David Bailey's Bitcoin treasury KindlyMD acquires $679 million in BTC

Key Takeaways

- KindlyMD acquired 5,744 Bitcoin worth approximately $679 million through its subsidiary Nakamoto Holdings.

- The purchase is part of KindlyMD's strategy to accumulate one million Bitcoin as a corporate reserve asset.

KindlyMD, led by President Donald Trump’s Bitcoin advisor David Bailey, announced Tuesday it had spent approximately $679 million to accumulate around 5,744 Bitcoin.

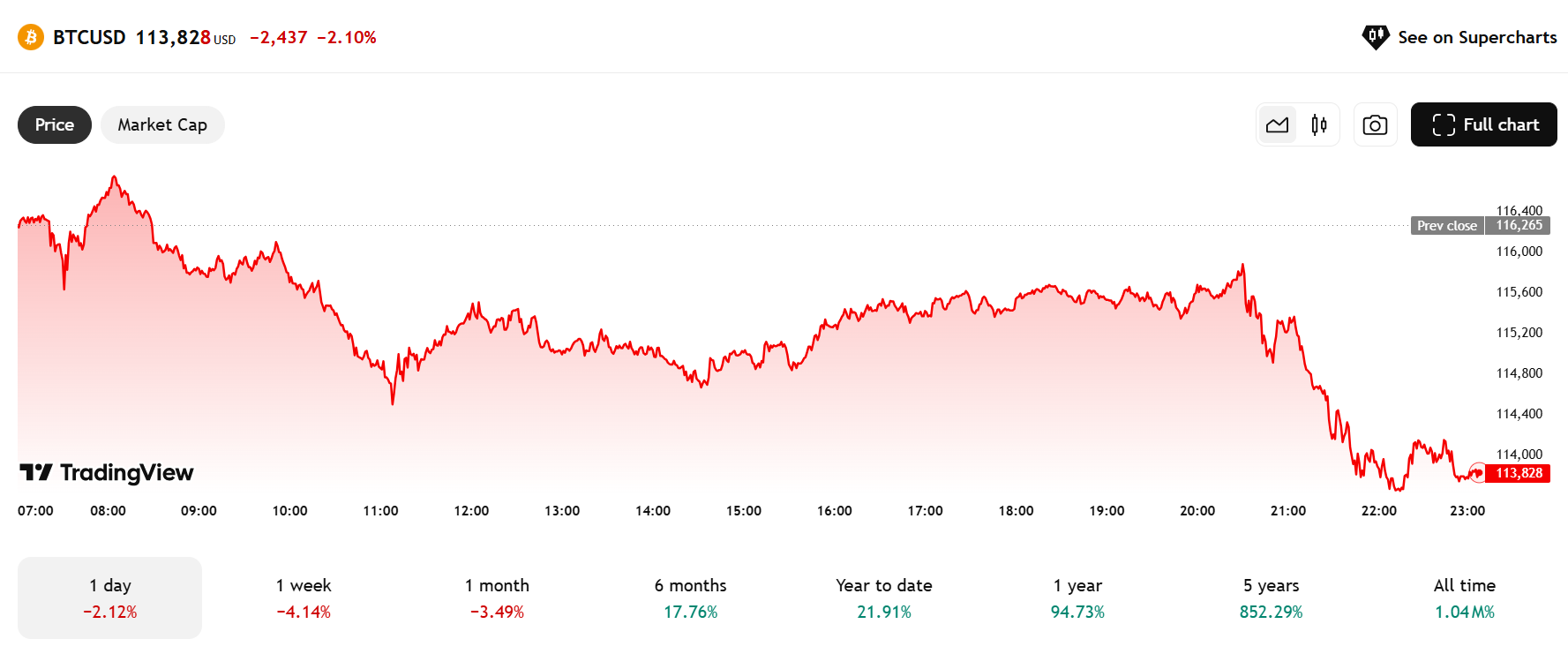

With the latest acquisition, KindlyMD’s Bitcoin stash surpasses 5,764 units, equating to over $655 million at current prices of about $113,840. The company used PIPE proceeds for the purchase as part of its strategy to acquire one million Bitcoin under the Nakamoto Bitcoin Treasury.

Commenting on KindlyMD’s BTC purchase, the first since it completed its merger with Nakamoto Holdings, CEO Bailey reiterated that his team is doubling down on Bitcoin as a cornerstone asset for the future.

“Our long-term mission of accumulating one million Bitcoin reflects our belief that Bitcoin will anchor the next era of global finance, and we are committed to building the most trusted and transparent vehicle to achieve that future,” he added.

KindlyMD now ranks sixteenth among corporate Bitcoin holders, ahead of firms like Semler Scientific and GameStop.

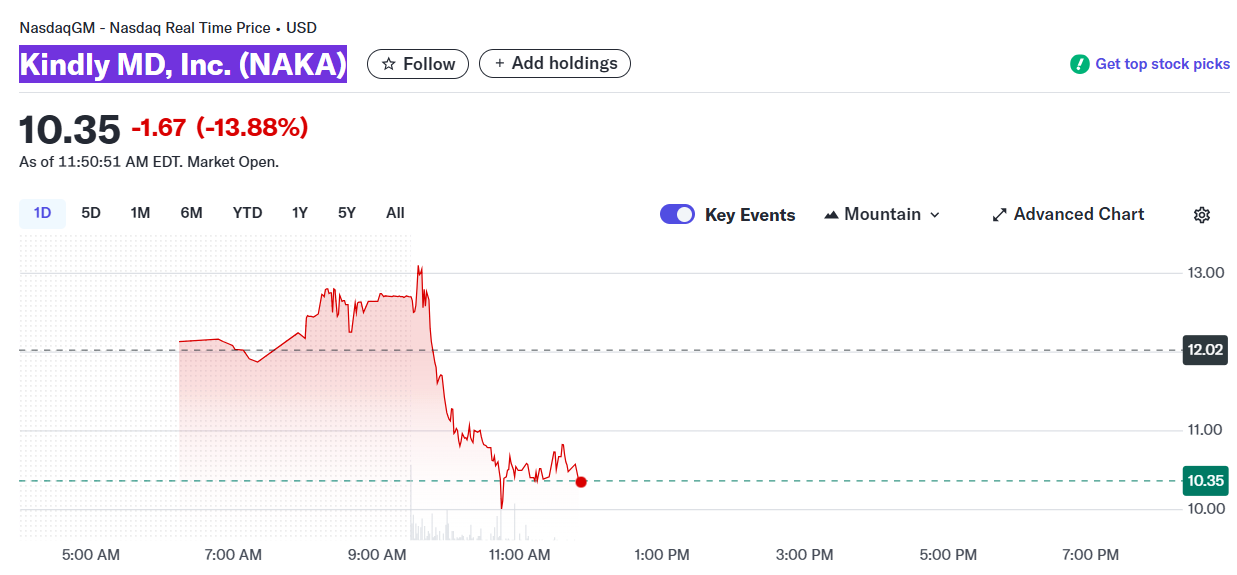

Shares of the company (NAKA) fell 14% at Tuesday’s open as Bitcoin slipped from above $115,800 to $113,846 amid a market-wide pullback.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ETH price fluctuates violently: the hidden logic behind the plunge and future outlook

Bitcoin risks return to low $80K zone next as trader says dip 'makes sense'

Bitcoin ‘risk off’ signals fire despite traders’ view that sub-$100K BTC is a discount

Trending news

MoreETH price fluctuates violently: the hidden logic behind the plunge and future outlook

[Bitpush Daily News Highlights] Texas Lieutenant Governor officially announces the purchase of bitcoin, aiming to build America’s digital future hub; Economists expect the Federal Reserve to cut interest rates in December, with two more possible cuts in 2026; Circle has issued an additional 10 billions USDC in the past month; Sources: SpaceX is in talks over share sales, with valuation possibly soaring to 800 billions USD.

![[Bitpush Daily News Highlights] Texas Lieutenant Governor officially announces the purchase of bitcoin, aiming to build America’s digital future hub; Economists expect the Federal Reserve to cut interest rates in December, with two more possible cuts in 2026; Circle has issued an additional 10 billions USDC in the past month; Sources: SpaceX is in talks over share sales, with valuation possibly soaring to 800 billions USD.](https://img.bgstatic.com/multiLang/image/social/dd58c36fde28f27d3832e67b2a00dab41764952203123.png)