Investors Staking for 70% APY in BullZilla's Deflationary Revolution

- BullZilla ($BZIL) emerges as a top 2025 meme coin with structured tokenomics, deflationary mechanisms, and 70% APY staking via its HODL Furnace. - The Ethereum-based project uses a progressive price engine and Roar Burn mechanism to increase token scarcity, with 50% of 159.999B supply allocated to presale. - Phased development includes Q4 2025 HODL Furnace launch and 2026 exchange listings, differentiating it from speculative rivals like Bonk and Peanut the Squirrel. - A $7,000 presale investment could t

BullZilla ($BZIL) has emerged as one of the most anticipated projects in the meme coin space for 2025, positioning itself as a top-tier investment opportunity through its structured tokenomics, deflationary mechanisms, and high-yield staking incentives. The Ethereum-based project is capturing attention for its unique approach to token scarcity and long-term value creation, distinguishing itself from traditional meme coins that rely solely on speculative demand.

At the core of BullZilla’s value proposition is its HODL Furnace, a staking mechanism offering up to 70% annual percentage yield (APY) for token holders. This system incentivizes long-term participation by locking tokens to generate compounding rewards. According to the project's roadmap, the HODL Furnace is scheduled to launch in Q4 2025, further solidifying BullZilla’s appeal for investors seeking sustainable returns in a traditionally volatile asset class [2]. The staking framework also introduces vesting logic to ensure that early adopters are rewarded proportionally to their commitment [2].

The project’s progressive price engine is another key differentiator. Every 48 hours or once $100,000 is raised—whichever occurs first—the price of $BZIL tokens automatically increases, creating a sense of urgency and encouraging early participation. This model is designed to reward early buyers while simultaneously increasing token scarcity through its Roar Burn mechanism. At certain milestones, a portion of tokens is permanently removed from circulation, directly enhancing the value of remaining tokens in the ecosystem [1].

BullZilla’s token distribution is structured to promote sustainability and community engagement. A total supply of 159.999 billion $BZIL is allocated across several categories, with 20% for staking, 20% for the Roarblood Vault, and 5% for the Burn Reserve. This allocation ensures that liquidity, staking rewards, and token burns are all integrated into a cohesive growth strategy [1]. Additionally, the referral system, known as Roar-To-Earn, allows holders to earn 10% of every purchase made through their unique referral code, further incentivizing community expansion [2].

The timeline, outlined in four phases, underscores the project’s methodical approach to development and launch. The initial phase, launched in Q2 2025, focused on team formation, contract development, and community building. The second phase, beginning in Q3 2025, activated progressive pricing and Roar Burn events. Q4 2025 will see the launch of the HODL Furnace and continued token burning, while the final phase in early 2026 is expected to culminate in a full token launch, liquidity injection, and exchange listings [2].

According to analysis in the Coinpaper report, a $7,000 investment at the price of $0.00000575 could accumulate approximately 1.217 billion $BZIL tokens. If these tokens were to appreciate to the projected listing price of $0.00527141, the investment could potentially reach a valuation of over $8.05 million [2]. While these figures represent a theoretical scenario, they highlight the potential for significant returns, particularly given the project’s structured approach to scarcity and reward distribution.

In a broader market context, BullZilla is being compared to other emerging meme coins such as Bonk and Peanut the Squirrel, which represent different value propositions within the meme coin landscape. Bonk, for instance, has played a role in Solana’s ecosystem resurgence, while Peanut the Squirrel leverages novelty and branding to carve a niche. However, BullZilla stands out for its engineered scarcity and structured incentives, which align more closely with long-term growth strategies [2].

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

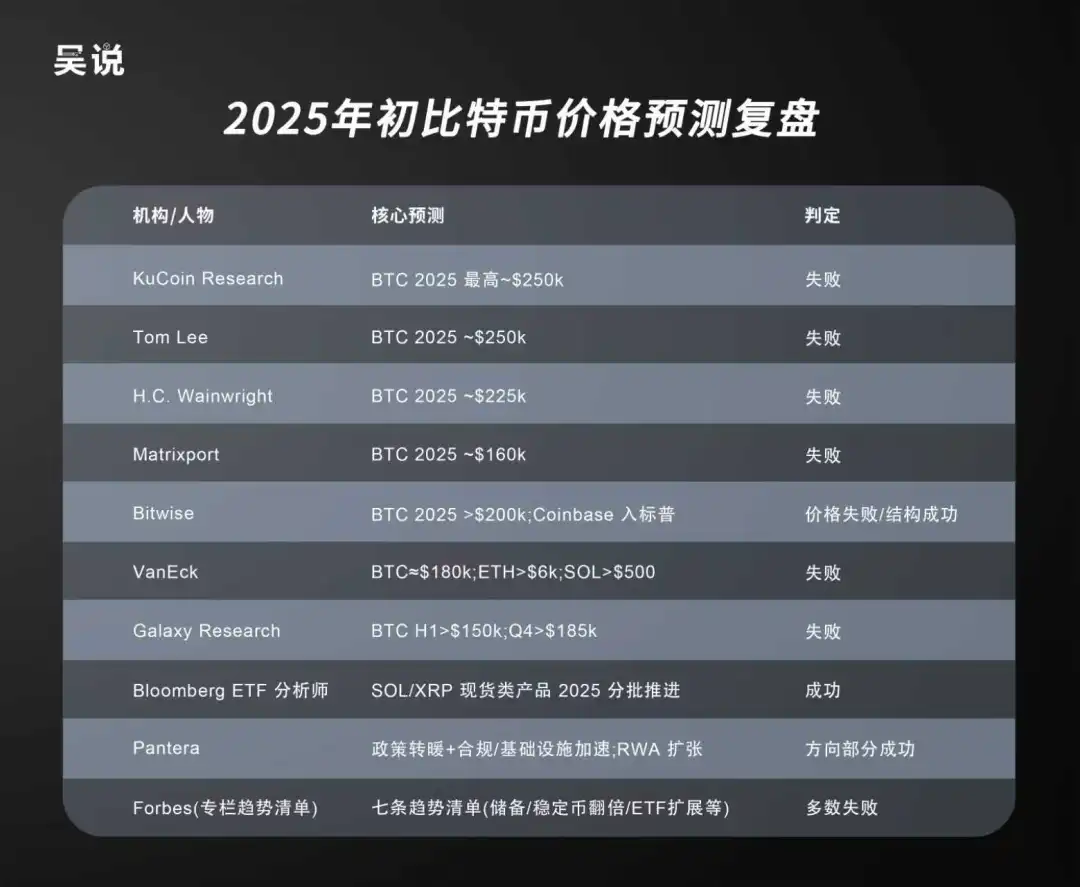

Galaxy Digital’s Head of Research Explains Why Bitcoin’s Outlook in 2026 Is So Uncertain

Crypto Coins Surge: Major Unlocks Impact Short-Term Market Dynamics

Revealing Insight: How Differing Views Shape Bitcoin Price Predictions at Fundstrat