Lending a Helping Hand in Crisis! Equinor (EQNR.US) Teams Up with the Danish Government to Support Orsted's (DNNGY.US) New Share Issuance

According to Golden Ten Data, Equinor (EQNR.US), the Norwegian state oil company, has announced that it will participate in the new share issuance of wind power developer Orsted A/S (DNNGY.US), becoming the first major investor to support this share sale after the Danish government.

The Norwegian energy giant stated that it plans to maintain its 10% stake in Orsted and will subscribe for new shares worth up to 6 billion kroner (approximately $940 million). In a statement released on Monday, Equinor emphasized that this move "demonstrates confidence in Orsted's core business and recognizes the competitiveness of offshore wind power in specific regions within the future energy mix."

It is understood that Orsted's management is making every effort to win investor support for its proposed 60 billion kroner ($9.4 billion) share issuance plan. Previously, the company's stock price fell to a historic low after the United States decided to suspend key wind power projects. Last week, company executives urgently traveled to London and Frankfurt to meet with shareholders and seek support. Securing the endorsement of Equinor, the second-largest shareholder, is seen as crucial to the success of the plan.

With Equinor and the Danish government, which holds a majority stake, both expressing support, Orsted has now secured subscription commitments from at least 60% of its shareholders. Although the recent suspension of the company's offshore wind projects in the United States by the Trump administration has brought unprecedented uncertainty, the participation of major shareholders is expected to boost the confidence of other shareholders in subscribing.

Orsted's management will hold a special shareholders' meeting on Friday to seek authorization for the share issuance. Key details such as the prospectus and issue price will be announced in the coming days. Orsted, with the Danish government holding a 50.1% stake, hopes to complete the entire issuance process by early October. Equinor also announced on Monday that it will nominate a new board member to Orsted's board before the next annual general meeting.

According to sources familiar with the matter, representatives from both sides held preliminary discussions last year regarding a potential merger, but no substantial progress was made. However, Equinor has consistently maintained its support for Orsted. In its statement, Equinor said: "In the face of challenges in the offshore wind industry, industrial consolidation and new business models will emerge. We believe that deepening the strategic industrial cooperation between Orsted and Equinor can create greater value for both parties' shareholders."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Galaxy Digital, Which Manages Billions of Dollars, Reveals Its Bitcoin, Ethereum, and Solana Predictions for 2026

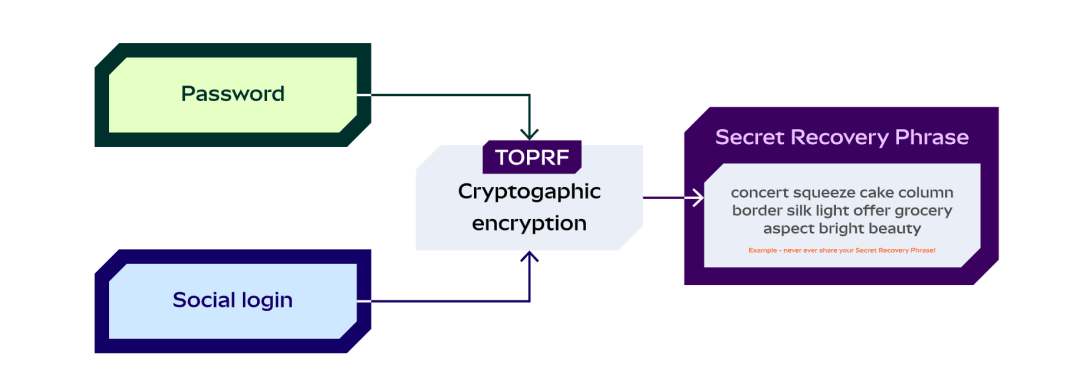

A Brief History of Blockchain Wallets and the 2025 Market Landscape

Tom Lee responds to X's debate with Fundstrat over differing bitcoin outlooks

Egrag Crypto: Selling XRP Now Makes No Sense. Here’s Why