Shiba Inu Slides—But Whale Activity and HODLing Pattern Say Recovery Is Near

Despite a 13% dip, whale accumulation and stronger HODLing from retail investors suggest SHIB could soon rebound toward key resistance.

Leading meme coin Shiba Inu has recorded a 13% drop in value over the past seven days, amid a broader environment of profit-taking and bearish market sentiment.

However, while many traders appear to be exiting their positions, some investors view the dip as a strategic buying opportunity that could help trigger the meme coin’s next leg up. But how?

SHIB Whales and Retail Traders Bet on a Bounce

Readings from the SHIB/USD one-day chart show that the meme coin has steadily declined since it broke below its ascending parallel pattern on July 28. This breakdown signals a loss of bullish strength and suggests that selling pressure has overwhelmed the market.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

SHIB Ascending Parallel Channel. Source:

SHIB Ascending Parallel Channel. Source:

SHIB Ascending Parallel Channel. Source:

SHIB Ascending Parallel Channel. Source:

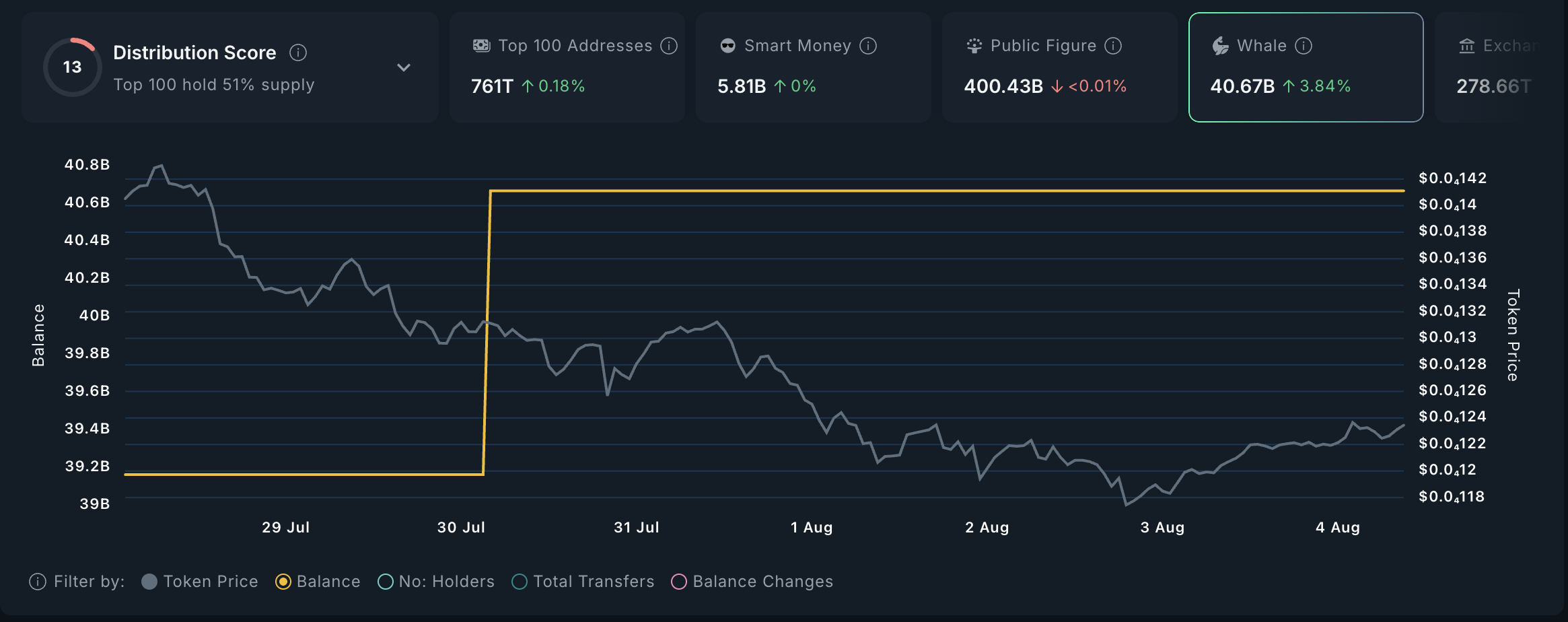

However, some traders see this decline as a buying opportunity. On-chain data from Nansen shows that whale addresses holding over $1 million worth of SHIB have been quietly accumulating during the downturn. Per the data provider, this cohort of large investors has increased their holdings by 4% in the past seven days.

SHIB Whale Holding. Source:

SHIB Whale Holding. Source:

SHIB Whale Holding. Source:

SHIB Whale Holding. Source:

The increase in whale accumulation suggests growing confidence in SHIB’s long-term value, even as its price struggles amid market volatility.

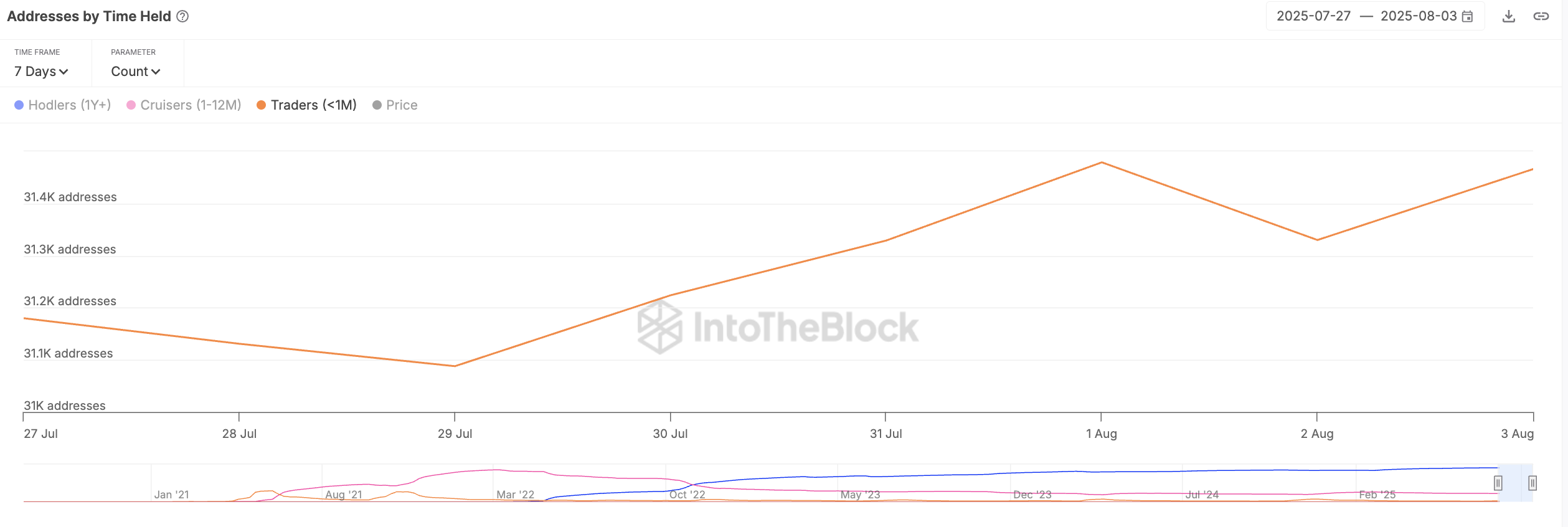

Moreover, an increase in whale activity usually spurs retail traders to follow suit, which is exactly what is happening. According to data from IntoTheBlock, the count of short-term holders extending their holding time has climbed by a modest 1% in the past seven days.

SHIB Addresses by Time Held. Source:

SHIB Addresses by Time Held. Source:

SHIB Addresses by Time Held. Source:

SHIB Addresses by Time Held. Source:

This signals increasing bullish conviction among investors who have held their coins for less than 30 days. It also improves SHIB’s short-term outlook because these holders are more reactive to price changes.

So, if this group is now choosing to hold rather than sell, it bodes well for SHIB’s price stability and near-term recovery.

Shiba Inu Bulls Aim for Breakout, But Bears Are Lurking

At press time, SHIB trades at $0.00001235. If whale accumulation continues and retail holders maintain their conviction, the meme coin could rebound toward the $0.00001362 resistance level in the short term.

SHIB Price Analysis. Source:

SHIB Price Analysis. Source:

SHIB Price Analysis. Source:

SHIB Price Analysis. Source:

Conversely, if bearish sentiment intensifies and profit-taking picks up again, SHIB risks extending its decline, potentially dropping toward $0.00001160.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Legislation Booms Globally, Why Is China Taking the Opposite Approach? An Article to Understand the Real National Strategic Choices

Amid the global surge in stablecoin legislation, China has chosen to firmly curb stablecoins and other virtual currencies, while accelerating the development of the digital yuan to safeguard national security and monetary sovereignty. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Liquidity migration begins! Japan becomes the Fed's "reservoir," 120 billions in carry trade returns set to ignite the December crypto market

The Federal Reserve has stopped quantitative tightening and may cut interest rates, while the Bank of Japan plans to raise rates, changing the global liquidity landscape and impacting carry trades and asset pricing. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.

Weekly Hot Picks: Bank of Japan Sends Strongest Rate Hike Signal! Is the Copper Market Entering a Supercycle Rehearsal?

The leading candidate for Federal Reserve Chair is being questioned for potentially "accommodative rate cuts." Copper prices have reached a historic high, and a five-hour meeting between the United States and Russia ended without results. Expectations for a Japanese interest rate hike in December have surged, and Moore Threads' stock soared more than fivefold on its first day... What market moves did you miss this week?

Monad Practical Guide: Welcome to a New Architecture and High-Performance Development Ecosystem

This article will introduce some resources to help you better understand Monad and start developing.