As we navigate through September, VET Coin and Ethereum $4,337 maintain investor focus amidst fluctuating market conditions. Michael Poppe anticipates a rally, highlighting the potential surge for VET Coin by 2025. Concurrently, Ethereum’s momentum continues as BlackRock’s ETH ETF demonstrates robust growth. The article discusses the rationale behind VET Coin’s possible ascent and the current state of Ethereum.

VET Coin

Bitcoin $0.02463 remains around $110,600 but has lost support amidst legal concerns involving Trump and Cook. With expected interest rate cuts in September, albeit not as drastic as Trump’s proposed 300bp, investors are scouting altcoins that have yet to rally. Michael Poppe identifies VET Coin as a promising candidate.

Poppe states that VET Coin is poised to maintain its success into 2025, boosted by Hayabusa securing stakeholder votes. This development signifies significant improvements in staking and tokenomics, reinforcing VET Coin’s promising outlook. With the technical setup indicating a major breakout, Poppe emphasizes the current accumulation phase as a strategic opportunity.

The shared chart underscores current price levels as advantageous for strengthening positions pre-rally. Poppe is optimistic, citing user growth and low inflation as positive indicators. Despite past macroeconomic hurdles, the disparity between VeChain’s “real” value and the macroeconomic environment presents considerable opportunity, particularly following a corrective phase of over 70% in recent months.

Poppe points out that past rally movements occurred at the 1.618 Fibonacci level, often used for profit reference. If this level serves as a benchmark again, a mid-term target of $0.12 suggests the potential for a substantial rise.

Ethereum (ETH)

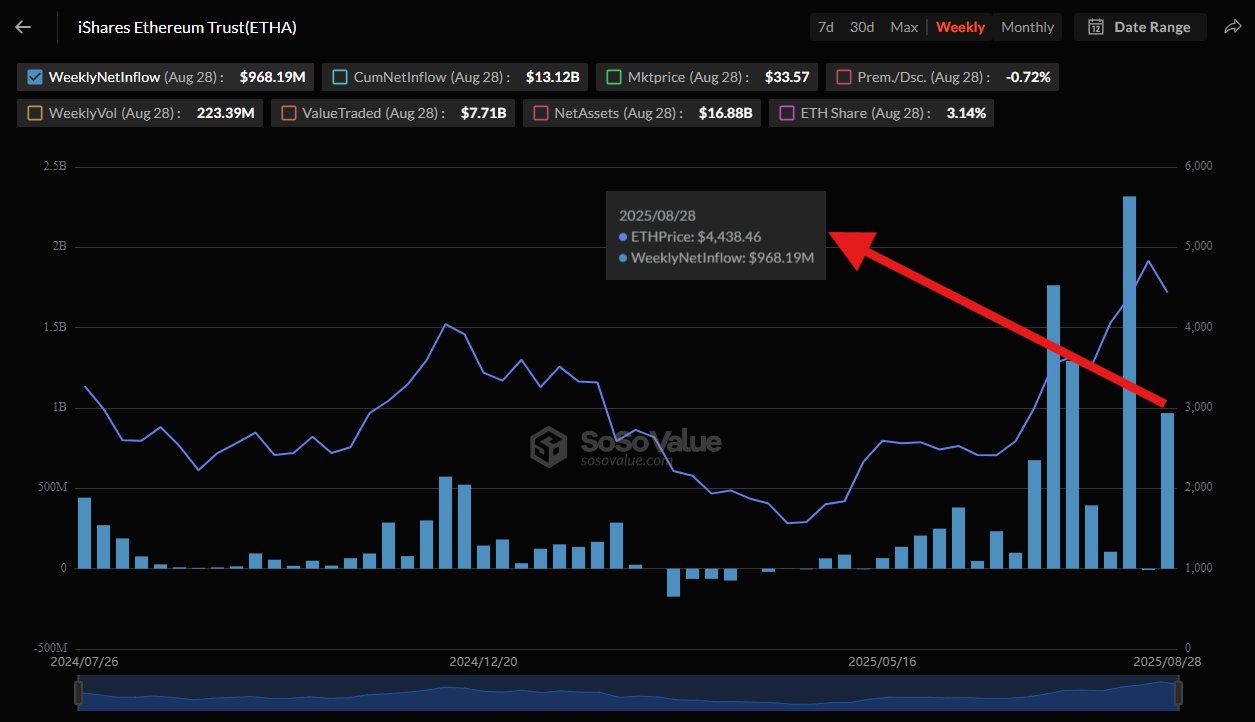

Meanwhile, BlackRock continues to expand its presence in the cryptocurrency ETF domain, notably with the ETH ETF swelling by $968 million despite ongoing debates. The consistent institutional demand for ETH is encouraging, underscoring confidence in the Ethereum channel.

Institutional ETH treasury entities also continue their acquisitions. These conditions are favorable, as indicated by the ETHBTC pair holding steady around the 0.039 mark.

Although ETH couldn’t surpass the 0.044 level in its latest attempt, hope remains as it stays above its mid-August peak.