Ethereum’s current cycle mirrors its 2017 performance, showcasing a bear trap and breakout setup, supported by institutional inflows and a robust DeFi ecosystem.

-

Ethereum’s 2025 cycle reflects 2017 with key accumulation and breakout patterns.

-

Institutional inflows via ETFs are driving ETH price targets between $7,500 and $8,500.

-

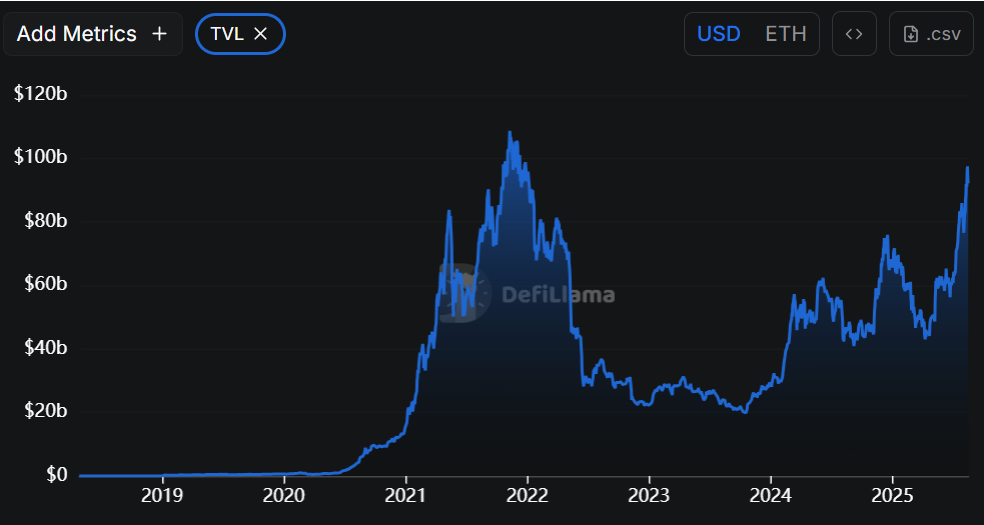

Ethereum’s ecosystem boasts a total value locked (TVL) of $92.5 billion and over 484,000 active addresses.

Ethereum’s 2025 cycle mirrors its 2017 performance, showcasing a bear trap and breakout setup. Discover how institutional inflows and DeFi growth support this trend.

What is Ethereum’s Current Market Cycle?

Ethereum’s current market cycle is characterized by structural similarities to its 2017 cycle, including accumulation, resistance tests, and a bear trap. The Ethereum price is currently around $4,545, maintaining upward momentum.

How Does Institutional Participation Impact Ethereum?

Institutional participation is a key differentiator in 2025. According to Standard Chartered, record inflows from ETFs and regulated products have reduced selling pressure, fostering long-term accumulation. Analysts suggest that if market conditions align, ETH could reach targets between $7,500 and $8,500.

Frequently Asked Questions

What is the total value locked in Ethereum’s DeFi ecosystem?

The total value locked in Ethereum’s DeFi ecosystem is approximately $92.5 billion, indicating a strong recovery towards previous highs.

How many active addresses does Ethereum have?

Ethereum has recorded over 484,000 active addresses in a single day, showcasing robust network participation.

Key Takeaways

- Market Structure: Ethereum’s 2025 cycle mirrors 2017, with similar accumulation and breakout patterns.

- Institutional Support: ETFs and regulated products are driving significant institutional inflows.

- DeFi Growth: The Ethereum ecosystem is expanding, with a TVL of $92.5 billion and strong Layer 2 adoption.

Conclusion

In summary, Ethereum’s current cycle reflects its 2017 performance, bolstered by institutional participation and a thriving DeFi ecosystem. As the market evolves, ETH’s potential targets between $7,500 and $8,500 remain plausible, encouraging investors to stay informed about future developments.

Ethereum mirrors its 2017 cycle with a bear trap and breakout setup as ETFs, $92.5B DeFi TVL, and 484K users support growth.

- Ethereum’s 2025 cycle mirrors 2017 with accumulation, bear trap, and breakout setup.

- Institutional inflows through ETFs support ETH targets between $7,500 and $8,500.

- Ethereum ecosystem shows $92.5B TVL, 484K active addresses, and strong Layer 2 growth.

Ethereum has shown strong structural similarities between its 2017 cycle and the current 2025 cycle. Both charts record accumulation, resistance tests, a bear trap, and recovery toward breakout. Analysts note that institutional participation and new financial products have added depth to this cycle. Ethereum is currently trading around $4,545, maintaining momentum near recent highs.

Ethereum 2017 vs 2025: Market Structures and Breakout Patterns

According to an analysis prepared by Merlijn The Trader, Ethereum’s 2016–2017 chart displayed repeated resistance around $17 before forming a bear trap. The market then surged above $300, producing one of the strongest rallies in its history with gains exceeding 5,000%.

$ETH 2017 vs 2025…

Same accumulation. Same fakeout. Same breakout loading.

Back then: +5,000%

This time: institutions, ETFs & trillions in liquidity behind the move.

The bear trap is set. The ignition is real. pic.twitter.com/b1Ju7MxD24

— Merlijn The Trader (@MerlijnTrader) August 16, 2025

The current 2024–2025 cycle shows nearly identical price action. Ethereum consolidated near $3,500 before forming a bear trap earlier in 2025. The rebound carried prices toward $4,300 and recently to $4,545, while maintaining the ascending market structure. Analysts point to similar accumulation and breakout phases, suggesting ETH could follow a comparable trajectory to 2017.

Institutional participation sets 2025 apart. According to Standard Chartered, ETFs and regulated products have drawn record inflows, limiting selling pressure and boosting long-term accumulation. Analysts project targets between $7,500 and $8,500 if broader market conditions align with rising Bitcoin valuations.

Ethereum Ecosystem Growth and Network Metrics

Ethereum’s decentralized finance activity continues to expand. DefiLlama data shows total value locked at $92.549 billion, recovering toward 2021 highs above $110 billion. Stablecoin capitalization connected to Ethereum stands at $142.832 billion, while daily chain fees reached $682,280 and chain revenue totaled $1.28 million.

Source: DefiLlama

Layer 2 networks including Arbitrum, Optimism, and zkSync have grown steadily, easing mainnet congestion and lowering costs for users. Analysts noted that adoption of these solutions supported scaling and encouraged broader application growth. Developer activity remained strong, with projects focused on tokenized assets and advanced DeFi applications.

NFT markets, decentralized exchanges, and staking protocols continue to support network participation. Ethereum recorded over 484,000 active addresses in one day, with decentralized exchange volume at $3.712 billion. According to TradingView data, Ethereum trades above $4,500 with resistance targets set near $4,780 and $4,950.