Hyperliquid Vault Manager Under Fire for Moving $29 Million of User Funds to Other Blockchains

HLP0, which offers depositors a tokenized representation of Hyperliquid’s HLP vault, is facing backlash for withdrawing user funds from the multi-sig and bridging them to Avalanche and Arbitrum DeFi protocols instead of contributing them to the HLP vault.

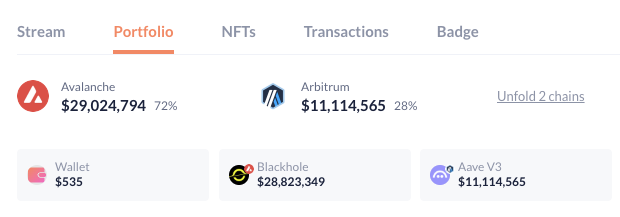

HLP0 boasts a total-value locked (TVL) of $40 million, but $29 million of that capital has been bridged to Avalanche, and $11 million remains on Arbitrum. The funds are being used on two DeFi protocols, Aave, and Avalanche-based decentralized exchange (DEX), Blackhole, according to the multi-sig’s DeBank profile.

Cain O’Sullivan of Hyperdrive flagged the activity on X where he said, “this would be great if it was still earning revenue from HLP but as of last week that liquidity has now been withdrawn and it's farming on Avalanche.” they said. “If you trust a mulitsig, they can simply do anything they want with your funds.”

As a follow up, O'Sullivan shared that Hyperdrive will be developing a tokenized HLP itself as soon as native USDC is enabled on the HyperEVM.

HLP0 Team Responds

The HLP0 team addressed the claims via Discord. The anonymous protocol lead known as “GigaSafu” said that HyperEVM’s introduction of native USDC rendered HLP0’s core mechanics as “pointless” and claims to be leveraging additional yield opportunities to beat HLP’s APR percentage.

GigaSafu says that by minting on Arbitrum as it does currently, allowed for “1:1’ zero-slippage deposits unlike most HyperEVM native wrappers”, but native USDC makes minting directly to HyperEVM more sense from a financial perspecitve.

“Now, since USDC is native to HyperEVM, it makes more sense to mint from HyperEVM directly, and implement CoreWriter to run a truly decentralized and permissionless/ownerless HLP wrapper” GigaSafu continued.

The team’s proposed solution is to integrate the current HLP0 token with Hyperliquid’s CoreWriter and native USDC CCTP mints, which would theoretically make it decentralized and safe pending an audit.

Native USDC

They also propose HLP0+ token, which is the same scenario as what they claim to be running now, where idle backing sits in the HLP0 multi-sig and implements “strategies on top to beat HLP APR% (arbitrage, AMO and bribing strategies)”.

USDC CCTP is natively integrated USDC on Hyperliquid’s HyperEVM. Until now HyperEVM would move USDC from Arbitrum to the chain via a multi-sig vault.

With CCTP v2 there will be frictionless USDC transfers between Hyperliquid and other CCTP v2 integrated blockchains, as opposed to the chain’s current deposit and credit mechanism. Circle did not specify a release date for native USDC on Hyperliquid other than “coming soon”.

Dual Token

Following the HLP0 team’s new dual token system, HLP0 would function as a true and verifiable HLP wrapper, while HLP0+ operates exactly as HLP0 does now, where the team pushes yield to it by running various DeFi strategies at their own discretion.

GigaSafu, who is also on the team at Sonic-based DEX Shadow, concluded “You don't have to do anything if you are fine with this. Just keep using HLP0. If somehow you didn't like this and didn't agree, just contact me directly, I will redeem your HLP instantly. We are of course not only fully backed but overbacked right now.”

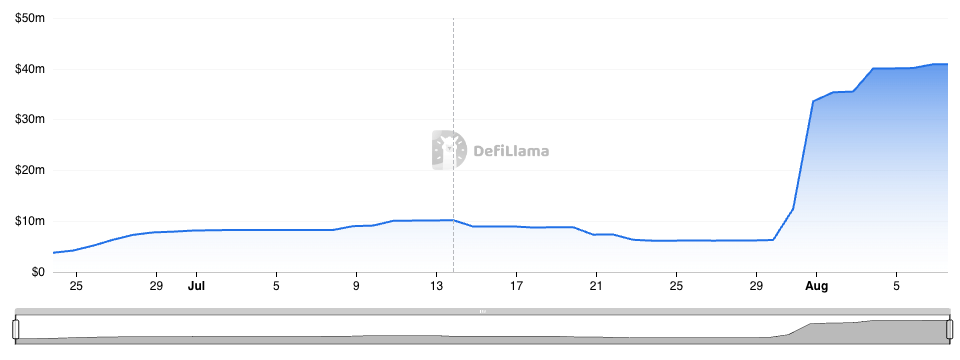

HLP0’s TVL has not moved today according to DeFiLlama, indicating that the team is yet to process any withdrawal requests.

The actual HLP vault, which provides liquidity to Hyperliquid, touts a $435 million TVL, with an average return of 11% APR over the last month.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Is the moat of public blockchains only 3 points? Alliance DAO founder's remarks spark heated debate in the crypto community

Instead of worrying about "moats," perhaps we should focus more on how cryptocurrencies can meet the real needs of more market users faster, at lower cost, and with greater convenience.

Digital Finance Game: Unveiling the US Cryptocurrency Strategy

Glassnode: Bitcoin weakly fluctuates, is major volatility coming?

If signs of seller exhaustion begin to appear, it is still possible in the short term for bitcoin to move towards the $95,000 level and the short-term holder cost basis.

Axe Compute (NASDAQ: AGPU) completes corporate restructuring (formerly POAI), enterprise-level decentralized GPU computing power Aethir officially enters the mainstream market

Predictive Oncology officially announced today that it has changed its name to Axe Compute and will trade on Nasdaq under the ticker symbol AGPU. This rebranding marks Axe Compute's transition into an enterprise-level operator, officially commercializing Aethir's decentralized GPU network to provide robust, enterprise-grade computing power services for AI companies worldwide.