SHIB burn rate soars as single wallet removes 85m tokens from supply

A single large address burned 85,795,990 Shiba Inu tokens, causing a major spike in the daily burn rate.

- Shiba Inu saw a dramatic spike in daily burn rate.

- One whale was behind the large daily spike, burning 85 million SHIB.

- Still, the transaction is even the biggest burn in the last two weeks.

Burn rates remain a keydriver of Shiba Inu’s (SHIB) medium- to long-term performance. On Wednesday, August 13, SHIB’s daily burn rate surged 48,247.45%, with almost 88 million tokens burned in the past 24 hours. This coincided with a 6% daily gain in SHIB’s price.

The spike in the burn rate was largely driven by a single whale wallet, which alone burned 85,795,990 SHIB tokens, according to data from Shibburn. Still, the transaction was not the biggest burn that Shiba Inu saw recently.

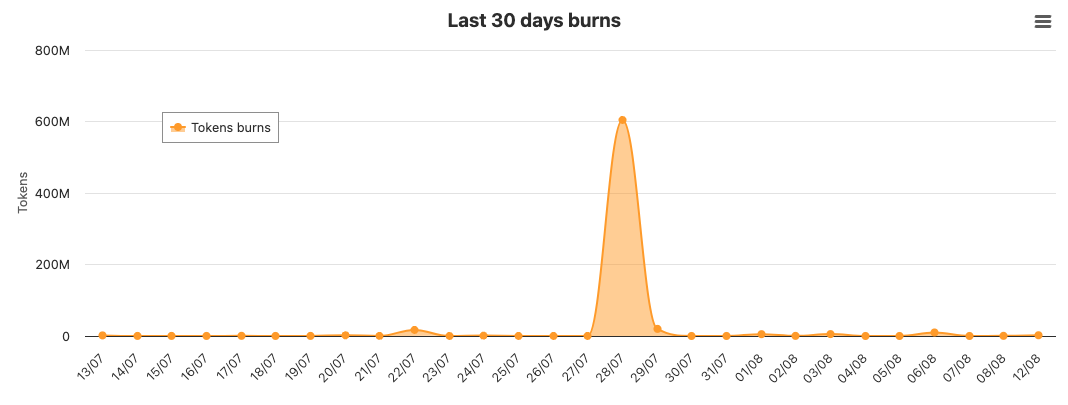

The latest large burn occurred on July 29, with 18 million SHIB tokens burned. What is more, just one day prior, one whale burned 600 million SHIB tokens, representing by far the biggest burn in the past 30 days.

Shiba Inu burn rate in the last 30 days | Source: Shiba Burn Tracker

Shiba Inu burn rate in the last 30 days | Source: Shiba Burn Tracker

Shiba Inu price moves sideways despite token burn

Interestingly, despite the major late-July burn, SHIB’s price moved in the opposite direction. Between July 28 and August 2, the token fell from $0.000014 to a monthly low of $0.000011. It has since recovered to $0.00001386.

This drop coincided with Bitcoin’s fall from above $119,000 to a monthly low of $122,321 in a few days. What is more, Shiba Inu’s recovery in the last seven days also coincided with Bitcoin’s (BTC) recovery.

While token burns are important for Shiba Inu’s long-term outlook, they rarely drive prices higher in the short term. Instead, SHIB’s day-to-day price action remains closely tied to broader crypto market sentiment, particularly Bitcoin’s performance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A decade-long tug-of-war ends: "Crypto Market Structure Bill" sprints to the Senate

At the Blockchain Association Policy Summit, U.S. Senators Gillibrand and Lummis stated that the "Crypto Market Structure Bill" is expected to have its draft released by the end of this week, with revisions and hearings scheduled for next week. The bill aims to establish clear boundaries for digital assets by adopting a classification-based regulatory framework, clearly distinguishing between digital commodities and digital securities, and providing a pathway for exemptions for mature blockchains to ensure that regulation does not stifle technological progress. The bill also requires digital commodity trading platforms to register with the CFTC and establishes a joint advisory committee to prevent regulatory gaps or overlapping oversight. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, is still being iteratively updated.

Gold surpasses the $4,310 mark—Is the "bull frenzy" returning?

Boosted by expectations of further easing from the Federal Reserve, gold has risen for four consecutive days. Technical indicators show strong bullish signals, but there remains one more hurdle before reaching a new all-time high.

Trend Research: Why Are We Still Bullish on ETH?

Against the backdrop of relatively accommodative expectations in both China and the US, which suppress asset downside volatility, and with extreme fear and capital sentiment not yet fully recovered, ETH remains in a favorable "buy zone."