PENGU’s Bullish Setup Strengthens as Short Squeeze Threats Build

- PENGU’s bullish pennant flag from June lows hints at the continuation of the current uptrend.

- On-chain data from Stalkchain shows over $424,000 in smart money buys, outpacing all rivals.

- Short liquidations total $16.72M near $0.040 zone, creating a setup for a possible short squeeze.

Pudgy Penguins (PENGU) is edging toward a critical technical point that could define its next major price swing. Market watchers are eyeing a possible surge toward $0.046–$0.056, provided momentum continues to build.

The token has climbed over 7% in the past week and delivered a striking 63% gain over the past month. The rally began after PENGU rebounded from a solid support band between $0.032 and $0.028 earlier this month.

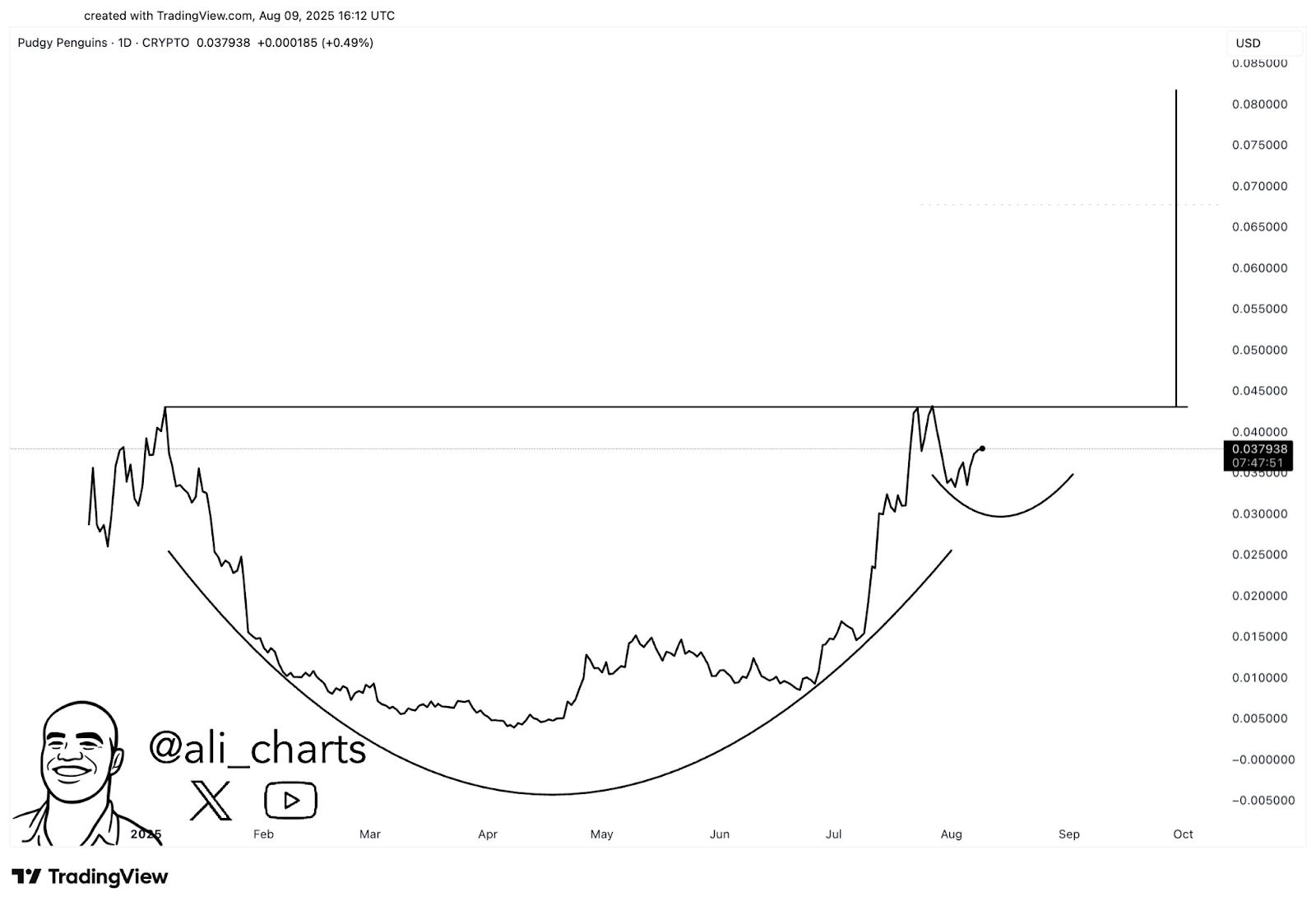

Since then, the token has shaped a bullish pennant pattern, originating from late June when it traded near $0.0077. Such patterns typically signal a continuation of previous gains, suggesting potential for further upside.

Source:

TradingView

Source:

TradingView

At press time, PENGU is holding just above the 61.80% Fibonacci retracement at $0.036 — a level that recently prevented deeper losses after a 13% dip. The immediate hurdle sits between $0.040 and $0.041, where a breakout from the pennant could trigger a fresh upward push.

Should PENGU clear this resistance, momentum could quickly carry it toward its projected targets. However, a stall at this level may pull prices back toward the $0.032–$0.030 zone, which aligns with the 50% Fibonacci level and offers a key cushion for buyers.

ETF Talk and Smart Money Push PENGU Price Higher

Building on recent momentum, PENGU continues to draw heightened institutional attention as a pending ETF filing backed by the CBOE advances under active SEC review. Market observers say such approval could unlock wider investor participation, giving the token a pathway to broader market exposure.

This institutional narrative is merging with strong technical signals, creating an environment ripe for a potential breakout. Besides, on-chain data from Stalkchain reveals PENGU led smart money purchases, with over $424,000 accumulated—far ahead of other top tokens.

This wave of concentrated buying, often viewed as a sign of high conviction, aligns closely with a developing bullish pennant formation on the charts. The pattern, widely considered bullish, adds weight to expectations for continued upward momentum.

PENGU’s rally is also being fueled by rapid adoption in Asia, where traders have begun referring to it as “Asia’s $DOGE.” This growing regional presence is feeding into global market interest, helping to broaden the token’s reach. Analysts suggest that if current buying pressure holds and PENGU clears the neckline at $0.041, the stage could be set for a sustained push higher.

PENGU Charts Point to Multi-Phase Rally Ahead

Crypto analyst believes Pudgy Penguins (PENGU) is primed for a significant rally, with a potential breakout target of $0.082. His outlook is based on the emergence of a classic cup-and-handle formation, a technical pattern often seen ahead of sharp upward moves. The fundamentals align with the chart setup, creating a strong case for bullish continuation.

Source:

X

Source:

X

Another market analyst shares a similar view and calls the formation a “monstrous” cup-and-handle that has been taking shape for more than seven months since PENGU’s launch.

Market cap data places the token at around $2.34 billion, but it is believed the next move could shatter its previous all-time high. There are warnings that the breakout phase could be “violent” if buying pressure accelerates. The projections point to a possible $8 billion market cap.

Short Squeeze Conditions Build as PENGU Eyes $0.040

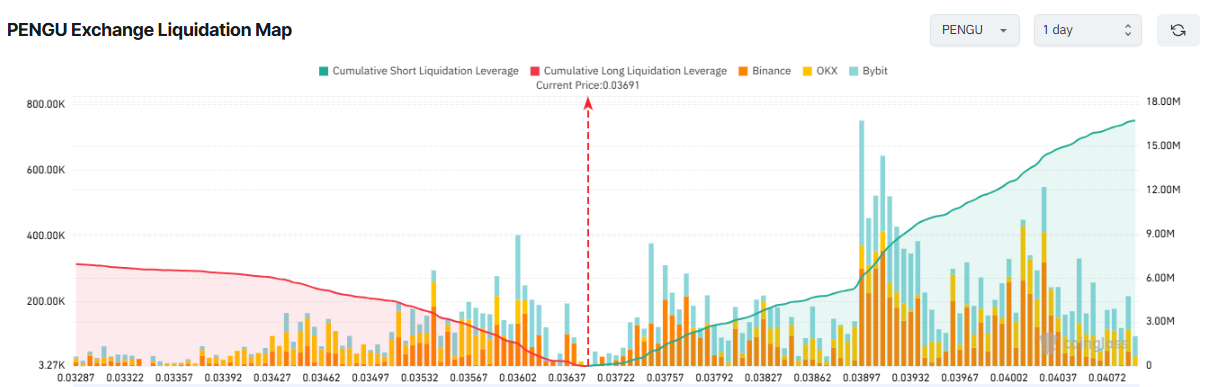

On-chain metrics are revealing a setup that could accelerate PENGU’s next move. Data from Coinglass shows a substantial build-up of short liquidations, with roughly $16.72 million positioned around the $0.040 mark.

Source:

Coinglass

Source:

Coinglass

In comparison, long liquidations are a lot smaller, totaling $6.94 million near the $0.032 level. This imbalance creates conditions for a potential short squeeze, where upward momentum could trigger rapid buying from short sellers, intensifying the rally.

Related: $66M in $PENGU Tokens Flood CEXs – What’s Driving the Surge?

Conclusion

Pudgy Penguins (PENGU) is building momentum on multiple fronts, with traders eyeing what could be its most decisive move yet. A rare mix of bullish chart setups, surging institutional interest, and strong on-chain buying is fueling anticipation for the next breakout.

Analysts see multiple upside targets ahead, while a concentration of short positions near resistance could spark a rapid squeeze higher. With the market watching closely, the coming sessions may determine whether PENGU’s climb transforms into a sustained and powerful rally.

The post PENGU’s Bullish Setup Strengthens as Short Squeeze Threats Build appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A decade-long tug-of-war ends: "Crypto Market Structure Bill" sprints to the Senate

At the Blockchain Association Policy Summit, U.S. Senators Gillibrand and Lummis stated that the "Crypto Market Structure Bill" is expected to have its draft released by the end of this week, with revisions and hearings scheduled for next week. The bill aims to establish clear boundaries for digital assets by adopting a classification-based regulatory framework, clearly distinguishing between digital commodities and digital securities, and providing a pathway for exemptions for mature blockchains to ensure that regulation does not stifle technological progress. The bill also requires digital commodity trading platforms to register with the CFTC and establishes a joint advisory committee to prevent regulatory gaps or overlapping oversight. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, is still being iteratively updated.

Gold surpasses the $4,310 mark—Is the "bull frenzy" returning?

Boosted by expectations of further easing from the Federal Reserve, gold has risen for four consecutive days. Technical indicators show strong bullish signals, but there remains one more hurdle before reaching a new all-time high.

Trend Research: Why Are We Still Bullish on ETH?

Against the backdrop of relatively accommodative expectations in both China and the US, which suppress asset downside volatility, and with extreme fear and capital sentiment not yet fully recovered, ETH remains in a favorable "buy zone."