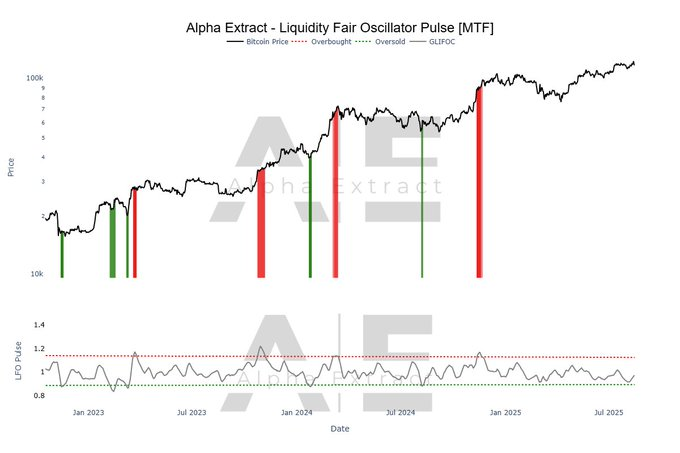

Bitcoin is currently trading above its all-time high of $117,823, with the Liquidity Fair Oscillator Pulse (LFOP) indicating potential for further upside growth as market conditions remain favorable.

-

Bitcoin surpasses its ATH while LFOP remains low, suggesting the rally has not yet reached cycle exhaustion.

-

Alpha Extract notes LFOP has historically provided reliable entry and exit signals, strengthening confidence in the tool’s readings.

-

With Bitcoin at $117,823, subdued LFOP values show conditions may allow further growth before a trend reversal emerges.

Bitcoin news: As Bitcoin trades above its all-time high, the Liquidity Fair Oscillator Pulse suggests continued growth potential. Stay informed!

What is the Liquidity Fair Oscillator Pulse?

The Liquidity Fair Oscillator Pulse (LFOP) is a tool that correlates Bitcoin’s market activity with global liquidity measures. Currently, LFOP readings are low, indicating that the market is not overheated, despite Bitcoin’s elevated price.

How Does LFOP Indicate Market Conditions?

The LFOP has consistently provided reliable entry and exit points throughout the current cycle. Green signals often align with oversold conditions, while red signals appear near short-term peaks. This reliability enhances its credibility among traders monitoring Bitcoin’s cyclical movements.

Frequently Asked Questions

What are the current Bitcoin market conditions?

Bitcoin is trading at $117,823, with a 24-hour trade volume of $26.9 billion, showing a 0.44% increase in the last 24 hours.

How can LFOP assist in trading decisions?

LFOP provides actionable signals that help traders make informed decisions based on market conditions rather than sentiment-driven choices.

Key Takeaways

- Bitcoin’s Current Price: Trading at $117,823 with steady growth.

- LFOP’s Reliability: Historically provides accurate entry and exit signals.

- Market Outlook: Conditions suggest further growth potential before any trend reversal.

Conclusion

In summary, Bitcoin’s current valuation above its all-time high, coupled with the Liquidity Fair Oscillator Pulse indicating favorable market conditions, suggests that traders should remain optimistic. Monitoring LFOP levels will be crucial as market dynamics evolve.

Bitcoin trades above its ATH while the Liquidity Fair Oscillator Pulse stays subdued, signaling continued upside potential amid global liquidity.

- Bitcoin surpasses its ATH while LFOP remains low, suggesting the rally has not yet reached cycle exhaustion.

- Alpha Extract notes LFOP has historically provided reliable entry and exit signals, strengthening confidence in the tool’s readings.

- With Bitcoin at $117,823, subdued LFOP values show conditions may allow further growth before a trend reversal emerges.

Bitcoin continues to trade above its all-time high with steady gains, while the Liquidity Fair Oscillator Pulse suggests additional upside. This valuation tool, which aligns global liquidity with price action, remains relatively low compared to past market peaks.

Liquidity Fair Oscillator Pulse and Price Action

The Liquidity Fair Oscillator Pulse (LFOP) is designed to pair Bitcoin’s market activity with global liquidity measures. As the graph indicates, Bitcoin has managed to perform well and its price has been rising steadily and recently, hitting new heights. As much as this has increased, the oscillator has been maintained at rather lower thresholds compared to those that require overheated conditions.

LFOP has consistently delivered reliable entry and exit points across this cycle. Green signals have often coincided with oversold conditions, providing favorable accumulation opportunities. Red signals, on the other hand, have appeared near short-term peaks, aligning with moments of reduced momentum.

This reliability has strengthened its credibility among traders observing Bitcoin’s cyclical movements. With its present subdued reading, the oscillator does not suggest excessive market conditions, despite Bitcoin’s elevated valuation.

Entry and Exit Signals from LFOP

Alpha Extract emphasized the effectiveness of the LFOP in identifying actionable signals during the current cycle. Their commentary highlights how the tool’s past reliability extends into present conditions. They noted, “Whether this indicates trend continuation or a potential negative divergence is unclear in isolation.”

Source: alphaextract via X

Source: alphaextract via X

When evaluated in context, however, the signals point toward continuation rather than weakness. LFOP’s relatively low reading compared to prior highs implies that Bitcoin may still have room to expand. Liquidity data continues to support this conclusion, suggesting markets have not yet reached exhaustion.

This alignment of liquidity with price action provides traders with an evidence-based framework for monitoring conditions. It also emphasizes the value of using structured tools instead of sentiment-driven decisions during rapid market moves.

Current Price and Market Outlook

Bitcoin trades at a price of $117,823 as of writing, and a 24-hour trade volume of 26.9 billion. Its asset has appreciated 0.44 percent in the past 24 hours and 0.83 percent during the past week. The consistent performance supports the story of prudent growth as opposed to rip tides of volatility.

Compared to previous cycle tops, global liquidity does not yet reflect overstretched levels. LFOP’s subdued state supports this observation, providing confidence in the durability of current momentum. This is compared to previous euphoria stages where oscillators peaked and then correctional actions ensued.

The rally with Bitcoin could persist as long as the liquidity trends are in line. It will still be necessary to watch the LFOP levels since any change in the oscillator can be a tip-off of a reversal or a period of consolidation.