BTCS Raises $10M Through Convertible Offerings, Increases Ethereum Holdings

- BTCS now holds 70,028 ETH, valued at $270M, showing strong crypto asset growth.

- $10 million convertible notes closed at $13/share, 198% above the current market price

- Raised $207 million in 2025 via equity, debt, and DeFi, fueling ETH accumulation.

BTCS Inc. (Nasdaq: BTCS) has reached a major balance sheet milestone. The company’s Ethereum holdings increased to 70,028 ETH, valued at approximately $270 million using an ETH price of $3,850. This accumulation was achieved through its DeFi/TradFi Accretion Flywheel strategy, which focuses on leveraging both decentralized and traditional financial tools. The increase of 14,240 ETH reflects BTCS’s operational strategy to expand its Ethereum reserves strategically.

BTCS completed a $10 million convertible note financing with a $13 per share conversion price. This price represents a 198% premium over BTCS’s July 18, 2025, closing share price of $4.36. The significant premium highlights strong investor engagement with the company’s Ethereum-focused operations. The structure of this financing provides BTCS with capital while limiting immediate equity dilution.

BTCS used both at-the-market sales of stock, convertible debt, and DeFi-backed financing to raise $207 million in 2025. These capital market campaigns have helped the company acquire digital assets without making it aggressive with regard to shareholder dilution. The increase in the possession of ETH is in line with the vision of the firm to develop vertically integrated Ethereum infrastructure. This plan favours a business model centred on creating blockchain-based incomes.

By the end of the week of July 25, BTCS had sold 271,580 shares under its at-the-market equity offering program at a price of $6.04 per share. This limited issuance reflects the company’s disciplined capital strategy, which prioritizes shareholder value while supporting treasury growth.

Operational Model and Treasury Yield Strategy

BTCS is developing a vertically integrated Ethereum operation involving both staking and block-building activities. The company deploys its ETH reserves through infrastructure services such as NodeOps and Builder+. This approach enables BTCS to generate yield from digital assets, supplementing value derived from price appreciation. The treasury assets are actively used to generate recurring income through Ethereum network participation.

By reinvesting its yield on operations in its digital asset strategy, BTCS is generating a compounding effect through its infrastructure business. This model categorizes BTCS apart from companies that exclusively maintain a foothold in passive, unutilized digital assets. The strategy based on Ethereum makes BTCS a distinctive publicly traded firm that provides direct access to the Ethereum economic model. Its inclusion of revenue-driven measures is in line with the ultimate realization of digital currency monetization.

Related: Ethereum Treasuries Surge as BitMine, BTCS Lead New Strategy

Market Position and Growth Outlook

BTCS’s treasury expansion and ETH acquisition suggest an increasing commitment to blockchain infrastructure investment. Its capital and operations allow Ethereum ecosystem participation in the 2025 financial undertakings. Due to the strategic allocation of resources, BTCS expects to create an all-encompassing system of blockchain-based financial services. Its contribution to Ethereum block-building as well as staking activities could serve as a source of future income.

With $207 million raised year-to-date, BTCS has diversified its funding sources effectively. The use of DeFi lending tools in tandem with equity and debt offerings showcases its hybrid financial strategy. Such a diversified derivative helps in sustaining the treasury flourishing without the track of an over-dependence on a single method of financing. The capital strategy of the company remains consistent with its blockchain business model.

BTCS positions itself as one of the few publicly traded companies offering direct exposure to Ethereum’s economic model. The strength of the balance sheet and the execution strategy can be a source of value over the long run as the Ethereum adoption process proceeds.

The post BTCS Raises $10M Through Convertible Offerings, Increases Ethereum Holdings appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Is the DA war coming to an end? Deconstructing PeerDAS: How can it help Ethereum reclaim "data sovereignty"?

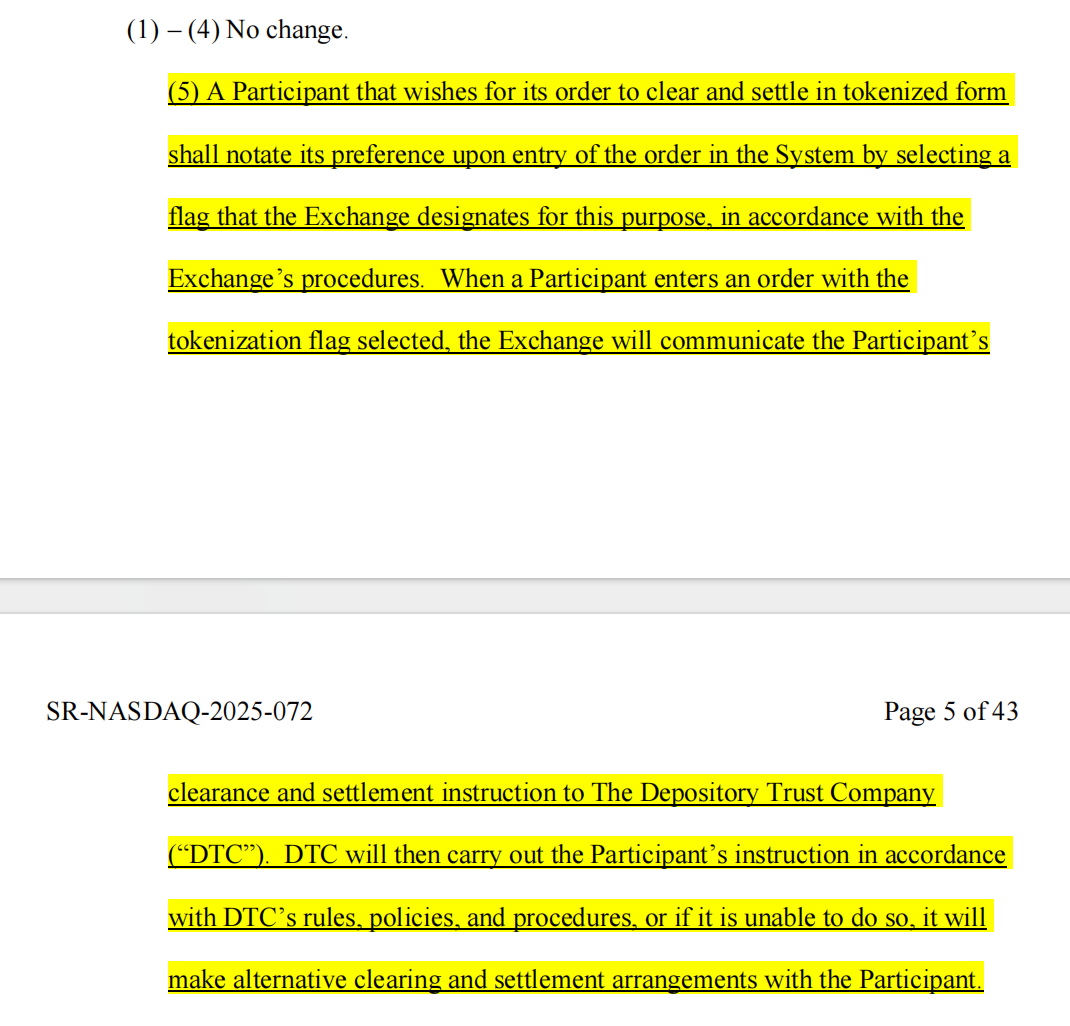

Frontline Report | Web3 Lawyers Interpret the Latest Developments in US Stock Tokenization

Why did the "Insider King" fall into his own trap on October 11?

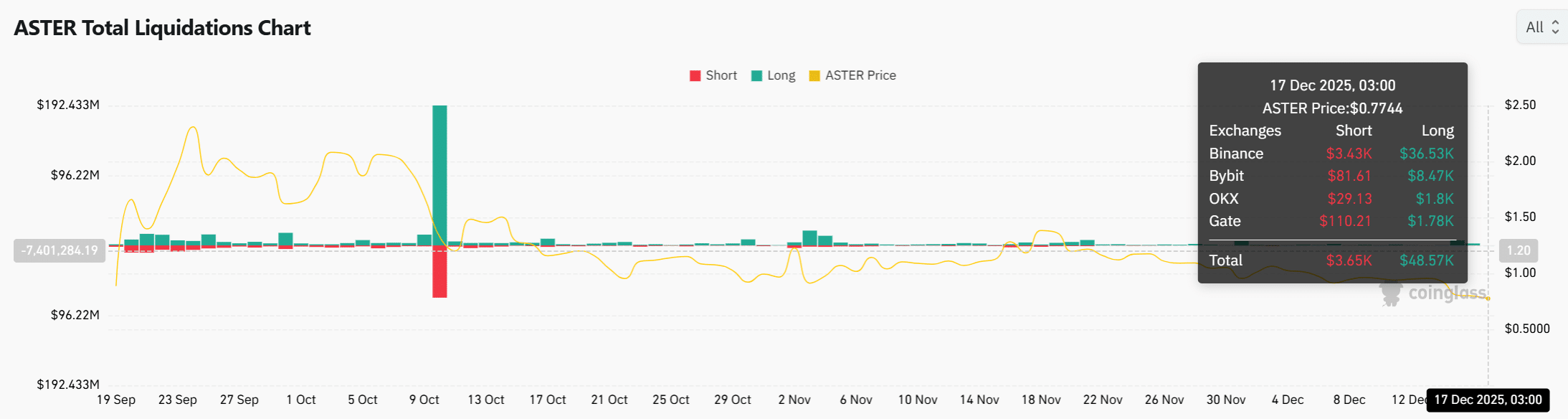

ASTER price sinks as whale losses deepen – Is $0.6 next?