Bitcoin Miners Earn $1.66 Billion in July, a Post-Halving Record

July marks a turning point for Bitcoin mining: revenues explode to $1.66 billion, a post-halving high. This boom hides persistent tensions on profitability. Between rising fees and technical adjustments, the sector adapts. But can this momentum last amid the uncertainties looming over August?

In Brief

- Bitcoin miners’ revenues reached $1.66 billion in July, a record since the 2024 halving.

- Despite this rebound, profitability remains 43 to 50% lower than pre-halving levels.

- August will be decisive with an expected difficulty adjustment and geopolitical uncertainties in the background.

Bitcoin miners hit a historic record in July

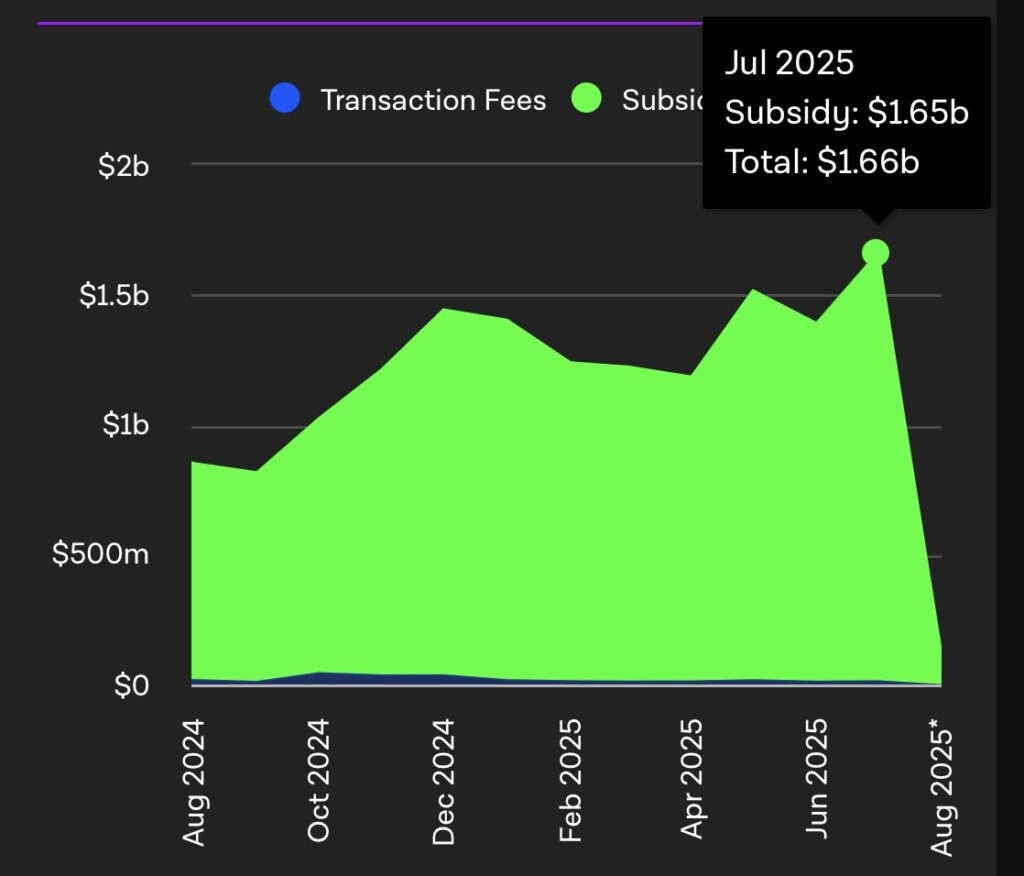

In July 2025, Bitcoin miners’ total revenue reached $1.66 billion, combining block rewards and transaction fees. This is the highest amount since the 2024 Bitcoin halving. The recovery comes amid rising difficulty and intense competition across the network.

Bitcoin miners’ revenues at $1.66 billion in July 2025.

Bitcoin miners’ revenues at $1.66 billion in July 2025.

The average daily income per exahash per second (EH/s) was $57,400, 4% higher than in June. However, these revenues remain 43% lower than those observed before the 2024 halving, when daily income was around $100,700 per EH/s. Gross margins remain 50% lower compared to levels before April 2024.

Mining under pressure: how players adapt to survive

To remain competitive, many Bitcoin miners have adjusted their operational model. This includes searching for low-energy-cost areas, automating operations, and pooling computational power in mining pools.

Profitability now depends on a trio of variables:

- BTC price;

- Difficulty level;

- Regulatory environment.

In addition to the $1.66 billion Bitcoin miners’ revenue in July , the average hashrate increased by 4% to 899 EH/s, while difficulty jumped 9% over the month, further pressuring less efficient miners.

Decisive August for Bitcoin mining: between hopes and uncertainties

A negative difficulty adjustment is expected early August, with a correction estimated around –3%. This readjustment is part of Bitcoin’s automatic mechanism, which balances difficulty based on the average observed computing power. This potential relief, combined with a BTC price stable around $113,000 at the end of July, could temporarily improve margins.

However, geopolitical uncertainty, energy volatility, and tax constraints in certain jurisdictions could quickly reshuffle the cards.

The resurgence of Bitcoin miners’ revenues in July hides a more nuanced reality: profitability remains under pressure. Between difficulty adjustment and macroeconomic uncertainties, August promises to be decisive. Is the current BTC mining model sustainable in the long term?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Balancer DAO Starts Discussing $8M Recovery Plan After $110M Exploit Cut TVL by Two-Thirds

ETH price fluctuates violently: the hidden logic behind the plunge and future outlook

Bitcoin risks return to low $80K zone next as trader says dip 'makes sense'

![[Bitpush Daily News Highlights] Texas Lieutenant Governor officially announces the purchase of bitcoin, aiming to build America’s digital future hub; Economists expect the Federal Reserve to cut interest rates in December, with two more possible cuts in 2026; Circle has issued an additional 10 billions USDC in the past month; Sources: SpaceX is in talks over share sales, with valuation possibly soaring to 800 billions USD.](https://img.bgstatic.com/multiLang/image/social/dd58c36fde28f27d3832e67b2a00dab41764952203123.png)