Dogecoin Price Analysis: $0.21–$0.22 Range Forms as Institutional Flows Spike

By:coindesk.com

News Background

- Dogecoin traded through a volatile 24-hour session from Sept. 1 at 03:00 to Sept. 2 at 02:00, in line with broader crypto choppiness as markets absorbed macro headlines on trade policy and Fed signaling.

- Institutional desks remain active in memecoins, with 809M DOGE traded at the 07:00 rally and 806M DOGE during the 20:00 pullback, far above normal averages.

- Analysts suggest CFOs and corporate treasuries are probing allocations into liquid digital assets like DOGE as diversification against traditional hedging strategies.

- Macro backdrop: G7 trade tensions, U.S. inflation monitoring, and central bank policy divergence continue to elevate volatility across both equities and digital assets.

Price Action Summary

- DOGE traded in a $0.01 (≈6%) range between $0.21 and $0.22.

- At 07:00 GMT, DOGE advanced from $0.21 to $0.22 on 808.9M turnover, establishing resistance at $0.22.

- Profit-taking followed through midday, with additional selling pressure hitting at 20:00 GMT as price slipped back to $0.21 on 806M turnover, reinforcing the floor.

- The session closed at $0.21, indicating consolidation between tested support and entrenched resistance.

Technical Analysis

- Support: $0.21 confirmed as structural floor after multiple high-volume defenses.

- Resistance: $0.22 remains the immediate ceiling; breakout requires decisive close above $0.225.

- Momentum: RSI steady near 50, showing neutral trend with potential for directional break.

- MACD: Histogram compression continues, suggesting buildup for momentum shift.

- Patterns: Range-bound consolidation forming; upside target $0.25–$0.30 if $0.22 breaks, downside risk to $0.20 if $0.21 fails.

- Volume: Institutional-scale flows (>800M twice in one session) underscore large-holder participation shaping price action.

What Traders Are Watching

- Whether $0.21 continues to hold under persistent selling.

- Break above $0.225 as the trigger for a rally toward $0.25.

- Futures open interest trends and whale wallet movements post-rally.

- Macro catalysts (Fed remarks, trade negotiations) as volatility drivers across crypto majors and memecoins.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

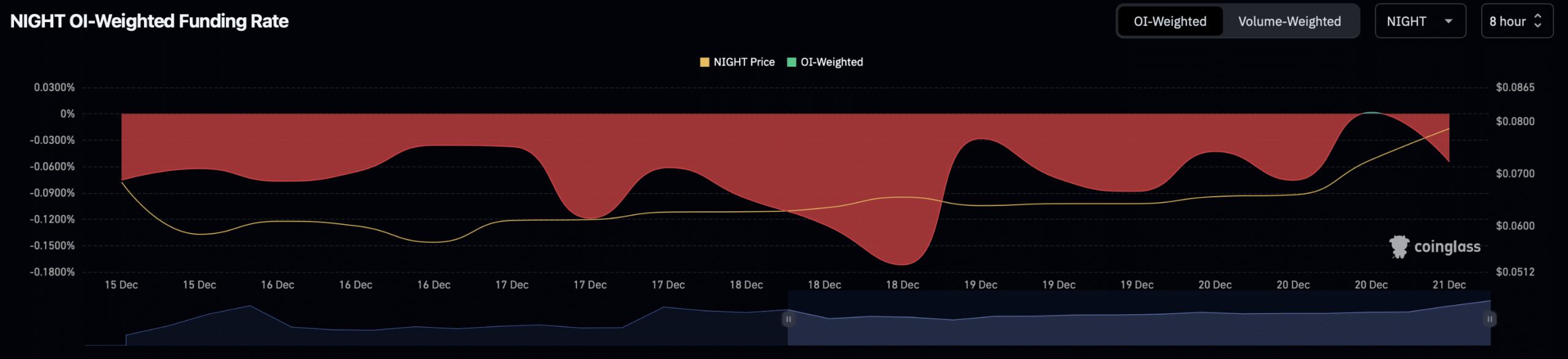

NIGHT rallies 24% as traders rush in ahead of AirDrop, but risks remain

AMBCrypto•2025/12/21 12:03

Pundit: XRP Will Have to be Extremely Expensive Once This Happens

TimesTabloid•2025/12/21 12:03

Best Meme Coins to Buy – Pudgy Penguins Price Prediction

Cryptonomist•2025/12/21 11:12

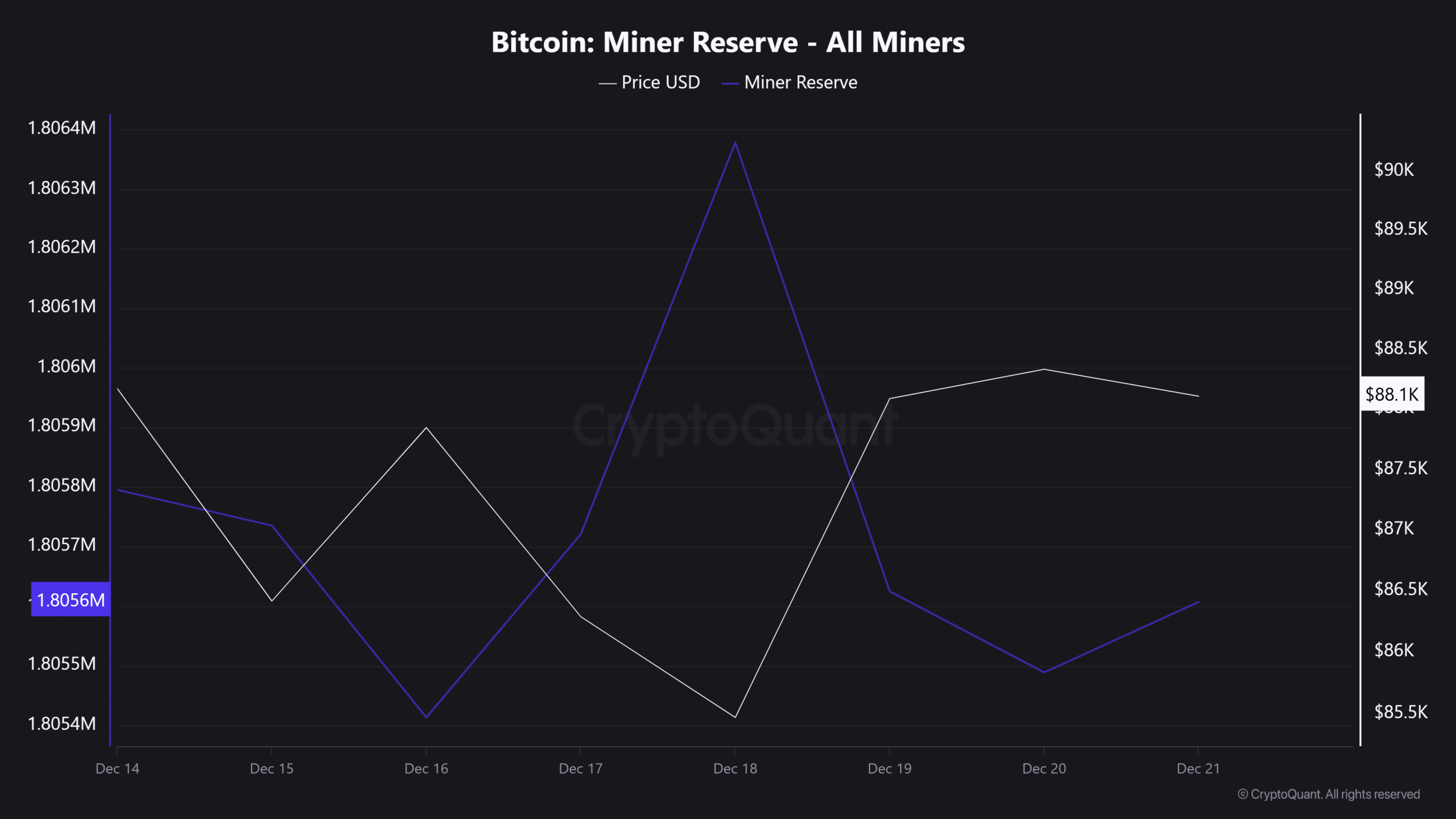

Bitcoin holds $85K despite miner stress – Is ‘buy the fear’ back?

AMBCrypto•2025/12/21 11:03

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$88,585.84

+0.38%

Ethereum

ETH

$2,995.51

+0.33%

Tether USDt

USDT

$0.9998

+0.03%

BNB

BNB

$856.18

+0.38%

XRP

XRP

$1.93

-0.44%

USDC

USDC

$0.9999

-0.00%

Solana

SOL

$125.45

-0.71%

TRON

TRX

$0.2856

+2.24%

Dogecoin

DOGE

$0.1317

-0.12%

Cardano

ADA

$0.3699

-2.20%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now