Date: Mon, Aug 25, 2025 | 11:56 AM GMT

The cryptocurrency market is cooling off after Jerome Powell hinted at potential rate cuts in September during today’s Jackson Hole event. Bitcoin (BTC) has retraced to $111K from its 24-hour high of $115K, while Ethereum (ETH) has dipped by 3%, adding downside pressure on major altcoins .

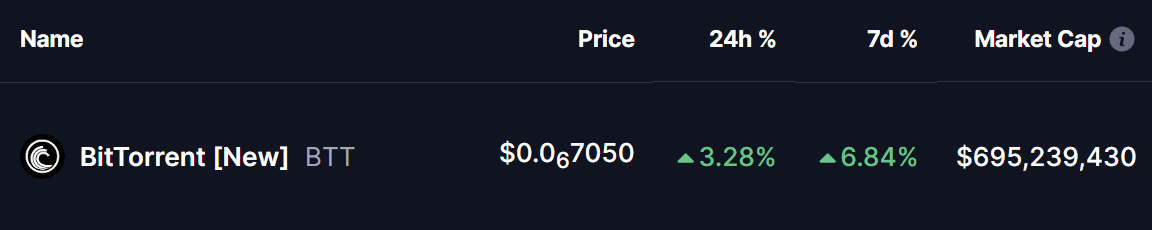

Despite this volatility, BitTorrent (BTT) is showing resilience and remains in the green — supported by an key harmonic structure.

Source: Coinmarketcap

Source: Coinmarketcap

Harmonic Pattern Hints at Potential Upside

On the 4H chart, BTT is currently forming a Bearish Butterfly harmonic pattern. While the name implies a bearish setup, this pattern often involves a strong bullish rally in the CD leg before approaching its Potential Reversal Zone (PRZ).

The structure began from Point X near $0.0000007544, declined to Point A, rallied toward Point B, and then corrected to Point C near $0.0000006375. From there, BTT has staged a recovery and is now trading at $0.0000007125, with bullish momentum starting to build again.

BitTorrent (BTT) 4H Chart/Coinsprobe (Source: Tradingview)

BitTorrent (BTT) 4H Chart/Coinsprobe (Source: Tradingview)

Importantly, BTT is holding above its 200-day moving average at $0.0000006791, a critical support zone that could serve as a foundation for the next leg higher.

What’s Next for BTT?

If buyers continue to defend the 200-day MA, BTT could extend its rally into the PRZ zone between $0.0000007882 (1.272 Fibonacci extension) and $0.0000008313 (1.618 extension). This would complete the Butterfly pattern and represent an upside potential of +16% from current levels.

However, traders should also remain cautious — intraday retracements toward the lower edge of the CD leg cannot be ignored, especially if momentum weakens before reaching the PRZ.