Pi Coin’s All-Time Low Price Journey: What’s Driving the Decline?

Pi Coin struggles near an all-time low as Bitcoin’s volatility and ongoing outflows weigh heavily. A shift in sentiment and reclaiming key support are crucial for a potential recovery.

Pi Coin has recently faced a challenging price action, culminating in the formation of a new all-time low (ATL) earlier last week.

Despite the ongoing downtrend, Pi Coin remains close to hitting a new ATL, as investor sentiment continues to worsen, reflecting a lack of optimism in the market.

Pi Coin Holders Are Choosing Not To Hold

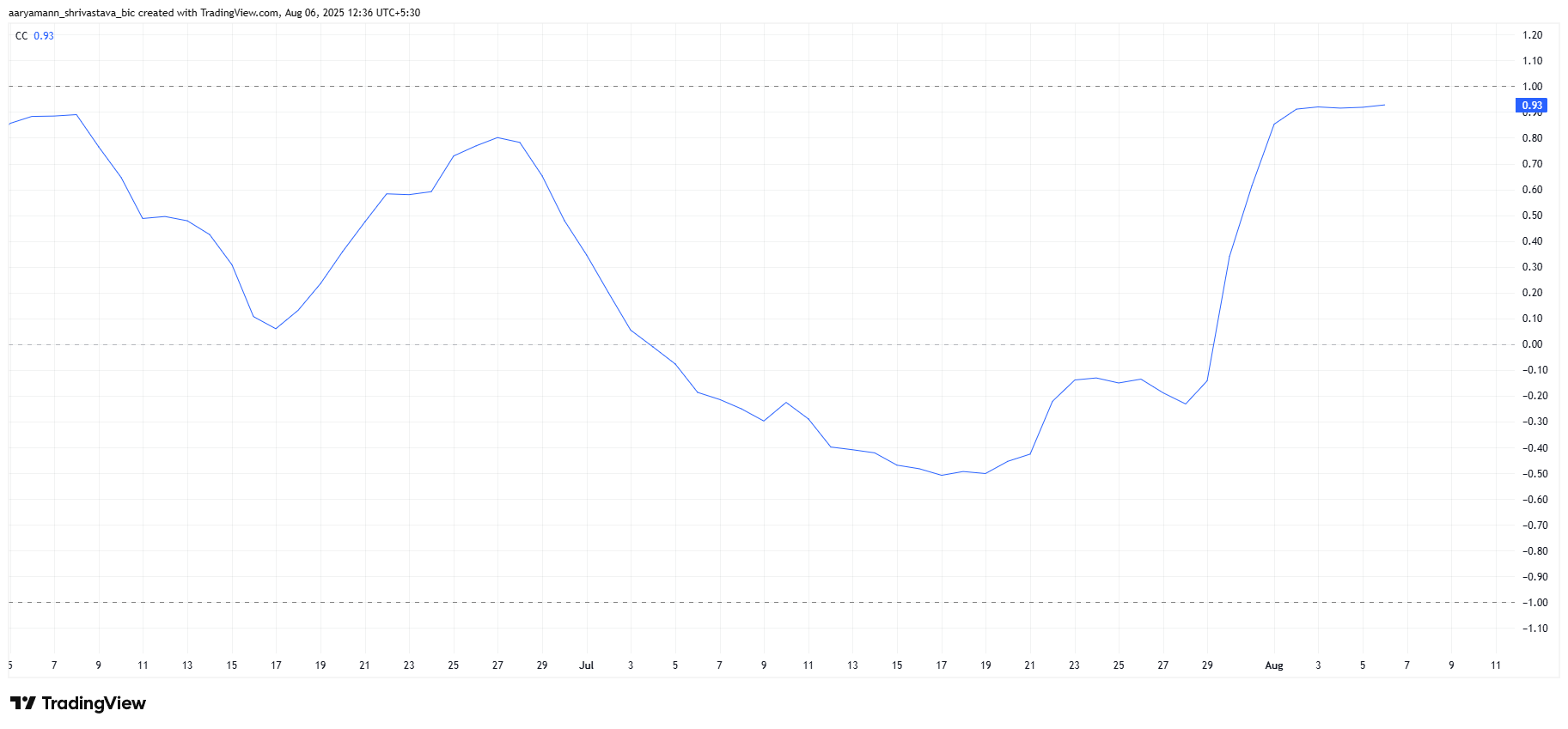

The correlation between Pi Coin and Bitcoin currently stands at 0.93, indicating a strong connection between the two assets. As Bitcoin experiences volatility and uncertainty, Pi Coin tends to follow its trajectory.

With Bitcoin’s price wobbling in recent days, Pi Coin’s price remains susceptible to the same market conditions. Bitcoin’s price uncertainty is a critical factor, as it often drives Pi Coin’s movements.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

Pi Coin Correlation With Bitcoin. Source:

Pi Coin Correlation With Bitcoin. Source:

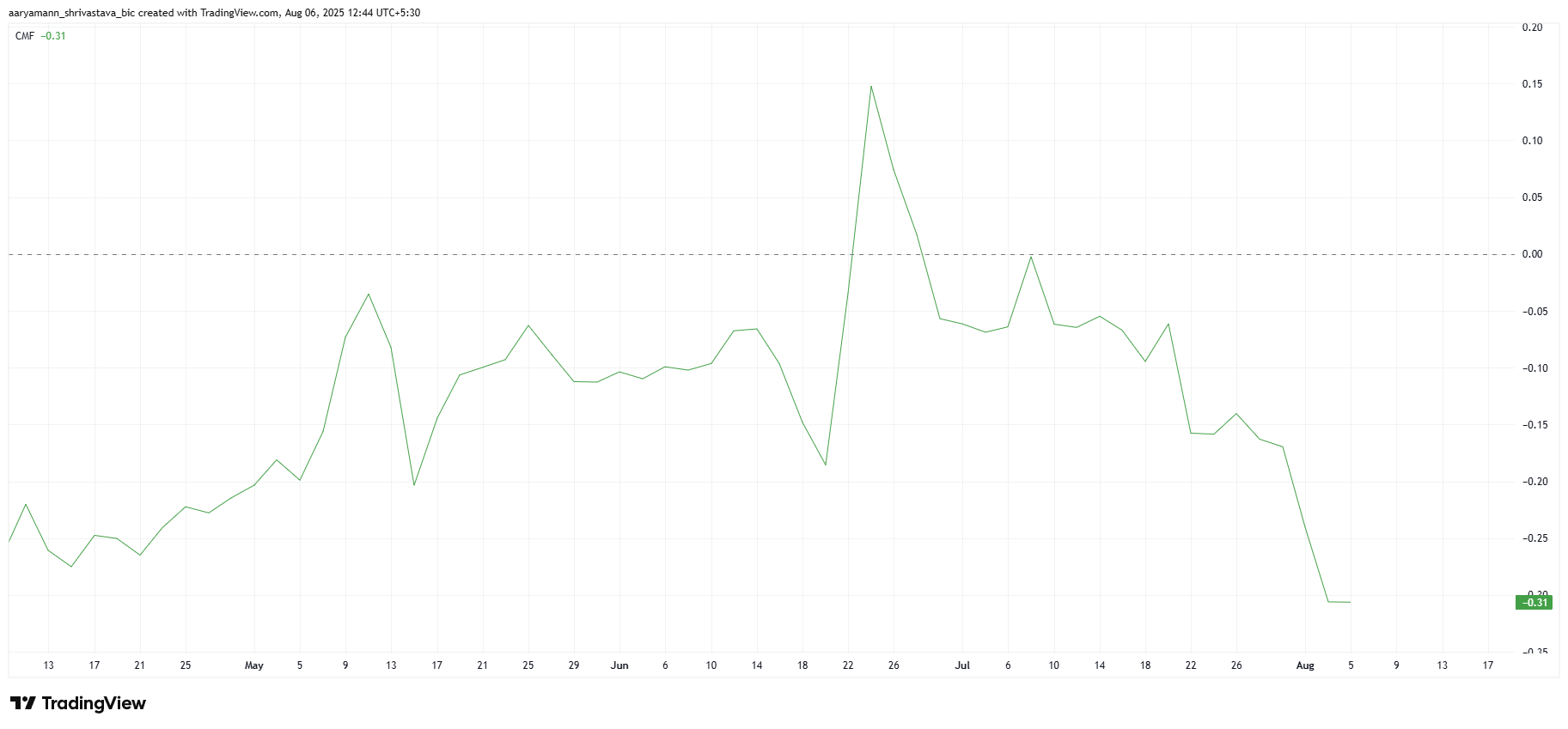

Pi Coin’s macro momentum is dominated by negative investor sentiment, as evidenced by the Chaikin Money Flow (CMF) indicator. The CMF has been steadily declining, showing that outflows are overwhelming inflows.

The continued decline in investor confidence is contributing to the overall negative momentum. This suggests that investors are bearish toward Pi Coin, with a significant portion of the market opting to sell their holdings.

Pi Coin CMF. Source:

Pi Coin CMF. Source:

Can Pi Price Bounce Back?

Pi Coin’s price is currently at $0.340, just 5.54% away from revisiting its recent ATL of $0.322. Given the current market conditions, Pi Coin remains under significant pressure, making it likely that the price will continue to decline. A new ATL below the current $0.310 could be in the near future.

Given the ongoing outflows and the correlation with Bitcoin’s price movements, Pi Coin’s price trajectory appears bleak. It’s expected that the price will maintain its downtrend unless a shift in investor sentiment occurs. A decline through the support levels is highly probable, pushing the price toward further losses.

Pi Coin Price Analysis. Source:

Pi Coin Price Analysis. Source:

However, in the unlikely scenario that Pi Coin experiences a reversal, it would need to secure $0.362 as a support floor to initiate a rally. If the price manages to break this barrier, it could rise to $0.401, invalidating the current bearish outlook and offering hope for a price recovery.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Legislation Booms Globally, Why Is China Taking the Opposite Approach? An Article to Understand the Real National Strategic Choices

Amid the global surge in stablecoin legislation, China has chosen to firmly curb stablecoins and other virtual currencies, while accelerating the development of the digital yuan to safeguard national security and monetary sovereignty. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Liquidity migration begins! Japan becomes the Fed's "reservoir," 120 billions in carry trade returns set to ignite the December crypto market

The Federal Reserve has stopped quantitative tightening and may cut interest rates, while the Bank of Japan plans to raise rates, changing the global liquidity landscape and impacting carry trades and asset pricing. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.

Weekly Hot Picks: Bank of Japan Sends Strongest Rate Hike Signal! Is the Copper Market Entering a Supercycle Rehearsal?

The leading candidate for Federal Reserve Chair is being questioned for potentially "accommodative rate cuts." Copper prices have reached a historic high, and a five-hour meeting between the United States and Russia ended without results. Expectations for a Japanese interest rate hike in December have surged, and Moore Threads' stock soared more than fivefold on its first day... What market moves did you miss this week?

Monad Practical Guide: Welcome to a New Architecture and High-Performance Development Ecosystem

This article will introduce some resources to help you better understand Monad and start developing.