XRP's Critical $2.83 Support: A Buying Opportunity Amid Regulatory Clarity and ETF Momentum?

- XRP's $2.83 support level in August 2025 faces critical technical and institutional tests amid regulatory clarity post-SEC lawsuit resolution. - A breakdown risks 5% decline to $2.66, while rebound could push to $3.70–$5.00 if $3.20 resistance is overcome. - Whale accumulation of $3.8B at $3.20–$3.30 and seven pending XRP ETF applications (87–95% approval chance) signal institutional bullish positioning. - Regulatory reclassification as commodity and RLUSD's $650M market cap reinforce XRP's utility in cr

The XRP price has been locked in a high-stakes battle around the $2.83 support level in late August 2025, a juncture where technical indicators, regulatory clarity, and institutional momentum converge. For investors, this level represents both a risk and an opportunity. A breakdown could trigger a 5% decline to $2.66, while a rebound might catalyze a surge toward $3.70–$5.00, contingent on overcoming resistance at $3.20 [1].

Technical Analysis: A Tipping Point

XRP’s price action reveals a fragile equilibrium. The Relative Strength Index (RSI) has lingered in oversold territory, suggesting short-term exhaustion among sellers [1]. Meanwhile, the MACD configuration signals bearish momentum, with downward pressure persisting in the near term [3]. However, the asset’s position within Bollinger Bands—testing the $2.76 support—indicates a potential consolidation phase. Analysts argue that defending $2.83 is critical; a sustained close below this level could expose the $2.66 support, eroding confidence in XRP’s utility-driven narrative [3].

Historical data from 2022 to 2025 offers context: when XRP tested support levels 54 times during this period, the average 30-day post-event return was approximately 8.4%. However, this strategy did not materially outperform a passive buy-and-hold approach, and statistical significance remained low across time horizons [6].

Whale activity adds nuance. Large holders have accumulated over $3.8 billion in the $3.20–$3.30 range since July 2025, signaling institutional positioning for a breakout [1]. This accumulation, coupled with reduced exchange inflows, suggests a “wait-and-watch” strategy among major players [5]. If bulls reclaim $3.00—a psychological and technical milestone—the path to $5.80 by year-end becomes plausible [1].

Macro-Catalysts: Regulatory Clarity and ETF Hype

The SEC’s resolution of its five-year lawsuit with Ripple in August 2025 has reclassified XRP as a commodity, eliminating a key overhang [1]. This regulatory clarity has accelerated institutional adoption: Ripple’s On-Demand Liquidity (ODL) service processed $1.3 trillion in Q2 2025, while its RLUSD stablecoin expanded to a $650 million market cap [2]. These developments underscore XRP’s role in cross-border payments and tokenized trade, reinforcing its utility beyond speculative trading.

The ETF front is equally pivotal. Seven XRP ETF applications are under review, with a 87–95% probability of approval by late October 2025 [1]. Analysts project that a $5–$8 billion inflow from institutional investors could mirror Bitcoin’s ETF-driven liquidity surge, potentially pushing XRP to $10–$15 if market conditions hold [4]. Ripple’s pursuit of a U.S. national bank charter further amplifies its institutional appeal, enabling direct Fed Reserve holdings for RLUSD [5].

The Case for Caution

Despite bullish signals, risks persist. The broader crypto market’s 6.5% weekly decline highlights fragile investor sentiment, exacerbated by delayed Fed rate cuts and trade tensions [1]. Additionally, AI-driven liquidity algorithms and competition from stablecoins and CBDCs could dilute XRP’s market share [1]. A breakdown below $2.83 would likely test $2.70–$2.75, with further declines to $1.73 or $1.19 if bearish momentum intensifies [2].

Conclusion: A Calculated Bet

XRP’s $2.83 support level is a microcosm of its broader narrative: a confluence of technical fragility and macroeconomic promise. For investors, the decision hinges on two questions: Can XRP bulls defend this level against a test of institutional resolve? And will the SEC’s delayed ETF rulings unlock the liquidity needed to propel XRP beyond $3.20? If both hurdles are cleared, the asset’s trajectory toward $5.80 by year-end becomes not just plausible but probable. However, without a clear breakout, XRP may remain range-bound, offering limited upside for risk-averse investors. Historical backtests suggest a moderate win rate (55–60%) for post-support trades, but these outcomes lack strong statistical significance [6]. Thus, while the $2.83 level warrants attention, investors should balance optimism with prudence.

Source:

[1] XRP's Regulatory Clarity and Institutional Adoption

[2] At the Crossroads—Critical Support at $3 and the Path to $5

[3] XRP Price Faces Bearish Pressure at $2.80 as SEC Appeal Withdrawal Provides Relief

[4] XRP ETF Approval Looms: Why Institutional Adoption and ...

[5] Delayed SEC Ruling on XRP ETF Sparks Debate Over

[6] Historical Backtest of XRP Support-Level Performance (2022–2025)

"""

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

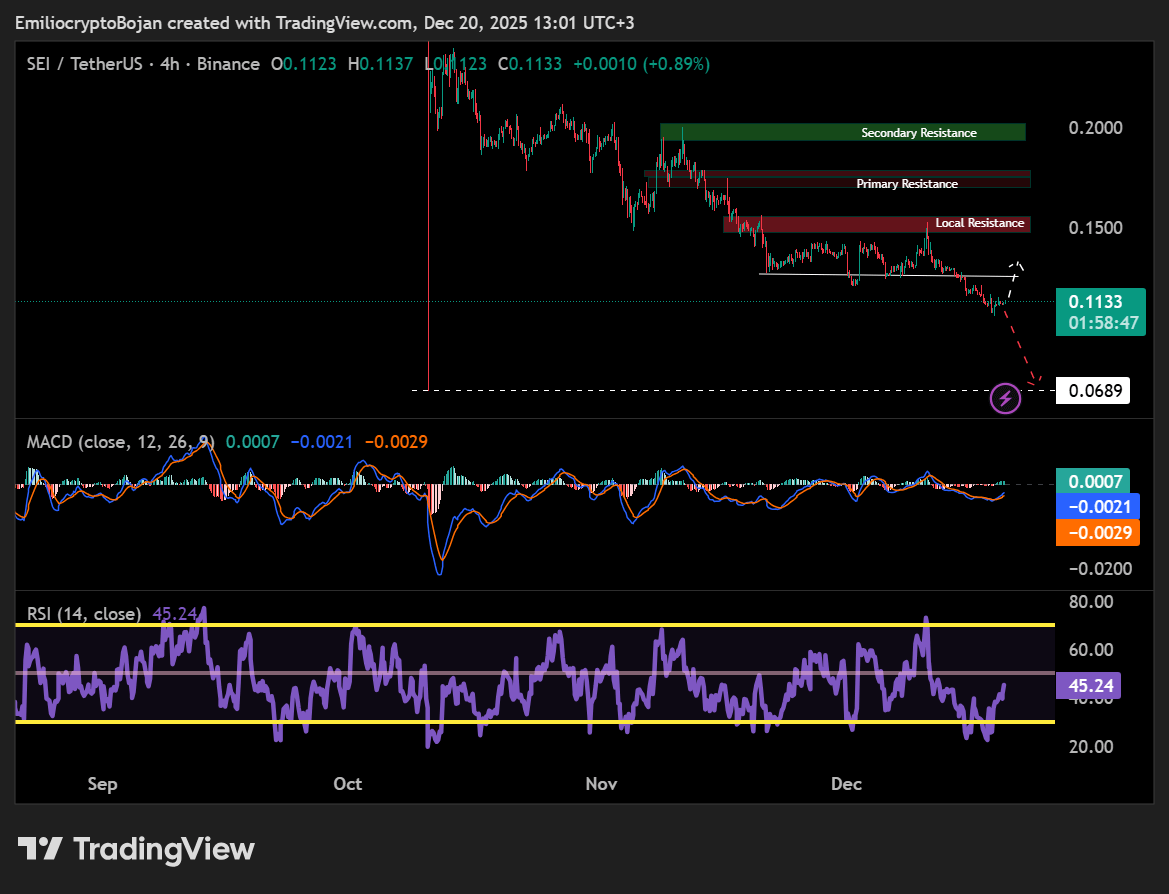

Why SEI must reclaim KEY support to avoid drop below $0.07

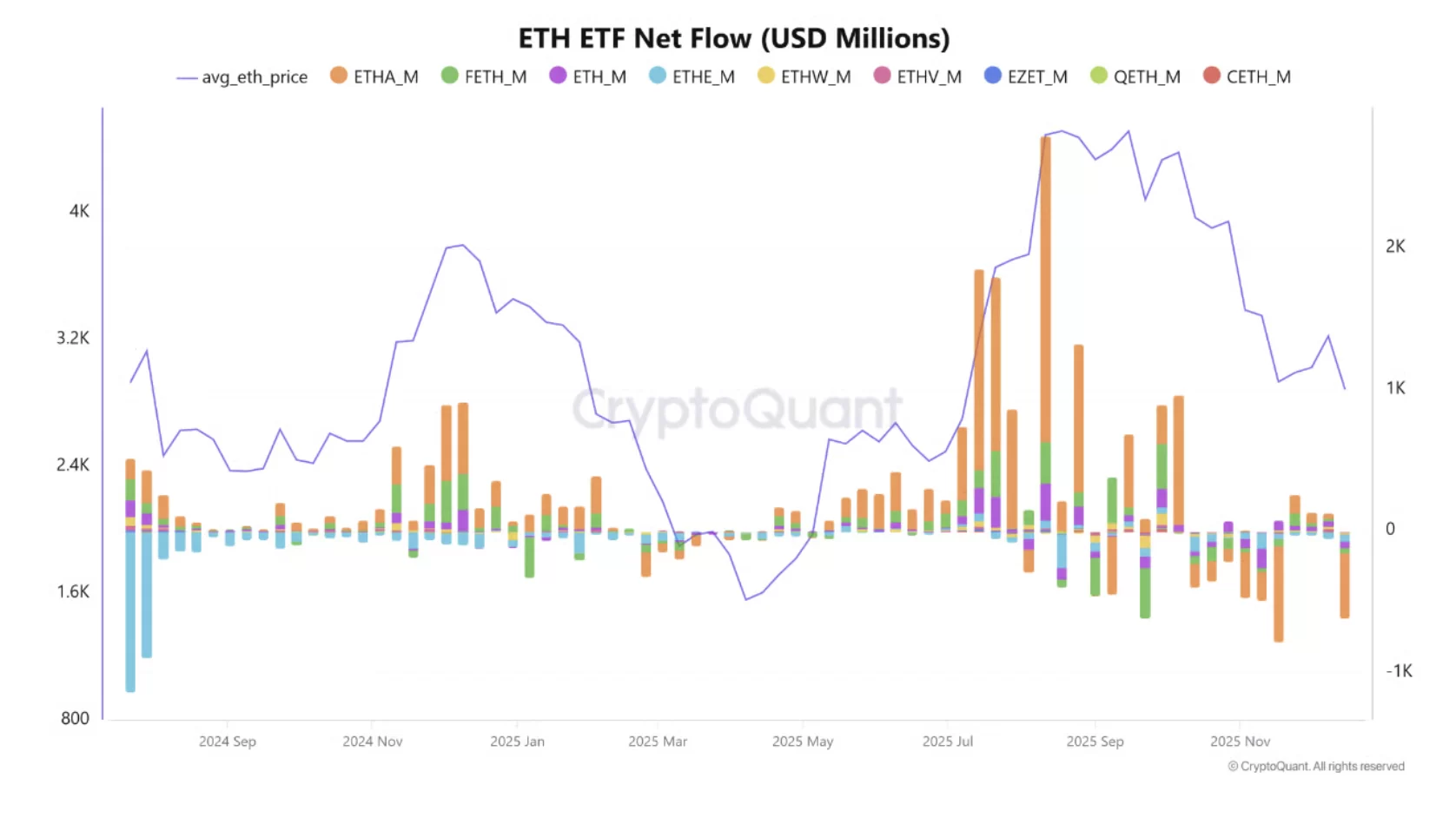

Ethereum Faces Uncertainty with Tight Trading Range

Fundstrat Internal Report Projects Crypto Drawdown Despite Tom Lee Bullish Stance