Key Notes

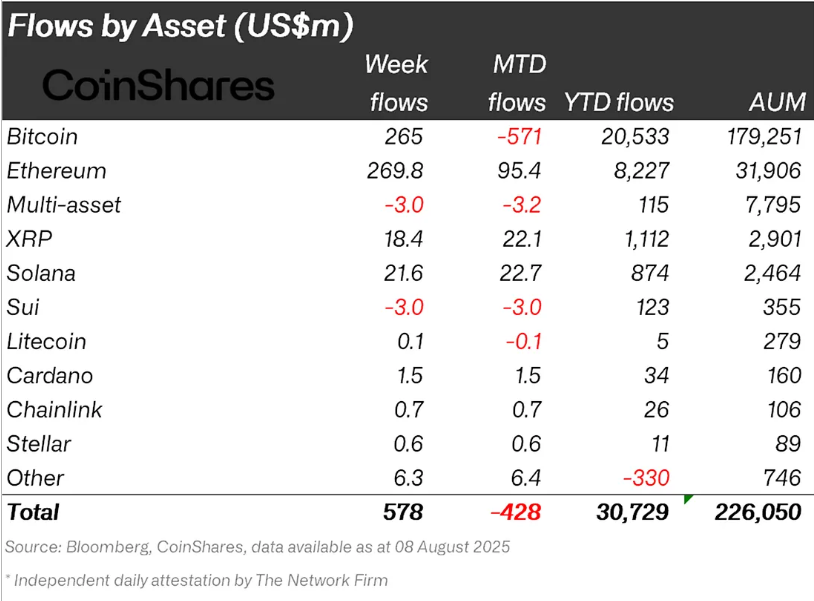

- Crypto funds drew $572 million in weekly inflows, led by Ethereum and Bitcoin.

- Solana and XRP posted strong gains, showing growing investor interest.

- The US policy shift allowing crypto in 401(k) plans generally boosted market sentiment.

The latest CoinShares report shows that global digital asset funds saw a strong comeback last week, drawing in $572 million in new investments. Solana SOL $178.4 24h volatility: 1.8% Market cap: $96.24 B Vol. 24h: $6.75 B and XRP XRP $3.19 24h volatility: 0.2% Market cap: $188.94 B Vol. 24h: $6.41 B stood out among altcoins, attracting strong interest from buyers. Bitcoin BTC $120 079 24h volatility: 1.1% Market cap: $2.39 T Vol. 24h: $57.96 B and Ethereum ETH $4 285 24h volatility: 1.5% Market cap: $517.21 B Vol. 24h: $36.36 B also gained traction, adding to the positive mood in the market as more investors showed confidence in major cryptocurrencies

Ethereum Leads as US Retirement Rule Change Lifts Market

It is worth mentioning that the turnaround in the market followed the United States government’s decision to allow digital assets in 401(k) retirement plans.

The announcement came midweek and sparked $1.57 billion in inflows during the second half of the week. This was enough to offset early-week outflows of $1 billion, which were linked to concerns about weak US payroll data.

Ethereum products brought in the most investment for the week, with $268 million. This pushed year-to-date inflows to $8.2 billion, the highest on record. In addition, rising prices have also lifted Ethereum’s total assets under management to $32.6 billion, an 82% increase since the start of the year.

Coinspeaker noted that in the same week, spot Ethereum ETF inflows increased to $461 million . Meanwhile, Bitcoin recovered after two weeks of losses, recording $260 million in inflows. Short Bitcoin products saw outflows of $4 million, showing reduced bearish positions.

By region, the United States recorded the largest inflows at $608 million, followed by Canada with $16.5 million. Europe was weaker, with Germany, Sweden, and Switzerland together losing $54.3 million.

Solana and XRP Post Strong Weekly Gains

It is important to add that while Ethereum and Bitcoin led overall flows, Solana and XRP posted some of the most notable gains among altcoins.

Solana recorded $21.6 million in inflows, bringing its total for the year to $874 million. XRP saw $18.4 million, taking its year-to-date figure to $1.1 billion.

Crypto Fund Inflow Chart | Source: CoinShares

More importantly, the persistent interest in Solana and XRP points to broader investor demand for blockchain platforms outside the two leading digital assets. Both assets have developed strong communities and have been used for faster, lower-cost transactions compared to older networks.

In addition, some market watchers believe XRP inflows were triggered as a result of Ripple’s lawsuit with the SEC , which added positive momentum. Others point to the inclusion of XRP in SBI’s ETF plans as another factor driving the recent inflows.

It is worth noting that despite the week’s gains, overall trading volumes in digital asset investment products were 23% lower than the previous month. This drop was likely due to slower summer activity.

Still, the strong performance in Ethereum, Bitcoin, Solana, and XRP has lifted sentiment, with many investors now watching to see if the momentum will carry into the coming weeks.