Date: Fri, Aug 08, 2025 | 06:04 AM GMT

The cryptocurrency market is showing renewed signs of strength, with Ethereum (ETH) reclaiming the $3,900 mark for the first time since late 2024. Riding this wave of momentum, several altcoins are beginning to show bullish breakouts — and one of the notable gainers is Virtuals Protocol (VIRTUAL).

Today, VIRTUAL is up 9%, and the technicals are aligning for potentially more upside.

Source: Coinmarketcap

Source: Coinmarketcap

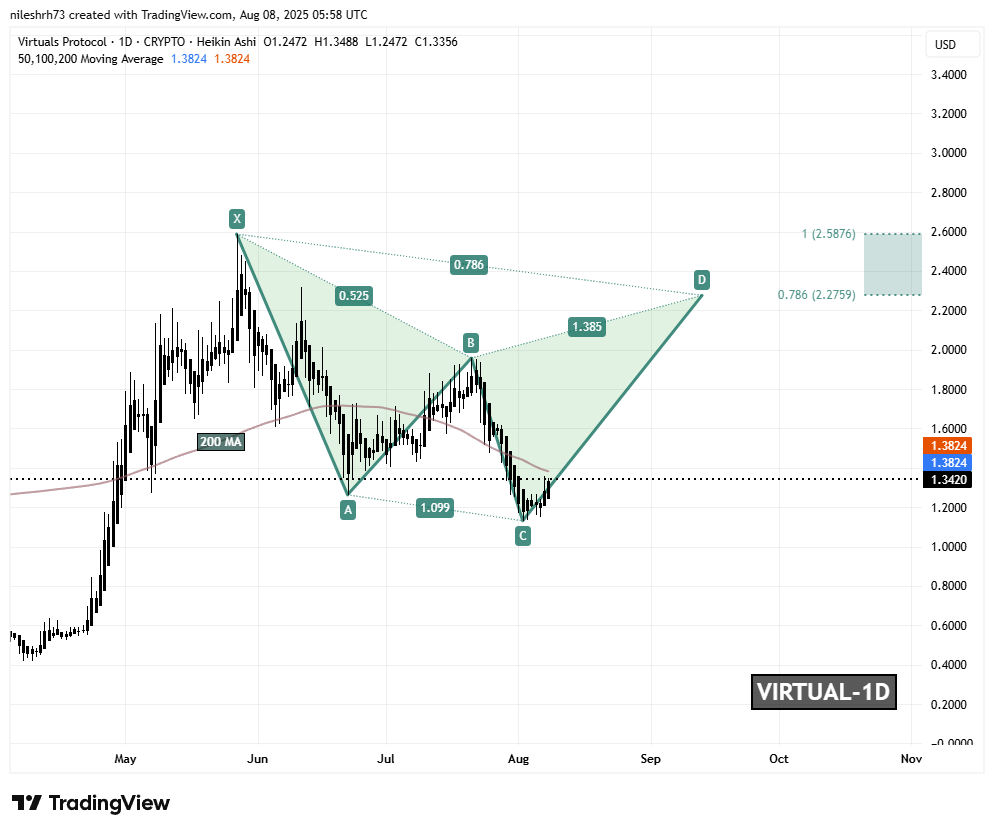

Harmonic Pattern Hints at Bullish Continuation

The chart shows a Bearish Cypher harmonic pattern in development — typically a bullish setup when the CD leg begins to accelerate, as we see now.

The pattern initiates at point X around $2.59, dips to point A, rebounds to point B, and then corrects down to point C, which was recently tagged around $1.12. From there, VIRTUAL has bounced back sharply and is now hovering near $1.34, testing the 200-day moving average at $1.3424 — a key resistance zone.

VIRTUAL Daily Chart/Coinsprobe (Source: Tradingview)

VIRTUAL Daily Chart/Coinsprobe (Source: Tradingview)

According to harmonic trading principles, the CD leg could potentially drive VIRTUAL into the Potential Reversal Zone (PRZ) between $2.2759 and $2.5876, which corresponds to the 0.786 to 1.0 Fibonacci extension levels. If this move plays out, it represents a potential gain of over 92% from current prices.

What’s Next for VIRTUAL?

For this bullish outlook to remain intact, VIRTUAL must break and sustain above the 200-day moving average with solid volume. A successful breakout could open the path to an extended rally toward the PRZ zone near $2.58.

However, caution is warranted. If price fails to hold above point C ($1.13), the structure could begin to break down, invalidating the current bullish setup and potentially leading to a deeper retracement.