

Are Bitcoin ETFs still a major driver of price?

Yes, ETFs remain an influential demand source, but inflows have declined since mid-July. Lower ETF momentum has reduced one pillar of institutional demand, increasing the importance of derivatives flows and retail activity.

How should traders interpret rising open interest?

Rising open interest near $40 billion signals more participants in futures markets and higher potential volatility; traders should manage leverage and monitor funding rates and liquidations to gauge risk.

Key Takeaways

- Local low: Bitcoin touched $107,000 then recovered to about $110,900 within the session.

- ETF momentum fading: Spot Bitcoin ETF inflows have contracted for two months, reducing steady institutional buying pressure.

- Derivatives signal: Open interest nearing $40B implies heavier derivatives activity and elevated volatility — trade with risk controls.

Conclusion

Bitcoin’s short-term outlook is balanced: price support around $107k held while ETF inflows cooled and open interest climbed near $40 billion. For traders and investors, the combination of reduced ETF momentum and rising derivatives exposure argues for disciplined risk management. Follow COINOTAG updates for verified data and market analysis.