FTX Customers Seek to Expand Lawsuit Against Former Legal Adviser Fenwick & West

Disgruntled former customers of the collapsed crypto exchange FTX are seeking to strengthen their lawsuit against Fenwick & West, accusing the law firm of playing a pivotal role in the exchange’s downfall.

Disgruntled former customers of the collapsed crypto exchange FTX are seeking to strengthen their lawsuit against Fenwick & West, accusing the law firm of playing a pivotal role in the exchange’s downfall.

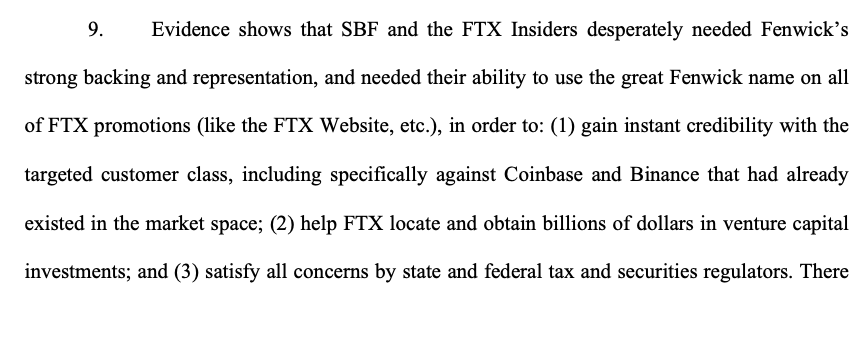

In a proposed amended complaint filed on August 11, the plaintiffs claim fresh evidence from Sam Bankman-Fried’s criminal trial and FTX’s ongoing bankruptcy proceedings shows the Silicon Valley firm was “deeply involved” in the structures and practices that enabled the alleged multibillion-dollar fraud.

Source

:

CourtListener

Source

:

CourtListener

According to the filing, Fenwick provided “substantial assistance” to FTX by crafting corporate arrangements that facilitated the diversion of customer funds. The plaintiffs also allege the firm represented related entities, including Alameda Research and its subsidiary North Dimension, despite “obvious conflicts of interest” and a lack of safeguards to protect customer assets.

Testimony from former FTX executives Nishad Singh, Gary Wang, and Caroline Ellison reportedly supports these claims. Singh allegedly told the court he informed Fenwick about improper loans, false statements, and misuse of customer funds, and that the firm advised on ways to conceal such actions.

The plaintiffs also cite findings from an independent bankruptcy examiner who, after reviewing over 200,000 documents, concluded Fenwick maintained “exceptionally close relationships” with FTX leadership. The examiner accused the firm of creating shell companies to mask asset transfers and setting up auto-deleting Signal chats for FTX executives, among other “concealment practices” later flagged by regulators.

The amended complaint adds two new claims under Florida and California securities laws, asserting Fenwick helped design and promote unregistered securities sales — including FTX’s native token (FTT), yield-bearing accounts (YBAs), and other instruments — to Florida residents.

Bankman-Fried himself testified that Fenwick, alongside FTX’s in-house counsel, oversaw critical legal work for Alameda’s North Dimension accounts, which handled customer deposits, and was aware of the encrypted, auto-deleting communications used by insiders.

Fenwick has previously denied any wrongdoing, arguing in a September 2023 motion to dismiss that its actions fell within the scope of standard legal representation and that it cannot be held liable for a client’s misconduct.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ripple CEO Declares ‘Nobody Can Manipulate XRP Prices’ amid December Volatility. Here’s Why.

Expert to XRP Holders: This Will Be One of the Biggest Fakeouts in History If This Happens

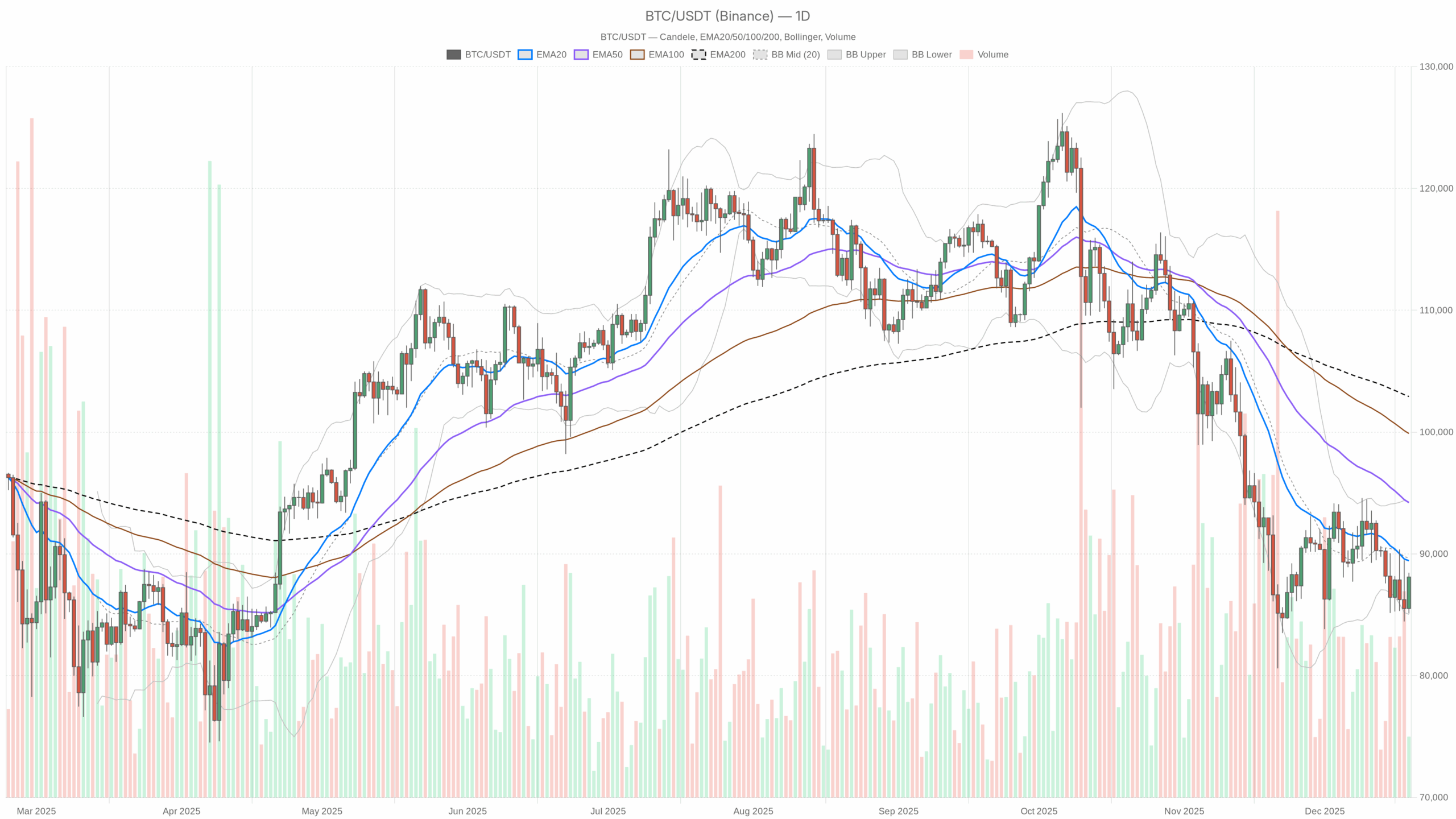

BTC price outlook: short-term bounce inside a larger downtrend

Best Solana Wallets as Visa Chooses Solana and USDC for US Bank Settlements