Chainlink Whale Activity Hit Seven-Month High — What’s Next for LINK Price?

Chainlink’s price has stalled its rally since it hit an intraday peak of $24.74 on August 13. Now trading at $22.29, the altcoin’s price has since dropped 11%.

While LINK’s price has dawdled, large holders appear unfazed. They view the dip as a buying opportunity and are ramping up their accumulation as a result. What does this mean for the altcoin?

LINK Whales Make Big Moves

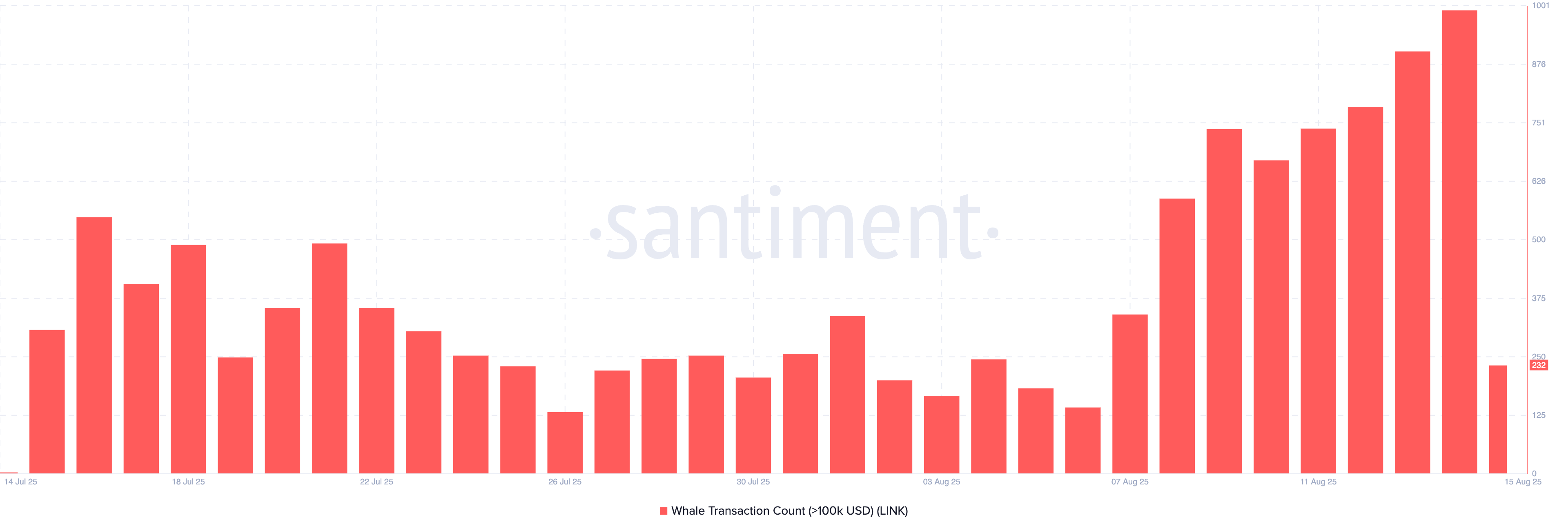

On-chain data has shown that the count of LINK whale transactions exceeding $100,000 soared to a seven-month high of 992 on Thursday.

— CryptosRus (@CryptosR_Us) August 14, 2025

LATEST: $LINK Rallies Nearly 40% in a Week as Whale Activity Surges

Whale transactions at their highest level in seven months, alongside profits not seen since late 2024.

On the on-chain side, we're seeing the most active $LINK addresses in 8 months, and most whale… pic.twitter.com/fRio7S0PZ8

This uptick in high-value transfers helped drive LINK’s price to a high of $24.31, just 2% shy of the previous day’s close, before easing lower.

As of today, 232 whale transactions worth more than $100,000 have already been recorded. This suggests continued interest from deep-pocketed investors despite today’s broader market consolidation.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

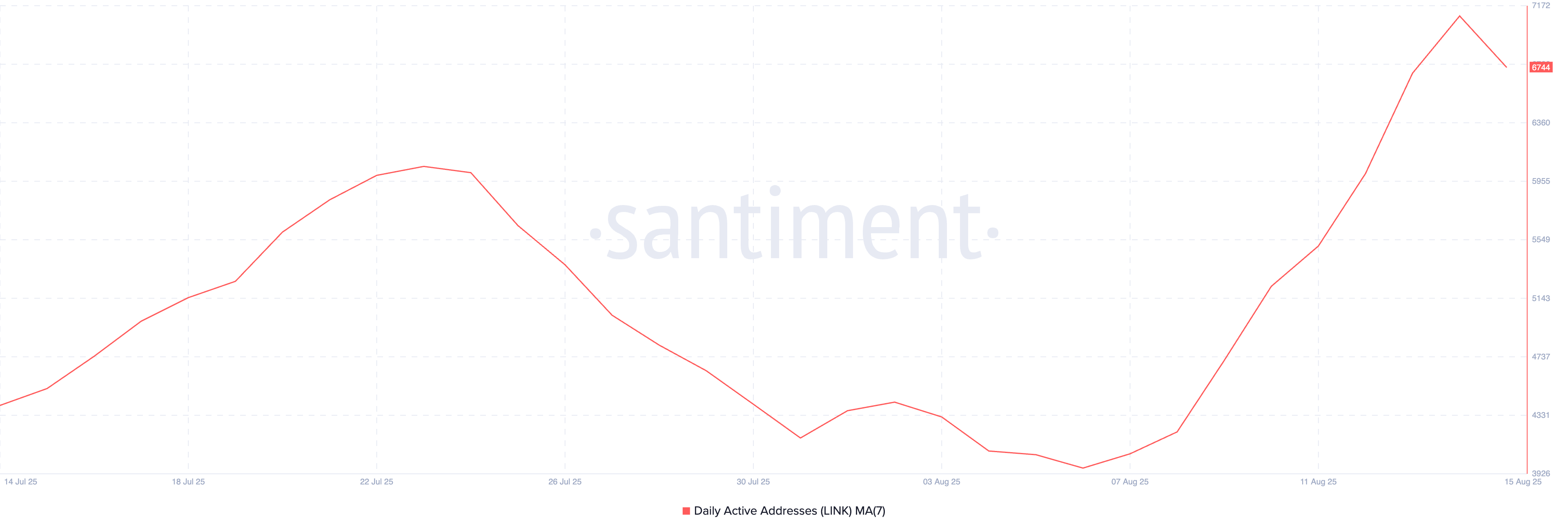

In addition, the number of daily active addresses trading LINK has also trended higher, signaling increased on-chain engagement. Per Santiment, this, observed using a seven-day moving average, has risen by 55% since the beginning of August.

This steady uptick suggests that while whales are active, broader participation from the LINK traders is also growing, confirming climbing interest in the asset despite recent market volatility.

LINK Price Poised for Breakout if $22.21 Support Holds

Higher active address counts reflect stronger network usage on Chainlink. If this trend continues alongside increased whale demand for LINK, it could strengthen the support at $22.21. In this scenario, LINK could rally toward $25.55.

Conversely, if the support floor weakens and gives way, LINK’s price could drop to $19.51.

Analyst George from CryptosRUs recently reviewed LINK as a token to watch in his latest YouTube video:

The post Chainlink Whale Activity Hit Seven-Month High — What’s Next for LINK Price? appeared first on BeInCrypto.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The $150,000 Collective Illusion: Why Did All Mainstream Institutions Misjudge Bitcoin in 2025?

There is a significant discrepancy between the expected and actual performance of the bitcoin market in 2025. Institutional forecasts have collectively missed the mark, mainly due to incorrect assessments of ETF inflows, the halving cycle effect, and the impact of Federal Reserve policies. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

JPMorgan Chase: Oracle's aggressive AI investment sparks concerns in the bond market.

Aster launches Shield Mode: a high-performance trading protection mode designed for on-chain traders

This trading feature, as an innovative protection mode, is dedicated to integrating the full 1001x leveraged trading experience into a faster, safer, and more flexible on-chain trading environment.

Crypto industry leaders gather in Abu Dhabi, calling the UAE the "new Wall Street of crypto"

Banding together during the bear market to embrace major investors!