Two Reasons Why Ethereum’s Rally Is on Hold This August

Ethereum's recent price stagnation is driven by diminishing leverage and whale activity, suggesting a prolonged period of consolidation or a possible price drop.

Over the past two weeks, the broader crypto market has shown lackluster performance, keeping Ethereum within a tight trading range.

Since July 21, the altcoin has repeatedly tested resistance near $3,859 while finding support at $3,524, struggling to break clear of this zone. With momentum fading, key on-chain metrics now suggest that ETH may face an extended period of sideways consolidation or a potential price breakdown.

Ethereum’s Big Players Step Back

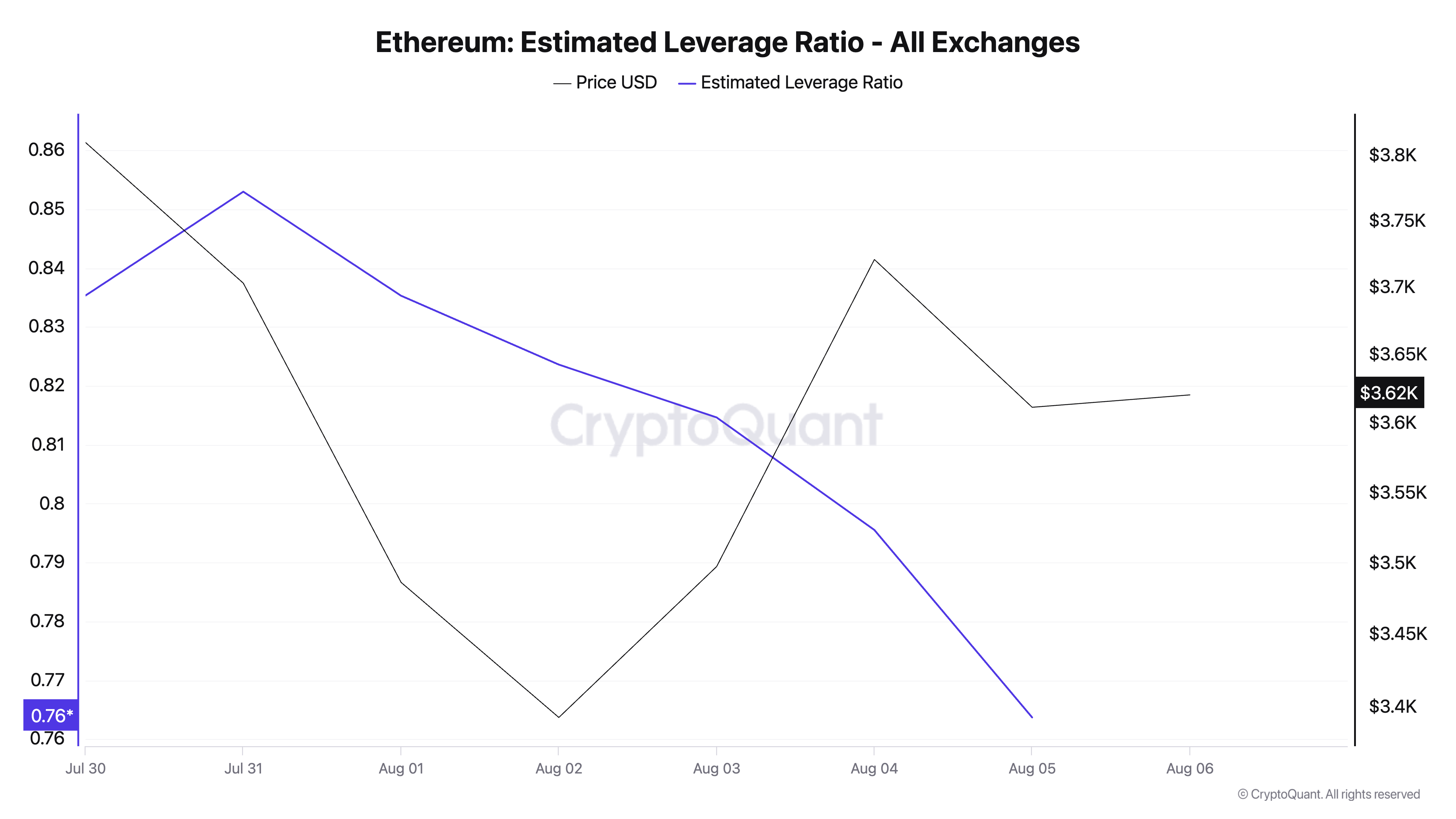

According to CryptoQuant’s data, ETH’s falling estimated leverage ratio (ELR) across all cryptocurrency exchanges reflects waning investor confidence and a declining appetite for risk among its futures traders. Per the data provider, ETH’s ELR now sits at a weekly low of 0.76.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Ethereum ELR. Source:

CryptoQuant

Ethereum ELR. Source:

CryptoQuant

The ELR metric measures the average amount of leverage traders use to execute trades on an asset on a cryptocurrency exchange. It is calculated by dividing the asset’s open interest by the exchange’s reserve for that currency.

ETH’s declining ELR signals a market environment where traders avoid high-leverage bets. Its investors are growing cautious about the coin’s short-term prospects and are not taking high-leverage positions that could amplify potential losses.

If this pullback in speculative activity continues, it will reduce the likelihood of a near-term breakout and increase the chances of ETH remaining range-bound.

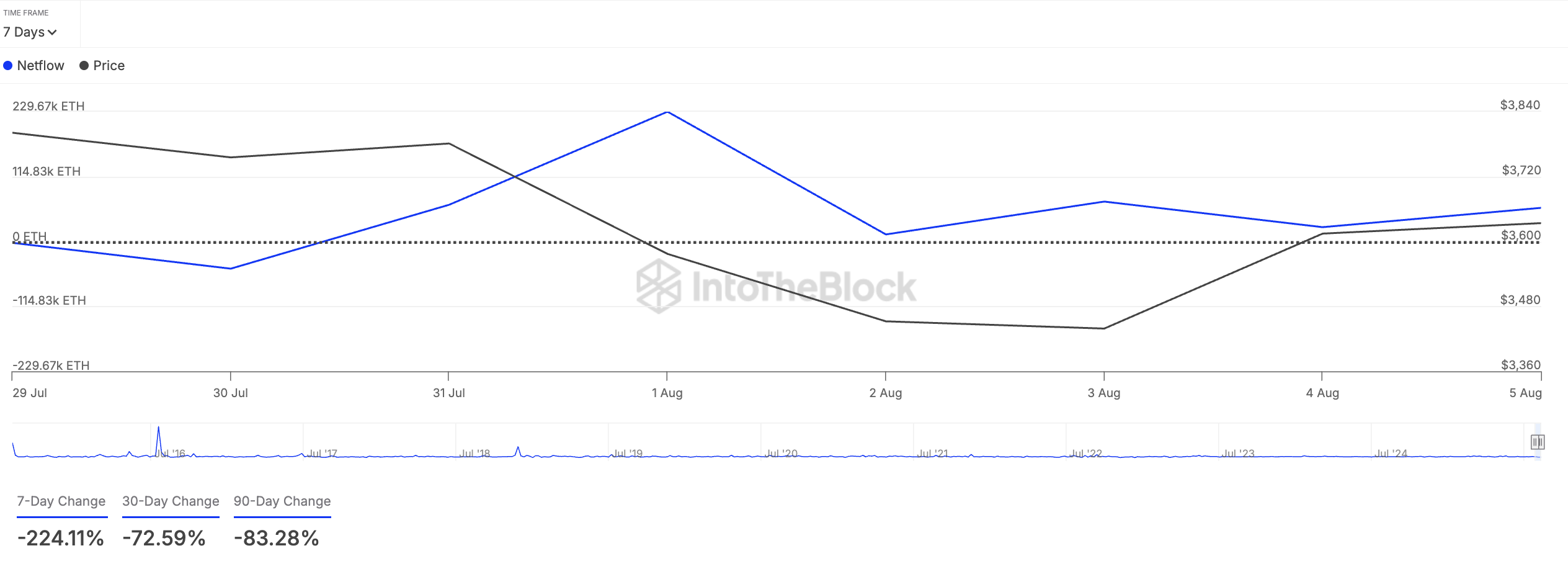

Furthermore, ETH whales have also reduced their accumulation over the past week, possibly to lock in profit. According to IntoTheBlock’s data, the coin’s large holders’ netflow is down 224% in the last seven days, showing the retreat from ETH’s key holders.

ETH Large Holders’ Netflow. Source:

IntoTheBlock

ETH Large Holders’ Netflow. Source:

IntoTheBlock

Large holders are whale addresses controlling over 0.1% of an asset’s circulating supply. Their netflow tracks the difference between the coins they buy and the amount they sell over a specific period.

When an asset’s large holders’ netflow increases, whales are buying more of its coins/tokens on exchanges, potentially in anticipation of a price rally.

On the other hand, as with ETH, when it declines, it signals reduced activity and profit-taking among these key investors.

ETH Bulls and Bears Face Off: Will $3,524 Hold or Break?

The metrics above highlight waning confidence in ETH’s near-term price gains and a reluctance among its key holders to commit significant capital to the market right now. If this persists, bearish pressure on the coin will increase, potentially triggering a breach of support at $3,524.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

If this happens, the coin could extend its dip to $3,067.However, if the bulls regain dominance, they could drive a break above the resistance at $3,859. If successful, ETH’s price could climb above $4,000.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Legislation Booms Globally, Why Is China Taking the Opposite Approach? An Article to Understand the Real National Strategic Choices

Amid the global surge in stablecoin legislation, China has chosen to firmly curb stablecoins and other virtual currencies, while accelerating the development of the digital yuan to safeguard national security and monetary sovereignty. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Liquidity migration begins! Japan becomes the Fed's "reservoir," 120 billions in carry trade returns set to ignite the December crypto market

The Federal Reserve has stopped quantitative tightening and may cut interest rates, while the Bank of Japan plans to raise rates, changing the global liquidity landscape and impacting carry trades and asset pricing. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.

Weekly Hot Picks: Bank of Japan Sends Strongest Rate Hike Signal! Is the Copper Market Entering a Supercycle Rehearsal?

The leading candidate for Federal Reserve Chair is being questioned for potentially "accommodative rate cuts." Copper prices have reached a historic high, and a five-hour meeting between the United States and Russia ended without results. Expectations for a Japanese interest rate hike in December have surged, and Moore Threads' stock soared more than fivefold on its first day... What market moves did you miss this week?

Monad Practical Guide: Welcome to a New Architecture and High-Performance Development Ecosystem

This article will introduce some resources to help you better understand Monad and start developing.