DevvStream plants crypto roots with Bitcoin and Solana treasury debut

As traditional carbon markets collide with blockchain, DevvStream makes its first move, allocating treasury funds to Bitcoin and Solana. Meanwhile, the firm’s $300 million credit expansion could fuel a new era of tokenized environmental assets.

- DevvStream allocates treasury funds to Bitcoin and Solana in a strategic crypto pivot.

- The firm views Bitcoin as a stable reserve asset and Solana as infrastructure for tokenized carbon markets.

- A proposed $300 million credit facility expansion would scale its blockchain-based sustainability strategy.

On August 1, Nasdaq-listed carbon management firm DevvStream announced the initial deployment of its crypto treasury strategy, purchasing Bitcoin ( BTC ) and Solana ( SOL ) using part of a $10 million tranche from its $300 million convertible note facility secured through Helena Global Investment Opportunities.

The move signals a deliberate shift toward blockchain-based liquidity, with Bitcoin serving as a reserve asset and Solana’s high-speed network positioned to support future sustainability-linked tokenization projects.

DevvStream also revealed plans to expand its credit line to $300 million, pending approvals, which would provide additional capital to scale its digital and environmental infrastructure investments.

Why Bitcoin, Solana, and a $300 million war chest?

DevvStream’s dual bet on Bitcoin and Solana appears to be a calculated play to address two distinct challenges in merging carbon markets with blockchain. Bitcoin, with its deep liquidity and established role as a non-correlated asset, offers treasury stability amid volatile carbon credit pricing. Solana, meanwhile, provides the technical backbone for high-speed, low-cost transactions, critical for scaling tokenized environmental assets.

“Deploying our treasury strategy with Bitcoin and Solana marks a critical step in connecting carbon markets to the digital economy,” said Sunny Trinh, CEO of DevvStream. “Combined with the planned expansion of our credit facility, we believe we are strengthening our balance sheet and positioning DevvStream to execute on tokenizing high-value environmental assets at scale.”

The $300 million credit facility expansion, if approved, would supercharge this strategy. DevvStream’s core business of developing, investing in, and selling environmental assets, positions it uniquely for this pivot.

According to the press release the firm already operates across three fronts: carbon offset portfolios, project investment/acquisitions, and hands-on development of green initiatives like EV charging networks. By integrating blockchain, it could streamline each segment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Arthur Hayes Claims to Those Waiting for the Altcoin Season: “The Altcoin Season Never Ended Anyway”

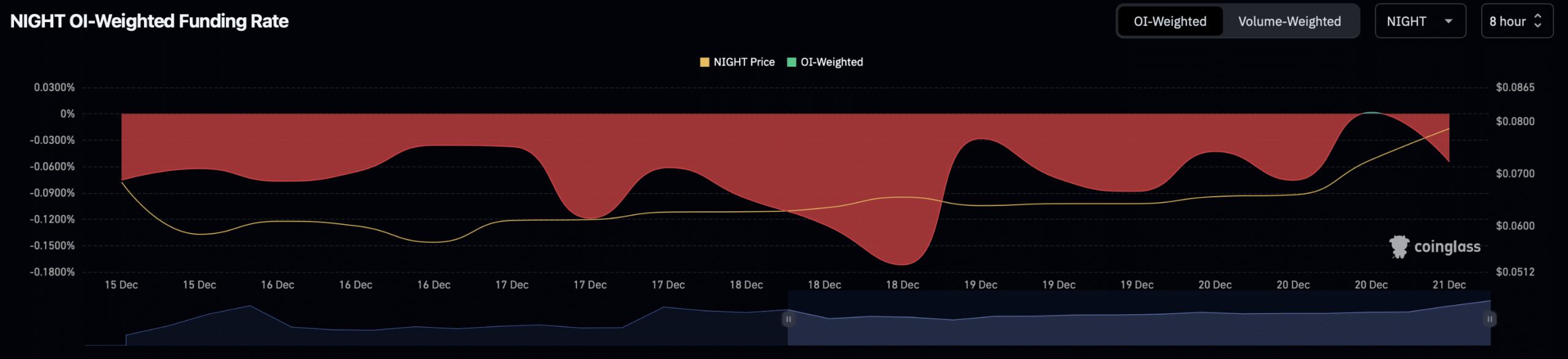

NIGHT rallies 24% as traders rush in ahead of AirDrop, but risks remain

Pundit: XRP Will Have to be Extremely Expensive Once This Happens

Best Meme Coins to Buy – Pudgy Penguins Price Prediction