Europe's New Crypto Power Play: Amdax's $23M Bitcoin Treasury Strategy and the Race for 1% of Global BTC

- Amdax's Amsterdam Bitcoin Treasury Strategy (AMBTS) aims to raise €30M by 2025 to acquire 1% of Bitcoin's supply via a MiCA-compliant structure. - The initiative positions Bitcoin as a strategic reserve asset, competing with gold/treasuries while leveraging Euronext Amsterdam for institutional access. - Europe's 8.9% institutional Bitcoin adoption rate faces MiCA-driven regulatory costs but benefits from direct ownership models contrasting U.S. ETF dominance. - AMBTS's success could challenge U.S. govern

The Amsterdam Bitcoin Treasury Strategy (AMBTS), launched by Dutch crypto firm Amdax, has ignited a new chapter in Europe’s institutional Bitcoin adoption. By raising €20 million ($23 million) in initial funding and targeting a €30 million capital raise by September 2025, AMBTS aims to accumulate 1% of Bitcoin’s total supply (210,000 BTC) through a MiCA-compliant, equity-based structure [1]. This initiative positions Bitcoin as a strategic reserve asset, competing directly with gold and treasuries in institutional portfolios [2]. Amdax’s plan to list AMBTS on Euronext Amsterdam underscores Europe’s ambition to bridge traditional finance and crypto, offering institutional investors a regulated, liquid vehicle for Bitcoin exposure [3].

Europe’s institutional Bitcoin adoption is being reshaped by regulatory clarity under the Markets in Crypto-Assets (MiCA) framework. While MiCA has harmonized crypto regulations across the EU and provided a legal structure for crypto asset service providers (CASPs), it has also imposed significant compliance costs, increasing sixfold for startups [4]. Despite these challenges, AMBTS and similar initiatives are leveraging strategic partnerships with entities like 21Shares and Societe Generale to enhance liquidity and execution quality [2]. This contrasts with the U.S., where spot Bitcoin ETFs dominate institutional adoption, and with Asia, where retail-driven adoption remains more prevalent [5].

The AMBTS model reflects a broader shift in European institutional strategies. Unlike the U.S., which focuses on indirect exposure via ETFs, Europe is prioritizing direct ownership through structured entities. This approach aligns with Bitcoin’s perceived role as a hedge against fiat devaluation and macroeconomic uncertainty [6]. By 2025, institutional investors globally allocated 16.5% of crypto transaction volume to Bitcoin, with corporate treasuries managing over 6% of the total supply [7]. Europe’s 8.9% adoption rate, while lower than Asia’s 21.19% (Vietnam) and the U.S.’s 15.56%, is growing rapidly as AMBTS and other projects gain traction [8].

However, Europe’s path to becoming a major Bitcoin reserve hub faces hurdles. The MiCA-driven regulatory environment has reduced the number of licensed crypto service providers, with compliance costs deterring startups [4]. Meanwhile, the U.S. is advancing a pro-crypto policy under the Trump administration, including the development of a Strategic Bitcoin Reserve to reinforce dollar dominance [9]. Despite these challenges, AMBTS’s focus on institutional-grade governance and liquidity frameworks could redefine how European institutions view Bitcoin, particularly as global macroeconomic conditions favor alternative assets [10].

If successful, AMBTS could cement Europe’s role in the global Bitcoin ownership landscape. By 2025, institutional players controlled 15% of Bitcoin’s total supply, with corporate treasuries and government reserves leading the charge [11]. Europe’s 1% target through AMBTS would add a significant institutional stake to this mix, potentially rivaling the U.S. government’s 205,515 BTC holdings [12]. As the race for Bitcoin reserves intensifies, Europe’s regulatory innovation and strategic partnerships may yet position it as a key player in the crypto era.

Source:

[1] The Rise of Institutional Bitcoin Treasuries in Europe

[2] AMBTS Raises $23.2M to Build BTC Treasury

[3] Amdax Launches AMBTS with 20 Million Euros for Bitcoin Reserve

[4] Europe Crypto Report 2025

[5] Cryptocurrency Adoption by Country Statistics 2025

[6] The Emergence of Bitcoin Treasury Reserves in Europe

[7] Institutional Crypto Reserves: Trend Analysis by CP Media

[8] Who Owns Bitcoin in 2025? Key Stats & Insights

[9] The 2025 Crypto Policy Landscape: Looming EU and US Divergences

[10] Bitcoin Q1 2025: Historic Highs, Volatility, and Institutional Moves

[11] Who Controls Bitcoin Now? A 2025 Deep Dive into Whales, ETFs, Regulation, and Sentiment

[12] Bitcoin Strategic Reserves

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

What are Intent Based Architectures?

Bitcoin could face severe headwinds amid macroeconomic growth warnings, analyst says

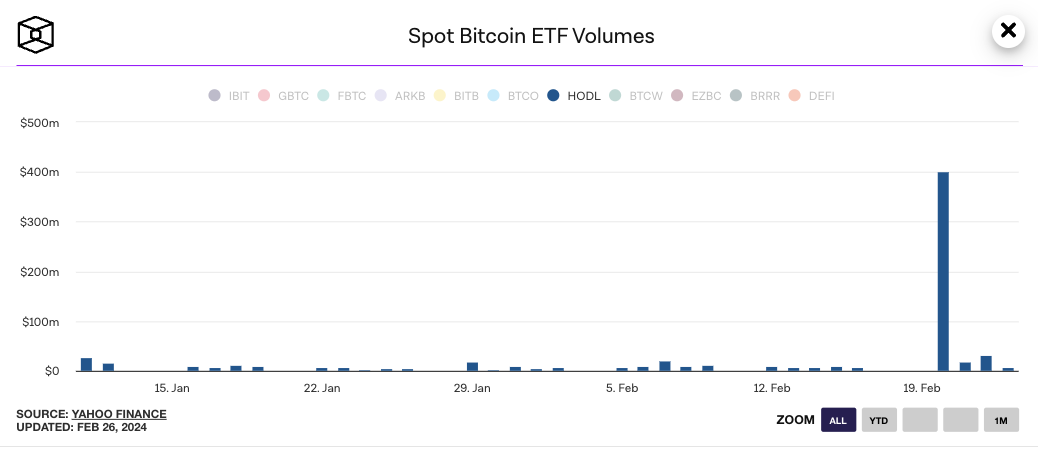

Spot bitcoin ETF volume spike may be due to high-frequency trading, CoinShares says

'Sloppy' US crypto mining survey put on pause by Texas judge