Key takeaways

- ETH is down 2% in the last 24 hours and has dropped below $3,800.

- The coin could rally towards $4k soon amid growing institutional demand.

ETH dips below $3,800 ahead of FOMC

The cryptocurrency market is bearish ahead of today’s FOMC meeting. Bitcoin has dropped below $119k while Ether is down 2% over the last 24 hours, but continues to defend the daily support level at $3,730.

The U.S. Federal Reserve is expected to leave the interest rate unchanged later today, and this could negatively affect BTC and other major cryptocurrencies. Despite that, ETH’s price continues to hold above a key level thanks to growing institutional demand.

In an email to Coinjournal, XBTO’s Chief Investment Officer, Javier Rodriguez-Alarcón, pointed out that institutional demand for Ether remains strong. He stated that,

“Ethereum’s institutional momentum accelerated last week as record ETF inflows and major fund launches signaled a decisive shift in crypto capital allocation. While Bitcoin held steady, the clear winner was ETH, which continues to attract both passive and active institutional money seeking yield and utility over pure store-of-value exposure.

This week brings critical macro tests: Wednesday’s FOMC rate decision, Tuesday’s JOLTS job openings data, and July ADP employment figures all have the potential to amplify or reverse current trends as Bitcoin approaches $120,000. Ethereum extended its rally last week, climbing another +3.6% and bringing its month-to-date gain to +55.9%. After a slow start to the year, ETH is now up +16.3% in 2025, marking a full turnaround and a clear shift in investor focus.”

ETH eyes $4k if $3,730 support holds

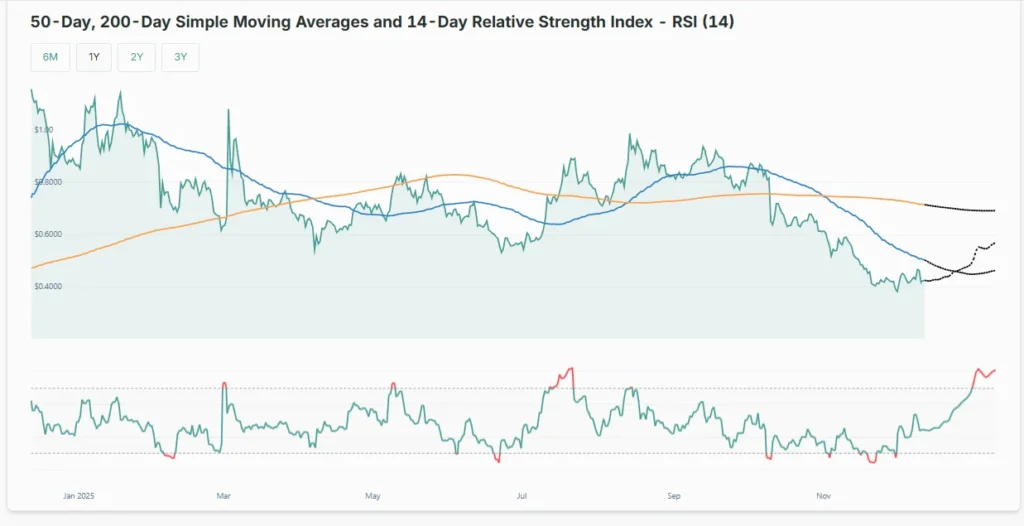

The ETH/USD 4-hour chart is bearish thanks to the market’s poor performance over the last few days. The technical indicators remain bearish, suggesting that the bears are still in control.

At press time, ETH is trading at $3,794 per coin. If the daily support at $3,730 holds, ETH could resume its upward rally, targeting its key psychological level of $4,000. The RSI of 55 is approaching the neutral zone, suggesting that the bullish momentum is fading. The MACD line is also set to crossover into the bearish zone, indicating a selling bias.

On the other hand, if Ether faces a correction and closes below the daily support at $3,730, the bearish momentum could extend to the next support at $3,500 over the coming hours.