MoonBull ($MOBU): The 2025 Whitelist-Driven Meme Coin Poised for 100x Returns

In the rapidly evolving 2025 crypto landscape, MoonBull ($MOBU) has emerged as a standout altcoin opportunity, blending meme culture with institutional-grade infrastructure. Built on Ethereum’s robust blockchain, the project leverages 2025’s Layer 2 upgrades to deliver enhanced scalability, security, and interoperability with DeFi protocols, setting it apart from meme coins on less established chains like Solana or BNB [1]. This strategic foundation positions MoonBull to capitalize on Ethereum’s growing dominance in the DeFi ecosystem while addressing scalability concerns that have plagued earlier meme tokens [3].

Tokenomics and Structured Growth

Unlike speculative projects like Pudgy Penguins or Moo Deng, MoonBull’s tokenomics are designed for compounding growth and long-term value retention. By integrating Ethereum’s DeFi protocols, the project enables seamless staking and liquidity provision, fostering a sustainable ecosystem [3]. Analysts project that these mechanisms could yield 100x returns for early whitelist participants as the token transitions to public trading, driven by Ethereum’s infrastructure and growing institutional adoption [1]. The project’s emphasis on transparency—via smart contracts and public roadmap updates—aligns with broader trends in the crypto space, where trust and governance are critical to success [2].

Market Position and Analyst Projections

MoonBull’s structured approach contrasts sharply with the volatility of traditional meme coins like Pepe and SPX6900, which have seen significant price declines in Q3 2025 [3]. By leveraging Ethereum’s security and DeFi integration, MoonBull reduces sell pressure and aligns investor interests with long-term stability [1]. Market analysts highlight the project as a “must-capture opportunity” for 2025 investors, citing its unique blend of meme-driven hype and institutional-grade infrastructure [5]. With the whitelist nearing capacity, the window for early access is rapidly closing, making this a strategic opportunity for those seeking to capitalize on the next wave of meme coin innovation [1].

Conclusion

MoonBull ($MOBU) represents a rare convergence of meme culture, Ethereum’s technological advancements, and structured incentives. For investors seeking high-potential altcoins in 2025, the project’s whitelist-driven model and Ethereum-based infrastructure offer a compelling case for 100x returns. However, as with all high-risk investments, due diligence and timely action are essential.

**Source:[1] MoonBull: The Whitelist-Driven Meme Coin Poised for ... [2] The Best Crypto to Watch in 2025: MoonBull ... [3] Why MoonBull's Whitelist Is a Must-Capture Opportunity for ... [4] MoonBull Whitelist Near Max Out as Demand Surges [5] 6 Top Meme Coins To Watch In Q3 2025 As Whitelist For ...

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

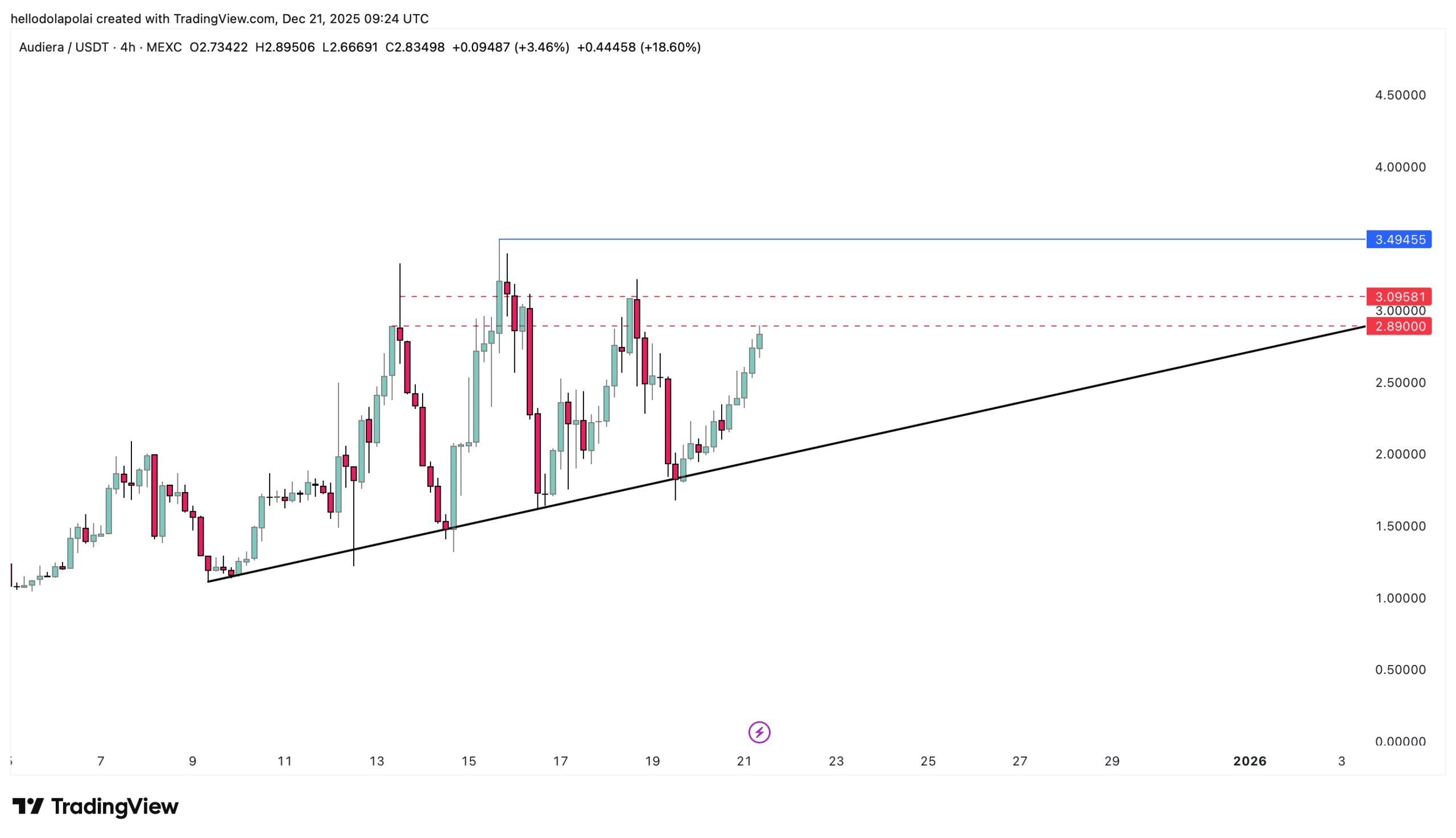

BEAT heats up, rallies 30%! A key level stands before Audiera’s ATH

Trending news

MoreBitget Daily Digest (Dec.22)|The U.S. House of Representatives Is Considering a Tax Safe Harbor for Stablecoins and Crypto Staking; Large Token Unlocks for H, XPL, SOON, and Others This Week; BTC RSI Near a 3-Year Low

Bitget US Stock Morning Brief | Fed Internal Divisions Widen; Trump Accelerates Space Militarization; Pharma Giants Accept Price Cuts for Tariff Relief (December 20, 2025)